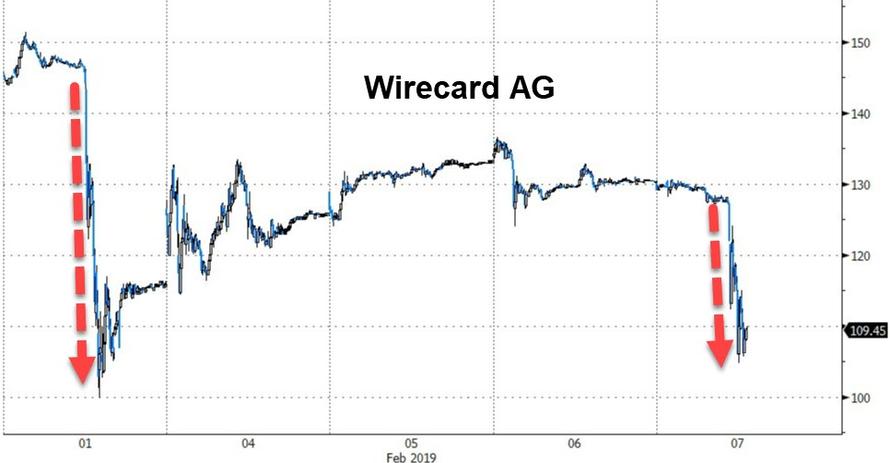

Last month, the Financial Times sent shares of German global payments company Wirecard – a market darling which had seen its shares nearly quintuple in a span of less than four years – reeling when it published a story purportedly sourced from company insiders revealing the existence of an internal investigation into widespread accounting fraud. Before the rout was over, Wirecard shares had fallen more than 20%. But analysts backed up the company’s insistence that no wrongdoing had actually taken place, with one calling the report “fake news”.

But refusing to back down, the FT returned on Thursday with another even more extensive story, sourced Theranos-style “whistleblower” company insider who claimed to have been complicit in the alleged fraud. The whistleblower managed to leak a copy of a report compiled by a law firm that examines the alleged malfeasance in great and sometimes stunning detail. And as a result, Wirecard’s shares are moving lower once again.

This time around, investors might find it difficult to ignore the FT’s findings, or find them anything short of compelling. because not only does it cite information from company insiders, but it also includes details from a preliminary report from one of Asia’s top law firms that appear to back up the allegations of wrongdoing. The company, according to the report, committed widespread book-padding as it sought to take over a regional payments business from Citigroup that ultimately granted Wirecard a stretch of territory spanning from New Zealand to India.

The gist is simple: As Wirecard embarked on its quest for globe-spanning domination in the payments space, heads of regional businesses were encouraged to inflate the company’s transaction volume numbers, mainly through the use of a technique referred to by the FT as “round tripping.”

One year ago, Edo Kurniawan, a jovial 33-year-old Indonesian who runs the Asia-Pacific accounting and finance operations for global payments group Wirecard AG, called half a dozen colleagues into a Singapore meeting room. He picked up a whiteboard pen and began to teach them how to cook the books.

His company would soon become one of Germany’s most valuable financial institutions, but as Mr Kurniawan spoke, the immediate task at hand was to create figures that would convince regulators at the Hong Kong Monetary Authority to issue a licence so Wirecard could dole out prepaid bank cards in the Chinese territory.

The group was seeking to take over payment operations from Citigroup, covering 20,000 retailers in 11 countries stretching from India to New Zealand. Regulatory approvals in every territory were crucial, even if it meant inventing numbers to be used in the Hong Kong licence application.

Mr Kurniawan then sketched out a practice known as “round tripping”: a lump of money would leave the bank Wirecard owns in Germany, show its face on the balance sheet of a dormant subsidiary in Hong Kong, depart to sit momentarily in the books of an external “customer”, then travel back to Wirecard in India, where it would look to local auditors like legitimate business revenue.

The practice, according to the report cited by the FT, was used to appease regulators throughout Asia, which suggests that the fraud wasn’t merely the work of one rogue employee.

