We recently discussed the dismal sales start for the US automobile industry in 2019. Now, a follow up by the WSJ paints an even more pessimistic picture for the start of February.

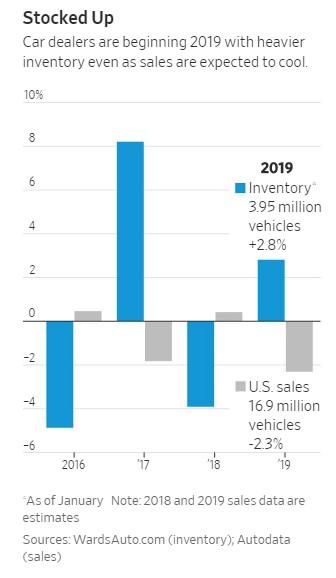

According to the report, dealers are starting 2019 with a growing surplus of inventory of unsold vehicles, which will likely pressure them to cut output: there were 3.95 million vehicles in lots at the end of January, a 4% increase from December and up nearly 3% from last January.

And even though seasonality exists in the industry and the winter is traditionally slower for automotive sales, the inventory build up could be problematic because dealers are starting the year with more unsold inventory than they had when auto sales peaked three years ago. Back then, 17.55 million cars were sold and now, while the latest estimates expect less than 17 million vehicles to be sold in 2019.

In response to the production glut, we already documented over the weekend that General Motors is slashing thousands of jobs across its North American factories. Meanwhile, Ford has worked to phase out slow selling sedans and shift its production to SUVs. This follows a strong year which saw 17.3 million sales in 2018, better than estimated. Alas, starting 2019 the trend has reversed, and auto sales were down 1% and passenger sales, including sedans, were down 4% last month. This continues amid a shift from sedans to SUVs.

As noted previously, auto companies were also relying on fleet sales to keep results looking good. Fleet sales and rental car sales are some of the last channels that auto companies have to try and juice results. Mark Wakefield, a co-head for the automotive practice at distressed consulting firm AlixPartners called this move a “short term band-aid”.

And yet, despite the clear industry headwinds, the plan still is to build about 17 million cars in North America this year, with most of those destined for the United States. And manufacturers continue to try to avoid heavy discounting to sell vehicles: the industry spent about $3720 per vehicle in January to incentivize sales, which was down $140 from the prior year’s record incentives.

In order to avoid offering discounts, automakers are going to have to trim production. But that, again, flies in the face of how many new model launches are planned for this year. There are 48 new model launches planned for the US this year, which is up from 46 last year and 36 five years ago. Dealers believe that manufacturers are simply being too optimistic about the upcoming year.

David Rosenberg, chief executive for New England dealership chain Prime Automotive Group said: “There is an oversupply of new products, but not everyone is going to achieve their sales targets.”

Separately, Ryan Gremore, president of the O’Brien Auto Team, which is a dealership chain in Illinois, Florida and Kentucky, echoed these sentiments and assigned the blame on, who else, the Fed and its near-decade low interest rate which have conditioned consumers to only expect the lowest possible rates: “We’ve carried too much inventory because we’ve been conditioned at artificial rates.”

via ZeroHedge News http://bit.ly/2GbHvq2 Tyler Durden