When the Census Bureau releases retail sales data at 830am on Valentine’s Day, it will be the first time in two months that markets have gotten an update on the state of US retail spending, as the January release was postponed due to the government shutdown (Thursday’s release will be for December data). And if Bank of America’s proprietary card spending data is any indication, it’s set to be a doozy.

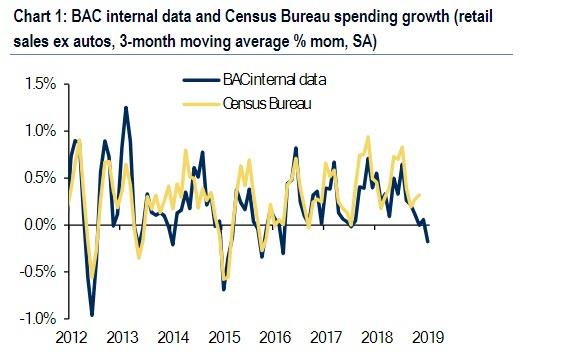

As BofA’s economists summarize the latest internal spending data, consumer spending weakened at the turn of the year, following a period of solid performance. In fact, retail sales ex-autos, as measured by the aggregated BAC credit and debit card data, tumbled 0.3% month-over-month seasonally adjusted in January – the biggest drop in three years. This follows a flat reading in retail sales ex-autos in December.

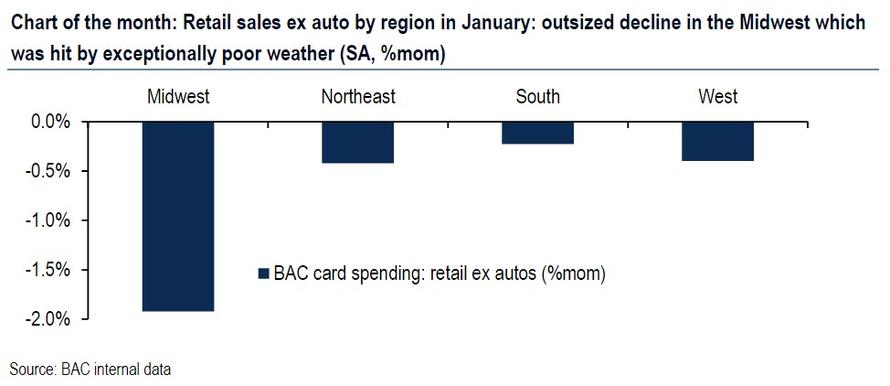

Turning to the January BAC internal data, the bank sees two factors influencing the data: the polar vortex and the government shutdown. The polar vortex delivered historically freezing weather to parts of the Midwest at the end of January which was visible with weaker spending in the metropolitan areas of Chicago, Detroit and Minneapolis. This contributed to a particularly big drop in activity in the Midwest.

The government shutdown appears to have also played a role. The next chart shows that spending was weaker for non-military government workers relative to the rest of the sample during the 35-day period of the shutdown.

To see whether this moves the needle on aggregate spending, BofA focused just on the DC metro area where 11% of workers are employed by the federal government. However, the bank did not find evidence that spending in DC was weaker as a result of the government shutdown. This suggests that although government workers reduced spending, it was not large enough to move the aggregate numbers. So there appears to have been little discernable direct impact but there may have been indirect effects on spending through impaired confidence more broadly. Nonetheless, an interesting takeaway is that the impact on spending generally grew with time. If the government were to shut again later this month, BofA’s economists warn that the risk is that consumers respond more quickly by reducing spend given that confidence is already impaired.

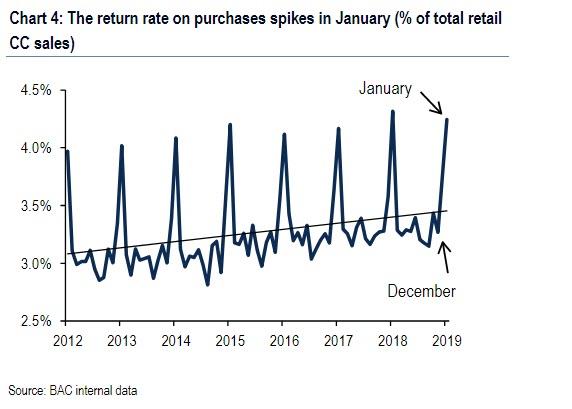

One other key consideration for the January data was the high rate of returns as 4.2% of total BAC credit card sales were returned. Similar to the Census Bureau, BofA’s analysts subtract returns out of the monthly sales data. The rate of returns has been on the rise as “free returns” have become more prevalent. This means we will likely see even greater volume in November and December but less in January, adding to the noise in the data.

BofA’s bottom line:

“While there are a number of special factors that skew the data, the softening of late has revealed the weakest trend for consumer spending since mid-2016.”

If the Census Bureau confirms this sharp drop in card spending, it will confirm that US consumer have indeed hit a break wall just in time for the Fed’s dovish relent, and if bad news continue to be good news, Thursday’s data has the potential to send stocks soaring as it would assure no more rate hikes this cycle.

via ZeroHedge News http://bit.ly/2TNUdyg Tyler Durden