The Fed’s dovish U-turn appears in jeopardy again.

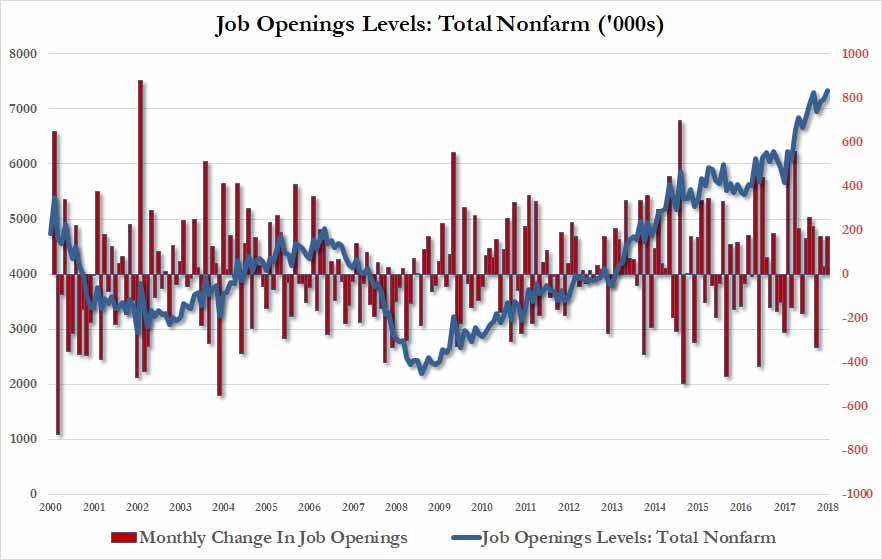

After a modest slowdown in job openings which started in September and continued through November, today’s November JOLTS report – Janet Yellen’s favorite labor market indicator – for the month of December showed an unprecedented surge in job openings across most categories as the year wound down, with the total number soaring from an upward revised 7.166 million (from 6.888 million), to an all time high 7.335 million, smashing expectations of a 6.846 million print.

And thanks to the surge in job openings, this will be the 10th consecutive month in which there were more job openings then unemployed workers: considering that according to the payrolls report there were 6,535MM unemployed workers, there is now exactly 800K more job openings than unemployed workers currently, (how accurate, or politically-biased the BLS data is, is another matter entirely).

In other words, in an economy in which there was a perfect match between worker skills and employer needs, there would be zero unemployed people at this moment (of course, that is not the case.)

Another issue: with the Fed positioned for an economic slowdown, the JOLTS data better turn negative fast or else Powell will soon be facing some very unpleasant questions why the Fed’s rate hikes are on pause when the number of job openings in the economy is soaring to unprecedented levels.

According to the BLS, job openings increased in a number of industries, with the largest increases in construction (+88,000), accommodation and food services (+84,000), and health care and social assistance (+79,000). The job openings level decreased in a number of industries, with the largest decreases in nondurable goods manufacturing (-37,000), federal government (-32,000), and real estate and rental and leasing (-31,000). Job openings were unchanged for government jobs.

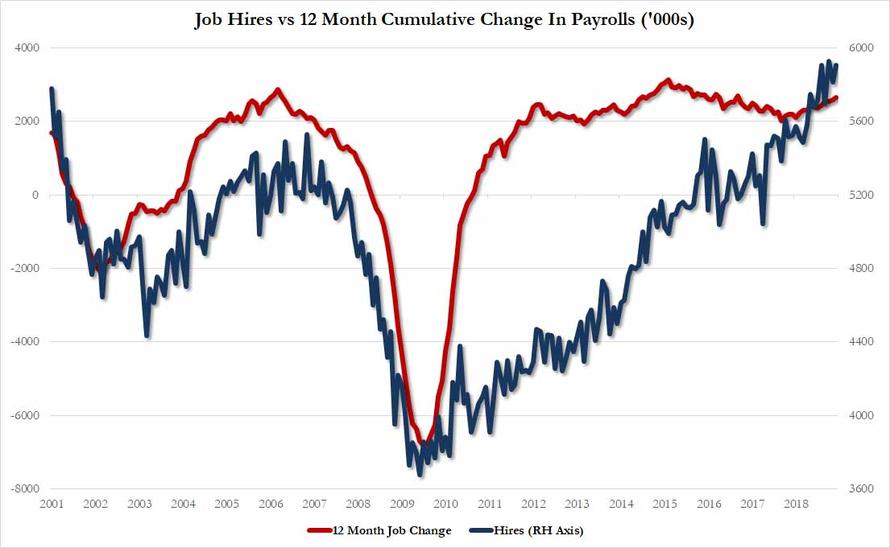

Adding to the unexpectedly strong labor picture to close the year, as job openings soared, the number of total hires also increased, rising by 95K in December to just shy of an all time high, and printing at 5.907 million. Hires increased in retail trade (+126,000), educational services (+19,000), and mining and logging (+9,000). Hires decreased in information (-22,000) and in federal government (-10,000). According to the historical correlation between the number of hires and the 12 month cumulative job change (per the Establishment Survey), the pace of hiring right now is precisely where it should be relative to the cumulative change in hiring.

