Plagued by another run of bank bailouts and simmering tensions between the partners in its ruling coalition, Italy’s brief reprieve following the detente between its populist rulers and angry bureaucrats in Brussels is already beginning to fade. As Bloomberg reminded us on Monday, Italy’s $1.7 trillion pile of public debt – the third largest sovereign debt pool in Europe – is threatening to set off a chain reaction that could hammer banks from Rome, to Madrid, to Frankfurt – and beyond.

Just the mention of the precarity of Italian debt markets “can induce a shudder of financial fear like no other” in bureaucrats and businessmen alike – particularly after Italy’s economy slid into a recession during Q4.

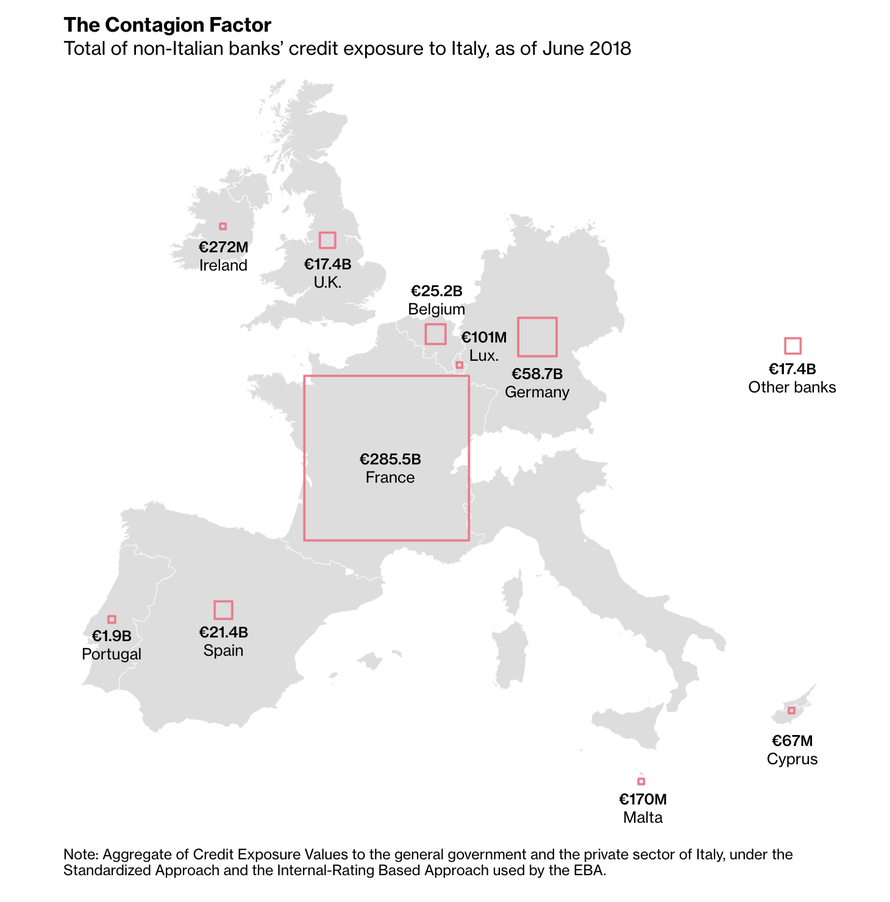

While much of Italy’s debt burden is held by its banks and private citizens, lenders outside of Italy are holding some 425 billion euros ($486 billion) in public and private debt.

The Bloomberg analysis of Italy’s financial foibles follows more reports that Italy’s ruling coalition between the anti-immigrant, pro-business League and the vaguely left-wing populist Five-Star Movement has become increasingly strained. Per BBG, the two parties are fighting a battle on two fronts over the construction of a high speed Alpine rail and a legal case involving League leader Matteo Salvini over his refusal to let the Dicotti migrant ship to dock in an Italian port last summer.

After M5S intimated that it could support the investigation, the League warned that such a move would be tantamount to “blackmail” against Salvini, whose lieutenants have been pushing for him to take advantage of the party’s rising poll numbers and push for early elections later this year. However, Salvini has rebuffed these demands, warning that there’s nothing stopping Italian President Sergio Mattarella from calling for a new coalition instead of new elections.

On the other hand, the League is growing increasingly weary of the “Citizens’ Income”, one of the boldest proposals included in Italy’s 2019 budget, which calls for a guaranteed subsidy for all Italians under the poverty line, provided they can prove they are looking for work.

On Monday, Luigi Di Maio and Prime Minister Giuseppe Conte presented the first of the cards that will carry the income during a ceremony that Salvini decided to skip, according to BBG. As many as 5 million Italians could be eligible for the microchip-embedded cards.

“We’ll be injecting 8 billion euros ($9.2 billion) into the real economy every year – people will be able to spend those 8 billion,” Di Maio said, at one point channeling Albert Einstein, saying those who claim something is impossible should leave those who are actually doing it alone.

