With China taking the week off for Lunar New Year, it seems vol-selling is back en vogue as overnight tape-bomb-risk ‘may’ have been removed (as well as immediate Chinese financial system liquidity issues). Do not worry, risk is “contained”…

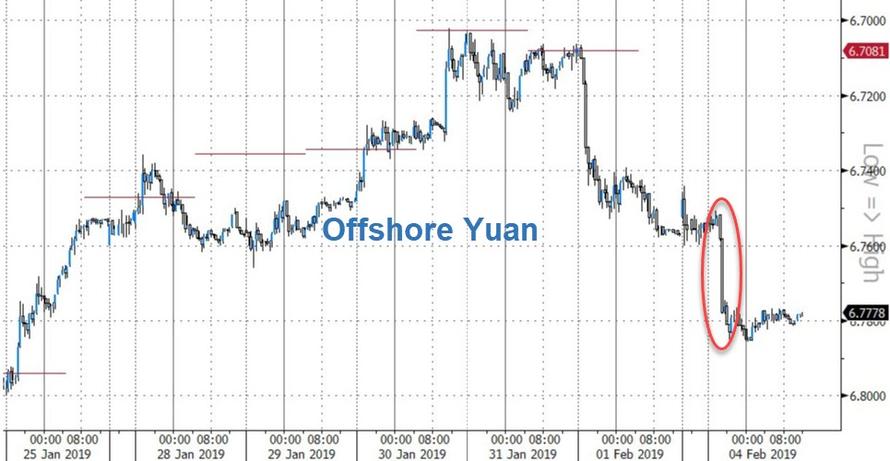

China closed so no equity market but the yuan tumbled overnight…

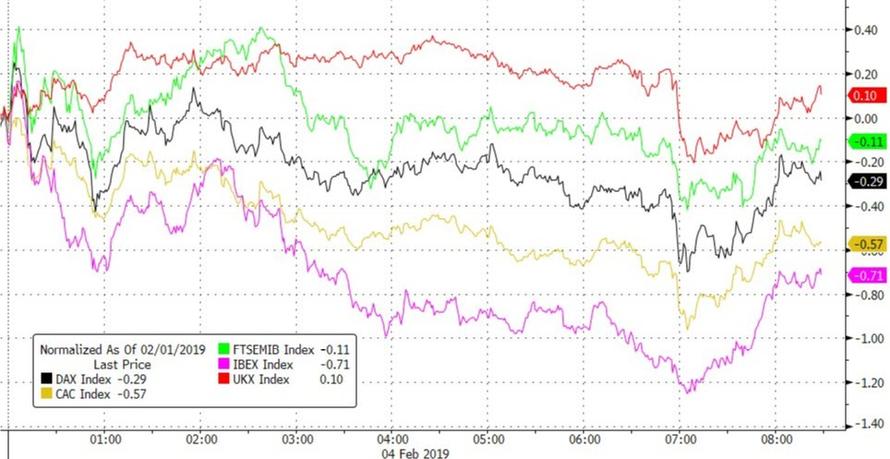

European stocks were generally lower on the day but UK’s FTSE managed to scramble back to close green…

But US equity markets all drifted higher all day, led by Nasdaq…with a vertical panic-bid into the close…

As we detailed earlier, today’s melt-up comes to you courtesy of CTAs – All the major indices have broken above key technical levels…

And so, almost exactly one month after trend-following CTAs flipped to net short for the first time in three years…

… accelerating the market’s slide into the Dec 24 bear market which lasted all of 5 minutes before a combination of Mnuchin’s invocation of the PPT (and bank liquidity check), Trump’s urge to buy stocks as it was “a tremendous opportunity to buy”, a massive pension fund rebalancing buy order and Powell’s dovish U-turn sent stocks soaring, CTAs are back to where they were for the most part since 2016: long.

