While headline and core CPI slowed in December, the print was still boosted by outsized gains in a few specific categories so it wouldn’t be a great surprise to see some payback in January (and expectations were for a slowdown).

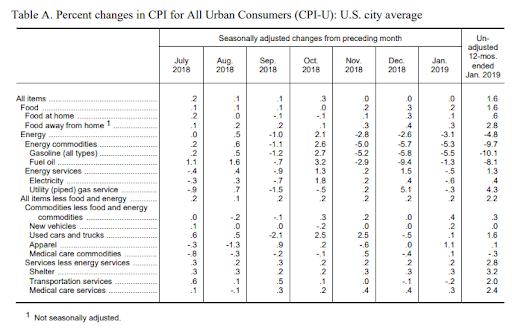

But – that did not work out – headline and core CPI YoY growth topped expectations (+1.6% vs +1.5% exp and +2.2% vs +2.1% exp respectively)…

However, headline CPI YoY slowed to its weakest since September 2016.

As Bloomberg reports, the CPI report had a few quirks, including a 1.1 percent rise in apparel prices that was the biggest in almost a year. Apparel prices reflected outsize gains in footwear, which had the biggest increase since 1988, and women’s clothing.

The report showed new car prices rose 0.2 percent from the prior month for the first increase since July. Used car prices were up 0.1 percent after declining in December.

Energy prices also had an outsize impact on the headline number with a 3.1 percent monthly drop that was the most in almost three years. Gasoline prices fell 5.5 percent from the prior month and were down 10.1 percent from a year earlier.

Another silver lining in the inflation slowdown is the drop in the growth of rent costs to its slowest since Jan 2015…

Notably, Deutsche Bank points out that January prints have tended to be higher than in other months, suggesting some residual seasonality. Over the past five years, January prints have averaged about 5bps higher than the prints in the other months of the year, though the recent methodological revisions are supposed to reduce this discrepancy by around half.

Of course, this adds to the goldilocks narrative – as Powell signaled at his last press conference in late January that rates are unlikely to rise until inflation accelerates.

“I would want to see a need for further rate increases, and for me, a big part of that would be inflation,” he said. “It wouldn’t be the only thing, but it would certainly be important.”

So, forget collapsing earnings expectations and slumping global growth – weak US inflation means The Fed is on the sidelines so BTFD!

via ZeroHedge News http://bit.ly/2RYG4wr Tyler Durden