However, the plan has irked business owners, who constitute some of the League’s most reliable supporters.

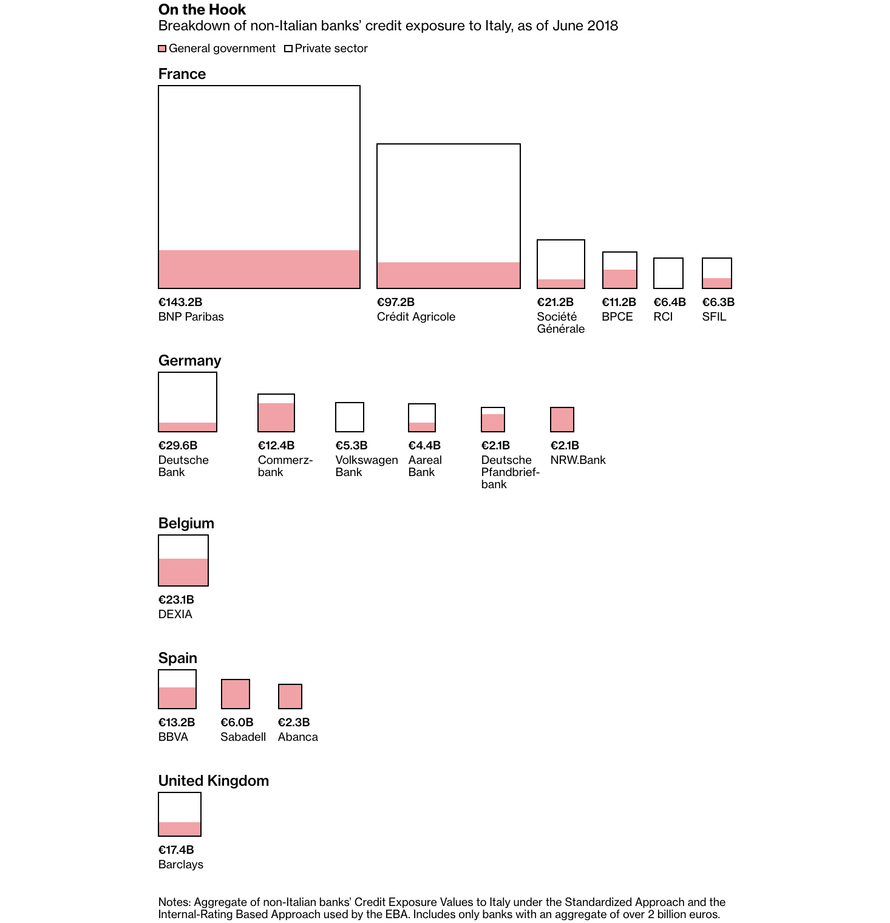

Circling back to the threat posed by Italian debt, BBG’s analysis showed that French banks are the most exposed, as BNP Paribas and Credit Agricole own retail banking units in Italy.

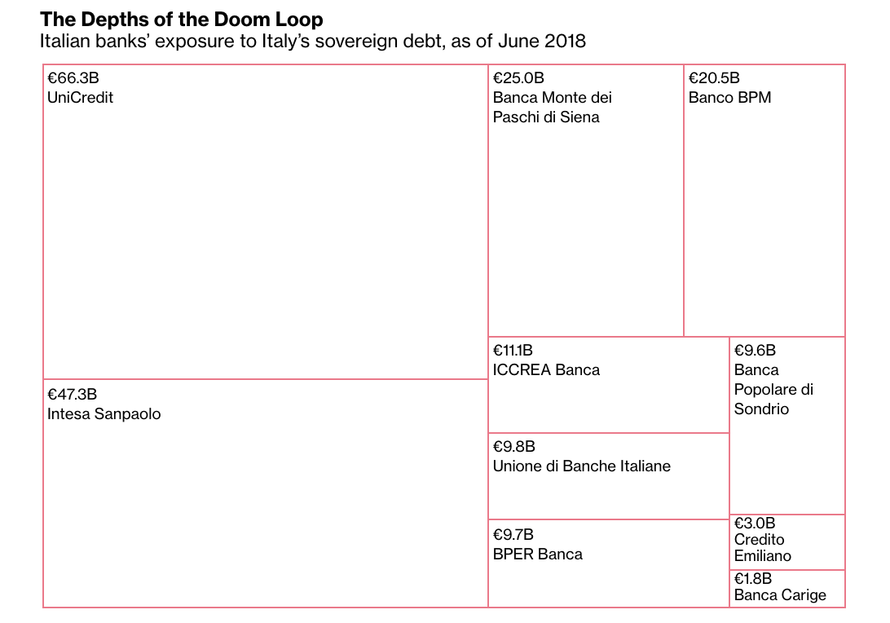

To keep operating without massive budget cuts (something neither party in the ruling coalition has shown any sign of supporting) Italy must sell 400 billion euros ($457 billion) of debt per year. But since Italy’s banks hold so much of the country’s debt, declines in the price of Italian bonds inevitably hurts the shares of Italian banks, and also forces them to hold more capital on their books to ensure liquidity from the ECB. This creates the potential for a negative feedback loop known as the “doom loop”.

