We were one of the very first to speculate that Elon Musk had mortgaged 5 of his homes in late January, when we highlighted research by an internet sleuth on Musk’s personal financial situation. According to public records cited by Tesla skeptic EVent Horizon and laid out in a timeline on Sutori in late January, Elon Musk looked as though he had leveraged some of his personal real estate.

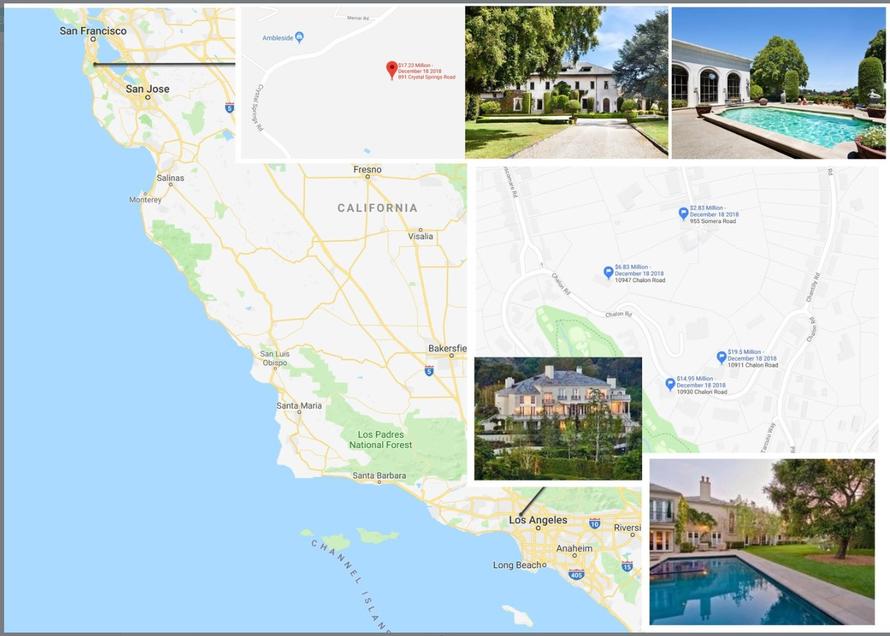

A follow up report from Bloomberg has confirmed that Musk recently took out $61 million in mortgages on five properties that he owns in California. Four of these properties are in the Bel Air neighborhood of Los Angeles and one is in the Bay Area.

The loans were signed off on by Morgan Stanley, as was originally speculated, and represent $50 million in new borrowing for Musk. One loan was a refinancing on a 20,200 plus sq. foot property that Musk purchased in 2012 for $17 million. The initial $10 million loan he took on the property has now turned into a $19.5 million debt, with a monthly payment of about $180,000.

Musk’s loans will be for 30 years with a fixed 3.5% interest rate for the first few years that will adjust based on an index.

“The loans show how even the wealthiest people use mortgages to maintain liquidity,” noted Bloomberg, yet oddly missing the other, potentially bigger story namely why a person worth a reported $23.4 billion would need $60 million in mortgages.

And houses aren’t the only thing Musk has leveraged against. As Tesla’s share price falls under $300 it’s likely once again worth noting that Musk has often used his personal shares in Tesla to obtain additional personal loans. As of the end of 2017, roughly 40% of Musk’s stake in Tesla had been pledged for loans. Musk also reportedly inquired last year about loans against his stake in SpaceX.

We had previously reported that Musk’s loans against his properties took place around mid December.

As a reminder, on December 17, a WSJ story about SpaceX using its resources to help The Boring Company broke, as we reported on December 18. SpaceX investors, including Peter Thiel’s Founders Found, were reportedly alarmed to learn that Elon Musk’s Boring Company was building a test tunnel entrance at SpaceX headquarters. Possibly even more alarming at the time was the fact that it was being constructed partly by SpaceX employees, using equipment that was purchased with SpaceX funds.

On December 18, banks that held Musk’s pledged shares and personal loans then issued notes on Tesla. MS said “shares may peak” in Q4 and Goldman maintained its sell rating on the name with a $225 target.

55% of the shares that Musk pledged at the end of 2017 were also with Morgan Stanley, where Musk has a “wide web of dealings”. Morgan Stanley has tripled its loans to high net worth individuals over the last 5 years.

Despite Musk’s increasingly “interesting” personal financial situation – and given the shaky start to 2019 for Tesla – why does Morgan Stanley, which already has material exposure to the billionaire investor, continue to be so interested in doing business with the Tesla CEO? Gauthier Vincent, lead wealth management consulting partner for Deloitte said: “To get a new relationship on the investment side with a new high-net-worth client is very difficult. On the credit side, it’s a much easier way to get in, if you’re really good at it, than to try and compete on the investments.”

via ZeroHedge News https://ift.tt/2GWzy7v Tyler Durden