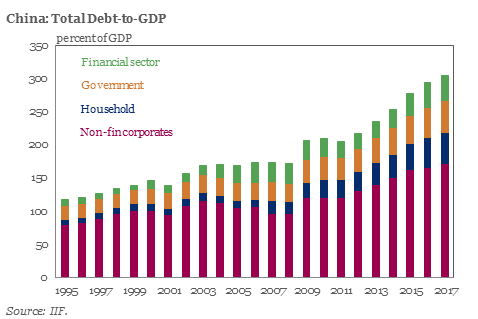

When it comes to estimating China’s total outstanding debt, there has long been confusion about the real number with most putting the debt/GDP at around 250%, while the IIF in 2017 calculated China’s debt load as high as 300% of GDP (which means that by now it is substantially higher).

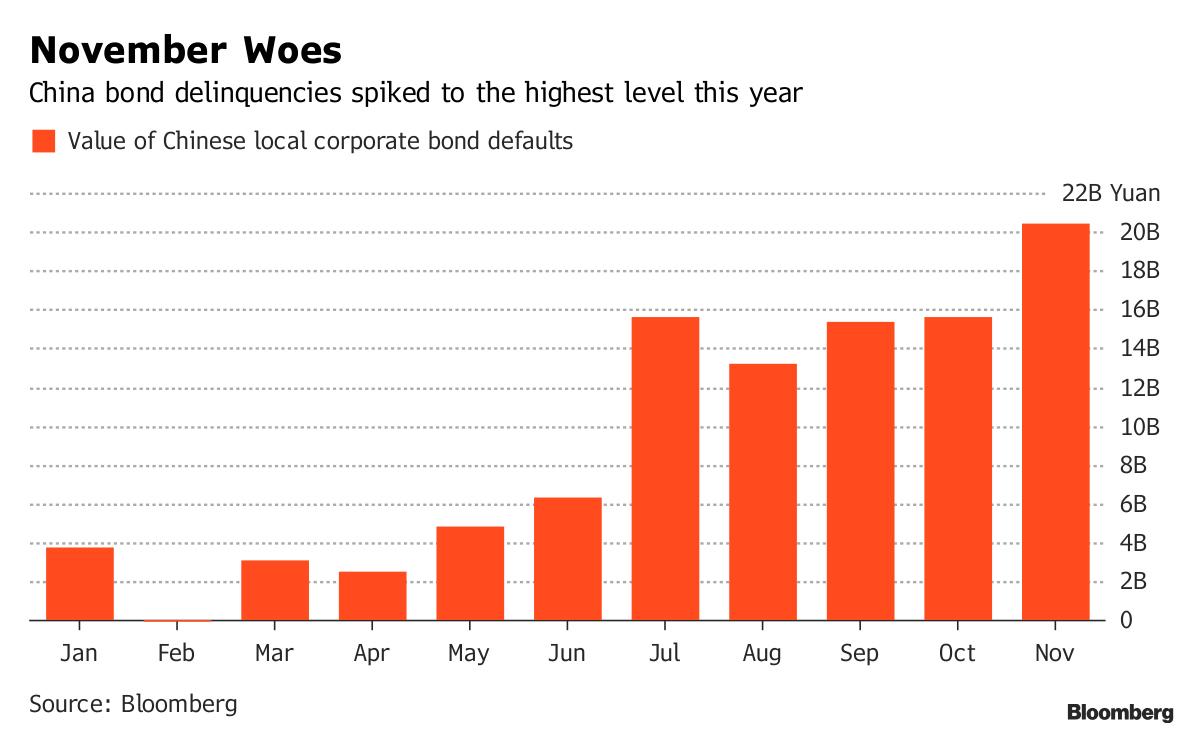

Then, last year, China watchers added another 40% of debt/GDP to the total when, as S&P calculated, China’s local governments had accumulated 40 trillion yuan ($6 trillion) – or even more – in off-balance sheet, or Local government financing vehicles (LGFV) debt, an amount Bloomberg has dubbed China’s “hidden debt bomb“, suggesting the already record surge in defaults in 2018 is set to accelerate further.

“The potential amount of debt is an iceberg with titanic credit risks,” S&P credit analysts wrote in October 2018, with much of the build-up related to local government financing vehicles, which don’t necessarily have the full financial backing of local governments themselves.

Local government debt has quickly emerged, together with “shadow banking” debt, as one of the main risks for China’s economy, because with the national economy slowing, and as a result of a crackdown on shadow lending and a Beijing quota for issuance of local-government bonds not enough to fund infrastructure projects to support regional growth, authorities across the country have resorted to LGFVs to raise financing, according to S&P. That’s left LGFVs “walking a tightrope” between deleveraging and transforming their businesses into more typical state-owned enterprises, S&P warned.