Put another way, “a government crisis could drag down the banking system or a banking crisis could suck in the government.”

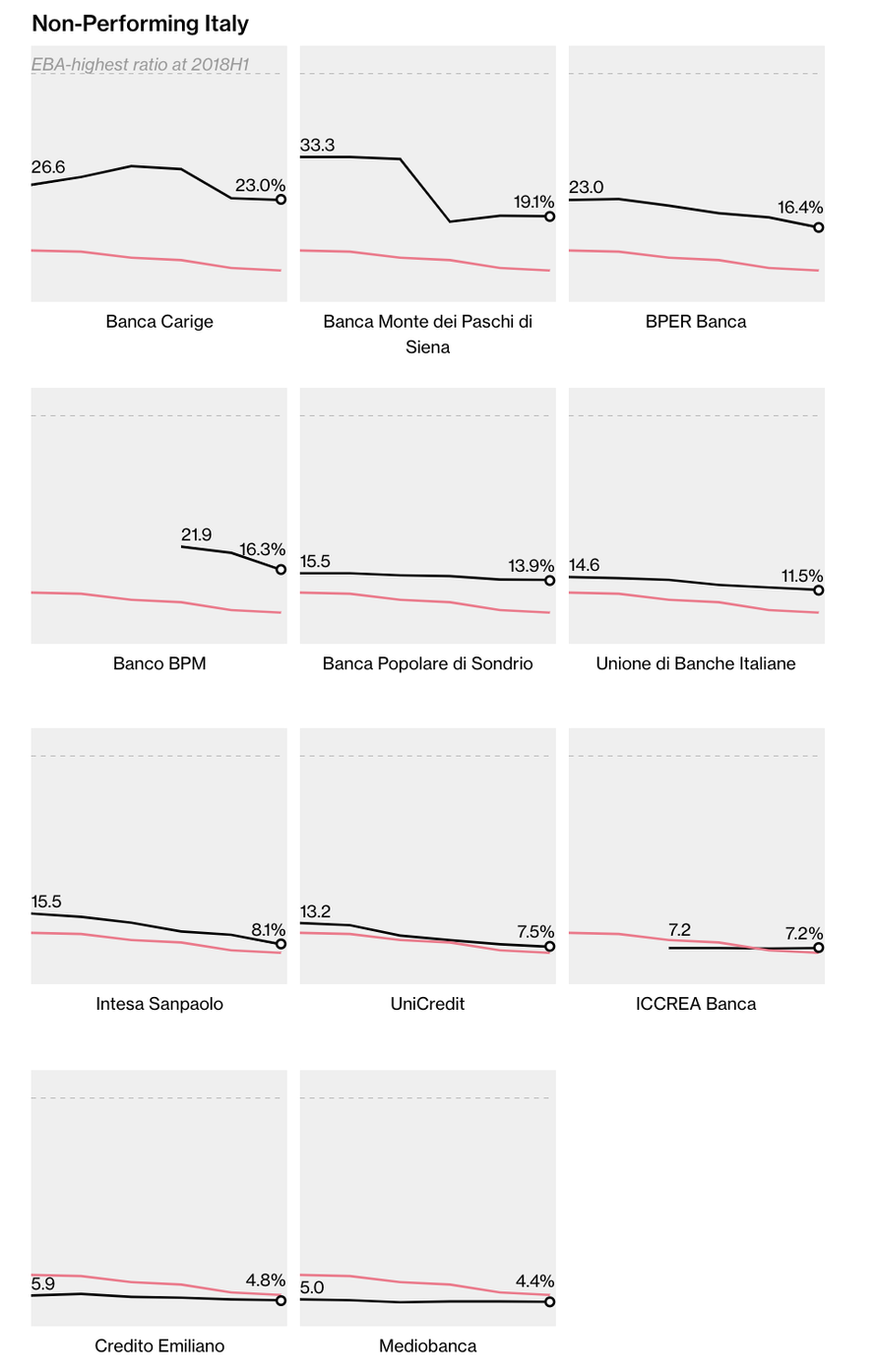

And while NPLs held by Italian banks have declined in recent years (as no fewer than seven Italian banks have required bailouts in the past three years)…

…A genuine crisis would exhaust the lending capacity of the European Stability Mechanism (some 410 billion euros or $470 billion) in just a year. With ECB President Mario Draghi set to depart later this year, and German Chancellor Angela Merkel’s power on the wane, if the populists don’t manage to generate the economic growth that they have argued will be unleashed by their stimulus programs, it’s not outside the realm of possibility that the crisis that tears apart the EU and eurozone is centered in Rome.

via ZeroHedge News http://bit.ly/2Sdn2Y8 Tyler Durden