Authored by David Weisberger via HackerNoon.com,

The story of QuadrigaCX has been told and retold over the past week, but all of the stories miss the most important point. Lost among the tales of lost keys, a suspicious death, & questions of the coins existence is the fact that QuadrigaCX routinely violated principles of best execution.

Wait??? Did he just say that a failure of best execution is more important than $190 million in lost Bitcoin???

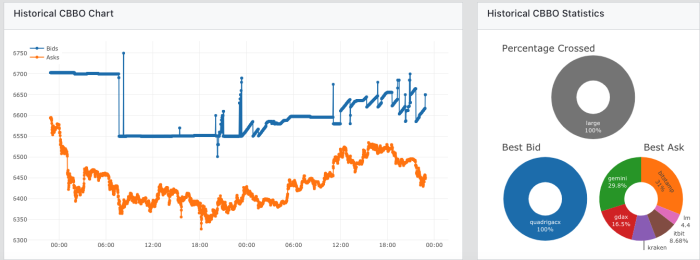

Yes I did. You see, dear reader, anyone who bought Bitcoin on QuadrigaCX was either woefully ignorant of Bitcoin’s price or perhaps they were laundering their money. At CoinRoutes, we track the best bids and offers from a large number of exchanges, and, over the past year have seen the bid on QuadrigaCX consistently multiple percentage points higher than the best offers elsewhere. Price charts, such as this one from the end of September were commonplace:

(In this chart, one can see that the best bid was from QuadrigaCX 100% of the time for the period and averaged over $150 dollars per coin more than the best offer from among the other exchanges.)

This price discrepancy existed for no rational reason. As Canada has no currency controls, why would anyone want to pay more than necessary for Bitcoin on a fringe exchange there??? It certainly was not for their top notch custodial services…

This, of course, calls into question whether the exchange actually had the Bitcoin they claimed, and, even if they did, if the coins were stolen or bought/sold from places that the authorities would be “interested” in. (OFAC countries, Drug Cartels, etc). That said, I am sure that QuadrigaCX managed to convince some poor retail investors to part with their money, as many of these investors are easily taken advantage of. While this was an extreme case, it should sound a warning note for the entire industry to start caring about best execution.

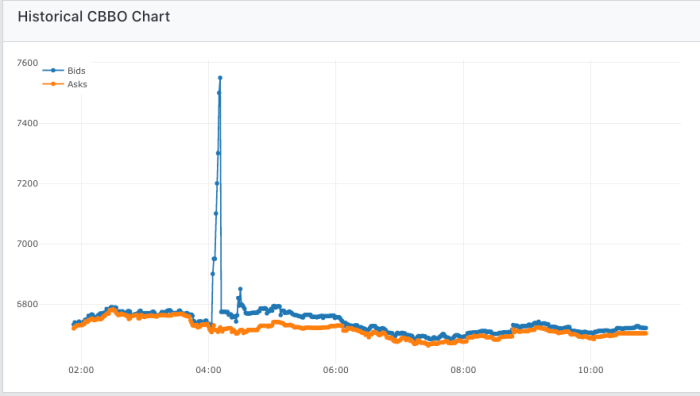

Before you dismiss this commentary as only applying to fringe exchanges, that is sadly not the case. To my knowledge none of the exchanges that dominate the market for retail investors, incorporate data from their competitors. In extreme cases, this can lead to huge potential losses for their customers, as happened late last summer on a “regulated” exchange based in NY:

In this example, clients entered multiple orders over a 10 minute period and traded Bitcoin up to over $7550 when all the other exchanges were offering Bitcoin around $6720

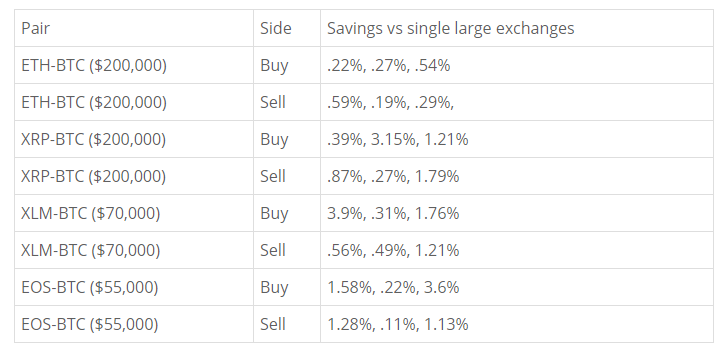

While exchanges could incorporate consolidated data feeds (such as CoinRoutes provides) to avoid these problems easily enough, there is no way for individual exchanges to provide best execution as long as they stay isolated. At any point in time during the day, even reasonably sized orders executed on one exchange alone will cost much more than smart routed or algorithmic orders. We have real-time tools at CoinRoutes to evaluate these excess costs, which are, quite often, significant. For example here is a table showing the excess costs for buying or selling several currencies on individual exchanges for orders of ranging from $55,000 to $200,000 in value (To avoid picking on specific exchanges, this table does not identify them, but uses the three largest exchanges that accept accounts from US investors)

So, considering all of this, what lessons should we take away from this? I would suggest the following:

-

Exchanges should stop ignoring best execution and implement consolidated data, routing technologies or both.

-

Savvy investors should “vote with their feet” and stop trading on single exchange interfaces. Use systems such as CoinRoutes or trading desks that access multiple exchange accounts and, more important, use algorithms that incorporate market data from all relevant exchanges.

-

Regulators tired of arm waving at the problems of the crypto market should get serious about best execution. That would facilitate forward movement of the industry including the approval of a Bitcoin ETF. After all, if best execution and manipulation surveillance was standard on a critical mass of exchanges, the SEC would have no reason to object to a well constructed proposal.

In conclusion, while the QuadrigaCX fiasco makes for interesting stories, it highlights more important deficiencies within the crypto markets than poor estate management. When markets institute the necessary technology, policies and procedures to deliver best execution, those adopters will flourish, while those which refuse to learn this lesson will ultimately fail.

via ZeroHedge News http://bit.ly/2DwkBWD Tyler Durden