So fast forward 6 months, when in China’s ongoing attempt to contain the soaring financial risks from its debt bubble, Beijing – seemingly content with the progress it has made on containing shadow debt – is re-focusing on the “hidden debt” owed by local governments, as officials seek to reduce repayment pressures amid falling tax revenues.

And with Beijing adding pressure on local authorities to become more transparent with their liabilities, Bloomberg reports that provinces and cities from Jiangsu in the east to Qinghai in the west are looking for means to pay-off or restructure their implicit borrowings, which include trillions in “off the books” funding via financing vehicles. Some authorities are seeking cheap refinancing from the nation’s largest policy lender, the China Development Bank, and others are selling off state-owned assets such as office buildings and housing.

Efforts to deleverage the “hidden time bomb” of 40 trillion in local government debt have gained urgency after the government recently pledged to cut taxes by two trillion yuan ($300 billion), further draining local coffers and adding to the possibility of missed repayments. Meanwhile, the lack of official estimates of the total local government debt load – S&P’s CNY40 trillion estimate is just that – which usually carries higher rates than on-book ones, makes the issue even trickier.

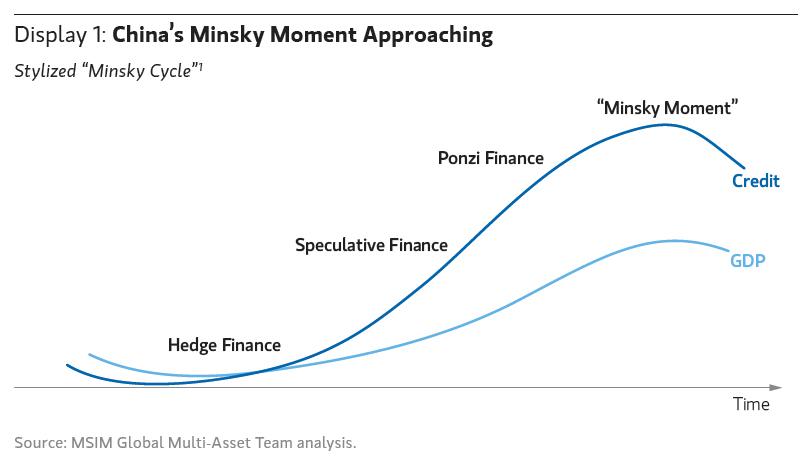

There is a more pressing reason behind the rush to deleverage: as Nomura’s China economist Lu Ting said, the motive is “just that the problem can’t be delayed anymore,” as in many places fiscal revenues and gross domestic product aren’t enough to cover the interest and principals.

In other words, China may be just months ahead of its own Minsky Moment.

With official probes now taking place to quantify the local debt, so far they’ve shown that hidden debt in some places exceeds the on-book borrowing, a lawmaker of the National People’s Congress Zhu Mingchun said over the weekend, according to Bloomberg.

Meanwhile, payments due for local-government financing vehicle debt are soaring and could reach 2.3 trillion yuan this year, according to estimates by Industrial Securities Co, which notes that local authorities will have to carry that burden at a time of slowing revenue growth due to tax cuts and shrinking receipts from land sales.

One possible solution is massive restructuring of the debt: in one case in December, the CDB led a group of commercial lenders in a swap of 260.7 billion yuan of implicit debt borrowed by Shanxi province to build highways. The debt was restructured with a tenor of up to 25 years, allowing the local authorities to save 3 billion yuan in interest payments every year, according to Shanxi Transportation Holdings Group. As Bloomberg notes, asset sales are also being used. For example, a district in the northeastern city of Shenyang is planning to sell more than 38,000 square meters of offices and government-built housing to repay maturing debt.

Of course, since in China everything is in some state of being a bubble, officials are simply using “the healthier part of the balance sheet of the public sector to address some of the hidden issues,” but they have to make sure the risky loans won’t get out of control again in the future, because by that time the balance sheet would be less capable of absorbing them, according to Grace Ng, a China JPMorgan economist.

China is also taking advantage of the current euphoria involving local capital markets: a financing platform in the eastern province of Jiangsu, where the CDB is involved in some cases of debt restructuring, sold a 270-day bond last week with a coupon of 4.8 percent, 150 basis points lower than a similar note the company issued in January. On Monday, a financing and investment company owned by a city in Shanxi province was upgraded to AA+ from AA by China Chengxin International Credit Rating Co., which cited the better outlook for capital quality.

“The bigger worry is the moral hazard issue,” said Zhu Ning, a professor of finance at Tsinghua University and the author of “China’s Guaranteed Bubble.” “Implicit government guarantees still lie at the core of so many problems.”

And nowhere is the problem of moral hazard greater than in China, whose financial sector is approaching double the size of its US peer even as China’s GDP is years behind catching up with America’s. Which makes Beijing’s choice relatively easy: keep kicking the can, or watch as the long-overdue Minsky Moment finally arrives and topples the biggest house of financial cards ever constructed.

via ZeroHedge News https://ift.tt/2CfRHKz Tyler Durden