In isolation, Mr Kurniawan’s scheme might have appeared to be the act of a rogue employee in the provincial outpost of a little known financial group. But the account of what happened, in a preliminary report on the investigation by one of Asia’s most eminent legal firms, indicated it was part of a pattern of book-padding across Wirecard’s Asian operations over several years. Documents seen by the Financial Times show two senior executives in the Munich head office had at least some awareness of the round-tripping scheme: Thorsten Holten and Stephan von Erffa, respectively the company’s head of treasury and head of accounting.

The revelations call into question the figures reported by one of Europe’s few technological success stories, a German fintech group that has grown into a €20bn global payments institution. Before the FT exposed the existence of the investigation last week, the group was more valuable than Deutsche Bank or Commerzbank, whose place it has taken in Germany’s main stock market index. Wirecard is a favourite of retail investors, who saw its rapid expansion into Asia as a sign that it can challenge the world’s biggest banks for primacy in the $1.4tn market for payments.

The “whistleblower” who spoke with the FT helped initiate the internal probe after finding the brazenness of one of the company’s regional managers, who had called a meeting to explain to employees how the fraud would be carried out, almost too shocking to be believed.

This time questions about its Asian operations began internally, prompted by a whistleblower left stunned by Mr Kurniawan’s January meeting last year. Notifying Wirecard’s senior legal counsel in the region on March 26, the whistleblower identified two senior finance executives, James Wardhana and Irene Chai, as accomplices in the book-cooking operation. A separate whistleblower also raised concerns in February, and on April 3 that person supplied the compliance team with a suspect contract they had received via Telegram, the encrypted messaging app. Daniel Steinhoff, Wirecard’s head of compliance in Munich, flew in to Singapore for a briefing. On April 13 he ordered the email archives of these individuals “mirrored”, with copies seized. Compliance staff, who evidently found the accounts of the whistleblowers credible, soon found enough in the documents to warrant a snap investigation, codenamed Project Tiger. They called in Singapore-based Rajah & Tann, which sent in a team of former prosecutors.

Eventually, much of the behavior that the whistleblower had complained about was borne out by the report, including “forgery and/or falsification” as well as “cheating, criminal breach of trust, corruption and/or money laundering.”

On May 4 R&T submitted a preliminary report, running to 30 pages of bombshell allegations: evidence in the documents of “forgery and/or of falsification of accounts”, as well as reasons to suspect “cheating, criminal breach of trust, corruption and/or money laundering” in multiple jurisdictions. The trio in Singapore, led by Mr Kurniawan, appears to have been fabricating invoices and agreements to create a paper trail which could be shown to auditors at EY, as if money was moving in and out of Wirecard for legitimate purposes.

And in what was undoubtedly a bad look for the company’s top brass, once the investigation got rolling, the company’s top brass installed a senior employee who had allegedly been involved in some of the fraudulent activities to help oversee the probe, inviting comparisons to the “fox guarding the hen house.”

A briefing document dated May 7 2018 was prepared for a meeting of Wirecard’s four most senior executives. Alexander von Knoop, chief financial officer, thanked the author in an email following the meeting “for the great job you are doing to clarify the circumstances and to prevent Wirecard Group from any financial and reputational damage”. The email also announced that Jan Marsalek, Wirecard’s chief operating officer, had been appointed to co-ordinate the inquiry, “to get the necessary pressure on the investigation”, Mr von Knoop said.

[…]

Wirecard’s lawyers in Singapore warned Mr Marsalek’s proposed role presented “a perceived and potential conflict of interest.” He was a material witness of fact who had worked closely with Mr Kurniawan on certain projects, they said.

To sum up, to call Thursday’s FT report “damning” would be an understatement. It suggests that managers throughout the company’s vast global network brazenly and blithely invented money flows and even in some cases fake customers to back them up. The company also reportedly violated AML reporting guidelines. Taken together, the fraud calls into questions not just Wirecard’s recent earnings results, but the very perception of WireCard as one of the Continent’s most successful fintech startups.

Which begs the question: When this is all said and done, will Wirecard be remembered as Germany’s “Theranos?” As the whistleblower put it: “If a payments company can do this, how can we trust the system?”

via ZeroHedge News http://bit.ly/2DZxv0F Tyler Durden