Authored by Ben Kilbey via Platts’ “The Barrel” blog,

“If there’s one trade that keeps me up at night, it’s palladium. If you want my advice, stay clear of it,” were the comforting words of one senior trader who spoke to S&P Global Platts recently.

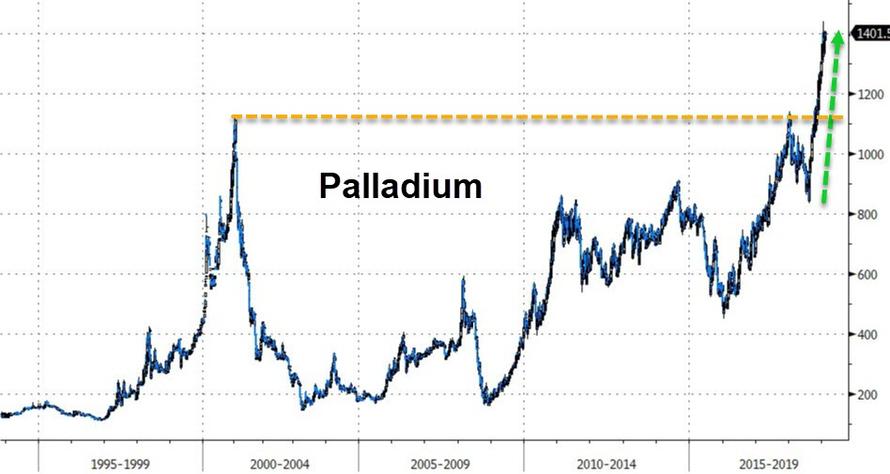

Palladium has been sky-rocking over the past two years, creating not only a sense of jubilation for those on the right side of the trade, but also fear for those trying to gauge the metal’s next move. As ever with trading, it’s all in the timing.

From a spot bid price of $700/oz at the start of 2017, the metal hit an all-time high of $1,440/oz in early January but then took a hammering lower. It leveled out around $1,320/oz, taking a breather that tempted some to question if the hot streak was finally over. Clearly not, because palladium was at a spot bid price of around $1,385/oz February 11.

“One of the major reasons for palladium’s price surge became clearer in Nornickel’s Q4 production results, where quarter on quarter palladium output fell 10% to 632,000 oz, leaving the full year down 2% at 2,729,000 oz,” noted financial services company BMO in its research. Nornickel is the world’s largest producer of palladium.

In November 2018 the company’s head of sales, Markus Meurer, told Platts that spikes in the price of palladium continue to be a cause for concern.

“We would like to grow the palladium business steadily, rather than seeing rapid price moves,” he said.

“A healthy palladium price is good, but we don’t like it spiking.”

In short supply, palladium was given a boost last year by the move away from diesel cars. The metal is primarily used in petrol vehicle autocatalysts to reduce emissions.

The consensus estimate in the market is that around 85% of palladium demand goes into gasoline engine autocats.

The “diesel-gate” emissions scandal that unfolded in 2015 was a major contributor to the “perfect storm” for palladium according to Meurer. He factored in growing demand not only from the physical market but also speculators, alongside stricter emissions regulations and implementation.

After the recent price correction, not the first and likely not the last, Mitsubishi analyst Jon Butler cautioned the market may be getting too frothy.

“With signs of rising [palladium] sponge inventories and waning industrial demand, we question the sustainability of the two-year uptrend,” Butler said in a research note, adding that the new high appeared to have been almost entirely driven by speculation.

“Palladium appears to be a two-tier market at present — investment demand in the OTC market has been very strong, whereas industrial demand has been weakening — there is evidence of this in the elevated premium of ingot (the investment form of the metal) over sponge (the industrial form),” Butler said.

Mitsubishi is forecasting an average palladium price of $1,150/oz in 2019, in a range of $1,050-$1,350/oz.

The London Bullion Market Association’s 2019 price forecasts, representing 30 analysts’ views and estimates, put forward a resoundingly bearish outlook. Participants from banks, brokerages and other outlets predicted it would be the worst performing precious metal in 2019. However, they wrongly made that prediction about palladium for 2018, as it continued on its longest bull run in history.

In the latest forecast, the sector predicted a 2019 average price of $1,267.68/oz, a high of $1,715/oz and a low of $900/oz — giving a huge $815 trading range, nearly two thirds of the average price.

A second senior trader at a major refiner told Platts a hefty correction was inevitable after a record-breaking rally.

“It’s bound to attract profit taking. Ingot supply is still tight. People are so quick to accept extreme conditions as the norm. Yes, lease rates have come down from 35%, but they are still [circa] 16%. It’s not like it has come back to flat. Forward rates are still in a backwardation,” the trader said.

Lease rates are the cost of borrowing a metal – a strategy used by companies including auto manufacturers, to avoid having too much raw material sitting on inventory. Lease rates tend to rise when physical supply is tight and fall when it improves.

“We may well never get back to $1,440 but the price is still $500 plus higher than 12 months ago,” the trader added.

For now, it seems the ball is firmly in the bull’s court, but the market is braced for volatility.

via ZeroHedge News http://bit.ly/2S1sNmX Tyler Durden