“Back to the future”…

Chinese stocks extended their epic run overnight…

Italian stocks are leading in Europe…

US equities drifted higher overnight, surged at the cash open, dumped on Marco Rubio’s tweet about taxing buybacks, then ramped back to the highs – because, well… just because…. and then faded as Trump asked Congress for more funding in the border bill…

Nasdaq futures plunged into the red late in the day after Trump funding headlines…

Notably – The Dow made a lower high on its post-European close surge before fading fast…

Once again the short-squeeze is invoked (5th day in a row)…

And once again it was all buybacks supporting the bid…

The S&P 500 opened (and closed) above its 200DMA for the first time since early December…

Before we leave stocks, we note that something changed today (and yesterday) with a late-day weakness we have not seen all year…

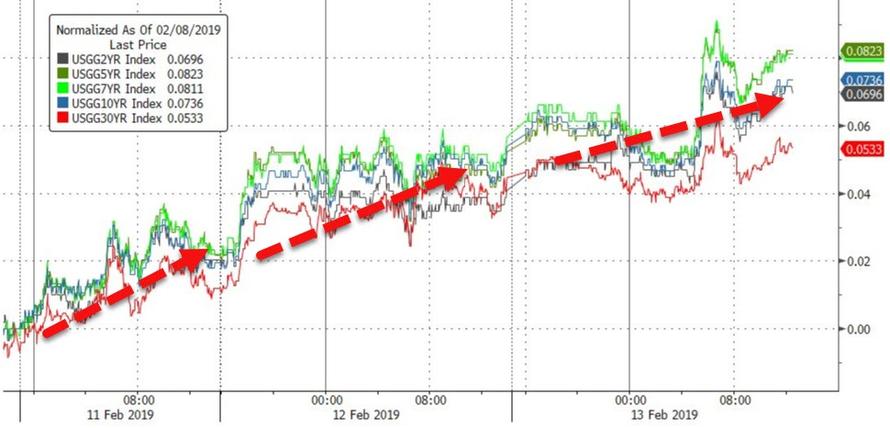

Treasury yields rose for the 3rd day in a row – led by the belly of the curve…

Debt Ceiling anxiety is starting to appear in the T-Bill curve…The slight dislocation aligns with Wall Street strategists’ very early forecasts as to when the Treasury could exhaust its extraordinary measures.

After rallying for 8 straight days, the dollar dipped yesterday… but that was all forgotten today as the dollar soared back to new highs…

The dollar strength weighed on PMs and copper but oil prices surged despite inventory builds…

Finally, we note that the initial Plunge Protection Team surge in global central bank balance sheets has now faded, leaving stocks on their own… for now…

With a gaping spread to reality…

It can’t happen again right?

via ZeroHedge News http://bit.ly/2X4gppI Tyler Durden