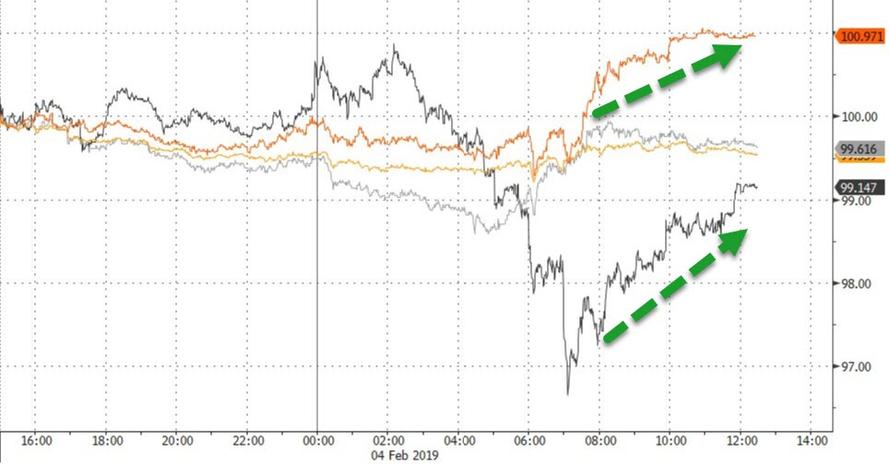

And the result is evident in futures – calm until the cash market opens and the algo-buying panic begins…

Another big squeeze of the shorts again today…and the meltup at the close…

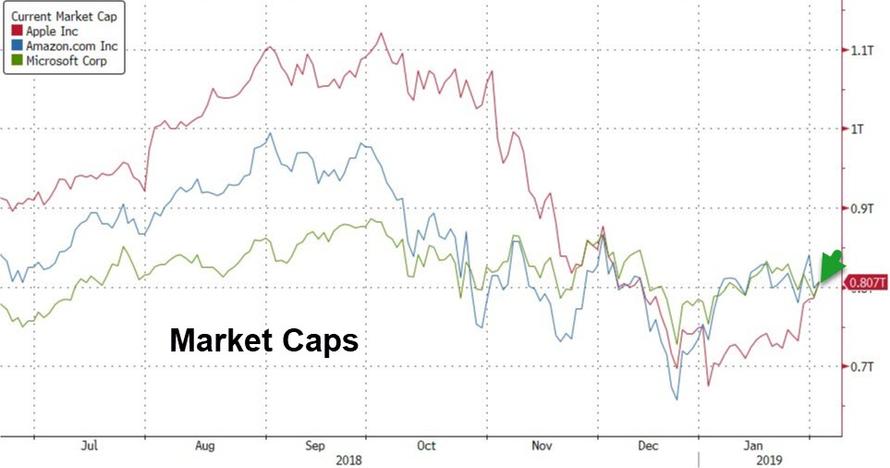

Apple’s recent resurgence has pushed it back to the most valuable US listed company once again at $807bn, back above (barely) Microsoft and Amazon…

Equity and Credit protection costs plummeted further… VIX tumbled to a 15 handle (4mo lows)

Treasury yields were up across the curve today…

10Y Yields rallied back to erase the post-Powell plunge, but were unable to breakout…

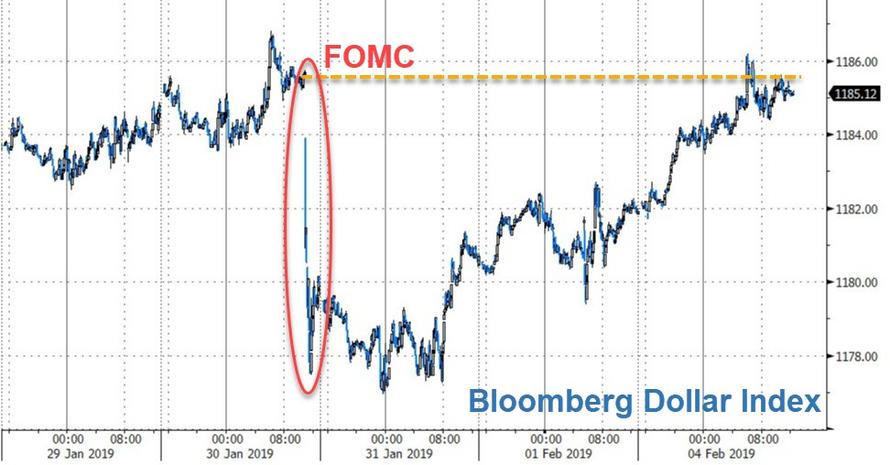

The dollar surged back up to recent highs – erasing the post-Powell plunge…but was unable to breakout…

