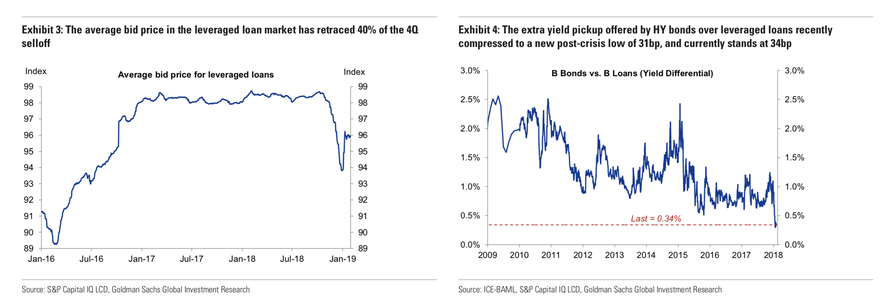

After a disastrous Q4 where “the wheels came off the leveraged loan market”, leaving banks unable to sell their loans as retail investors and institutional buyers yanked money out and moved it to more secure areas in the credit market (sending the yield on the 10-year Treasury back toward 2.5% during the opening days of 2019), the market has made a sudden and surprising comeback, with the average bid price in the leveraged loan market retracing 40% of its decline from the prior quarter, according to the credit team at Goldman Sachs.

Still, many are uneasy about upping their exposure to leveraged loans – including private equity giant KKR, which, as we noted a couple of weeks ago, has opted to reduce its exposure to leveraged loans to zero from overweight. In its place, KKR Balance Sheet CIO Henry McVey said he’s shifting the firm’s holdings to more liquid areas of the credit market (high yield, structured credit and loans), based on the view that these assets have already priced in the growth slowdown that KKR is forecasting in 2019. All discussion of KKR’s macro view – and its merits – aside, as we’ve explained, a cautious approach to lev loans and CLOs is probably prudent, given the looming risks of one “unexpected development” with the potential to crush the market.

With both long- and short-term risks looming on the horizon, Bloomberg pointed out a strategy that banks are employing to once again shift warehoused inventory off of their books: Offering CLOs comprised of short-dated deals. Of course, it’s not hard to find reasons why buyers might be more interested in shorter-dated offerings at this point in time, particularly given the nascent slowdown in global growth that has surfaced in the data from the developed and developing world, banks who are selling these loans have one overweening reason to push the inventory: To avoid getting stuck with a bunch of crap loans and being forced to “liquidate” them from their books.

This latest crop may be driven by several different motivations. In some cases a manager may be trying to time the maturing credit cycle, by leaving the door open for a refinancing in a year’s time and before defaults start to rise.

But for others, the shorter maturity may be the final lifeline to converting an older warehouse into a CLO. That could help them avoid the worst case scenario of having to liquidate a warehouse, while allowing the arranger to unclog some of these older facilities from its balance sheet and move ahead with its pipeline.

By selling loans with shorter non-call periods, buyers can rest easy knowing that borrowers can always call the loans and refinance if, say, a recession in the US or Europe suddenly surfaces on the horizon.

A shorter maturity deal might help improve the chances of a take out because you get cheaper liabilities and also more leverage with a shorter reinvestment period, according to one U.S.-based CLO manager. That in turn can improve both the arbitrage between assets and liabilities and the equity returns.

And just with the maturing cycle motivated deals, the shorter non-call period gives the manager and equity investors the option to refinance the transaction earlier. That will allow them to reduce funding costs if liability spreads have decreased or to call the CLO earlier.

Perhaps this is why there’s suddenly a large universe of investors asking for long-dated loans.

There’s a larger universe of AAA-rated investors with an appetite for shorter duration, said the U.S. manager. That may have to do with their view of the credit cycle, or it may just be that the liabilities they are using to fund their investment are shorter and they are just matching that duration, he added.

A let up in the volume of CLO refinancings reaching the market might bolster demand for shorter dated new issue paper given there is a group of investors who typically support the refinancing trade.

Or maybe its a simple issue of matching assets and liabilities. To be sure, not everybody shares KKR’s pessimism. Goldman recently attached an overweight call to HY loans, citing the spread compression between HY bonds and HY loans. But the fact that fund outflows have continued even as new CLO issuance ramps (loan creation accelerated to $5.2 billion across 10 deals after a slow start to the year) should give some investors pause.

via ZeroHedge News http://bit.ly/2St3EG8 Tyler Durden