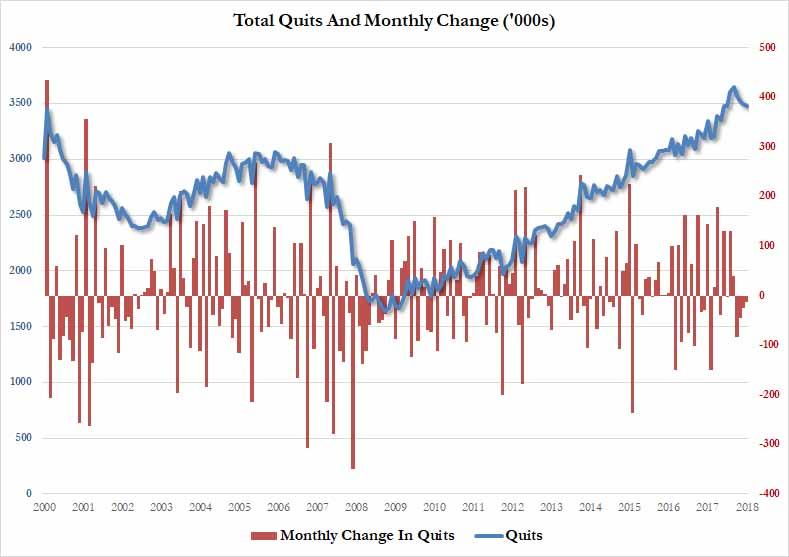

Meanwhile, the so-called “take this job and shove it indicator”, the quits level, edged down slightly, dropping by 12K to 3.482MM, and was little changed for total private but decreased for government (-18,000). Quits increased in professional and business services (+60,000) and in health care and social assistance (+49,000). Quits decreased in a number of industries, with the largest decrease in other services (-42,000).

Putting all this in in context

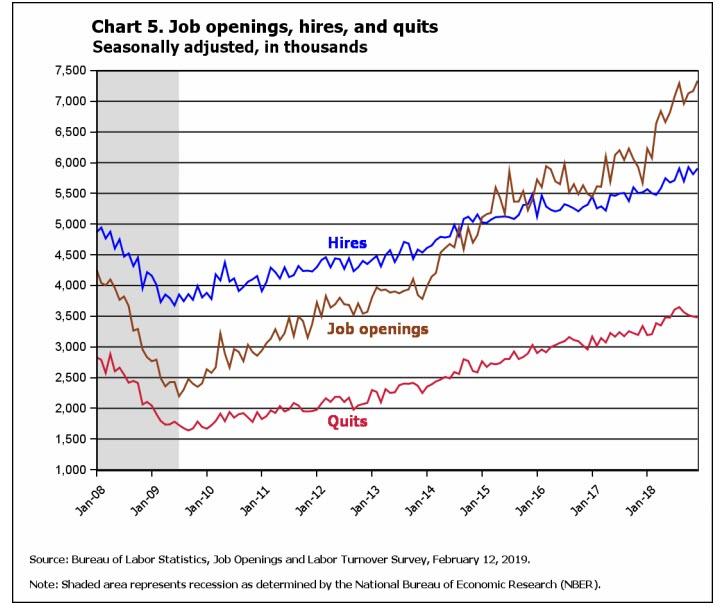

- Job openings have increased since a low in July 2009. They returned to the prerecession level in March 2014 and surpassed the prerecession peak in August 2014. There were 7.3 million open jobs on the last business day of December 2018.

- Hires have increased since a low in June 2009 and have surpassed prerecession levels. In December 2018, there were 5.9 million hires.

- Quits have increased since a low in September 2009 and have surpassed prerecession levels. In December 2018, there were 3.5 million quits.

- For most of the JOLTS history, the number of hires (measured throughout the month) has exceeded the number of job openings (measured only on the last business day of the month). Since January 2015, however, this relationship has reversed with job openings outnumbering hires in most months.

- At the end of the most recent recession in June 2009, there were 1.2 million more hires throughout the month than there were job openings on the last business day of the month. In December 2018, there were 1.4 million fewer hires than job openings.

via ZeroHedge News http://bit.ly/2DvI36h Tyler Durden