But, with SOTU tomorrow, some wonder if Trump’s falling approval will lead the dollar lower again…

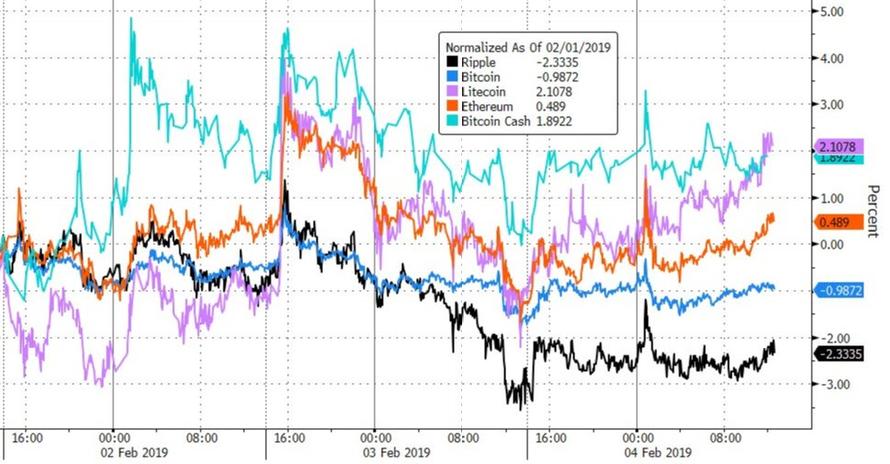

Cryptos were a mixed bag…

Copper managed notable gains and while Crude rebounded it remained red like PMs as the dollar surged…

Gold erased its post-Powell jump…then rebounded…

WTI plummeted into and across the US equity market open, breaking back below $54, but like the rest of the market, it rebounded strongly (some noted that the selloff was attributed to a large producer)…

Since The FOMC statement, Bonds, Bullion, and the Dollar are now back to unchanged but stocks are panic-bid…

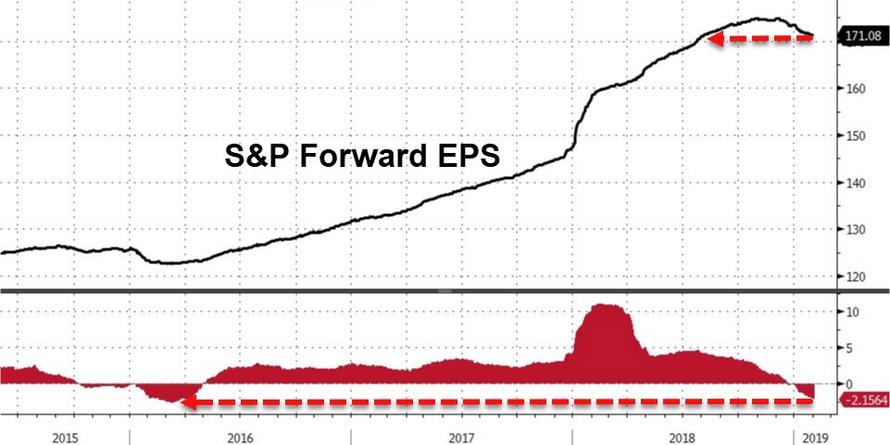

Finally, this is becoming a farce…

Stocks are soaring as Earning expectations plunge to six-month lows…

via ZeroHedge News http://bit.ly/2SaCyUR Tyler Durden