Submitted by Howard Wang of Convoy Investments

Thoughts on Modern Monetary Theory (MMT)

Modern Monetary Theory (MMT) has been the most recent fad in politics and a few of my clients asked that I provide my thoughts on its economic viability. I tend to not get into politics but this was an interesting economic question so I’m sharing the following. I will say that I’m not an expert on the theory and even proponents don’t seem to agree on all aspects of the theory, so take the memo with the appropriate grain of salt.

The US has a lot of debt and few options

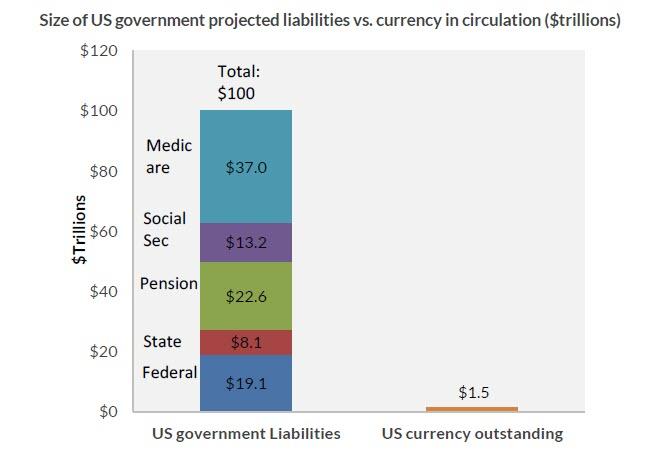

As of last year, the federal government directly owed about $19 trillion, the state governments owed about $8 trillion, and the pension system had about $23 trillion in entitlements. Social security and Medicare are expected to cost $50 trillion through the next 75 years. We are currently looking at about $100 trillion in projected government liabilities and the deficits are only getting worse and now there is a push for new initiatives that will cost $trillions more.

When faced with ballooning debt we really only have three options short of a direct default:

- Tighten the belt, spend less and tax more.

- Keep borrowing money and increasing the debt.

- Print money.

Our nation has historically pursued some combination of the first two options, keeping an eye on the deficit while increasing the debt ceiling as necessary. However, in the current environment where debt levels are already high, economic growth slow and income inequality wide, the third option seem increasingly attractive to politicians pushing for additional government spending.

Revival of MMT

The recent political push for increased spending found steam behind the revival of an economic ideology called the Modern Monetary Theory. The theory is centered on the idea that a dollar printing press frees the US government from the budgetary constraints facing normal entities. Because America borrows in its own currency, it can always print more dollars to cover its obligations. As a result, the thinking goes, the US can always run sustained budget deficits and rack up an ever-increasing debt burden with the printing press as the ultimate back stop. The Fed can then keep interest rates low to contain the cost of servicing the debt and should there be an inflation problem from too much printed money, simply increase taxes. At the surface, this sounds like a free lunch that the leaders of our country have been either too dumb or too scared to take in the last few centuries. Why worry about balance sheet problems when we can print them away?

I believe MMT is the wishful thinking of politicians

I haven’t done an exhaustive literature review, but I believe anyone who truly understands the balance sheet of the US government will not buy into MMT. For example, in a recent congressional hearing, the Chairman of our Federal Reserve Jerome Powell said the following about MMT and the role of the central banks.

“The idea that deficits don’t matter for countries that can borrow in their own currency I think is just wrong. The US debt is fairly high to the level of GDP — and much more importantly — it’s growing faster than GDP, really significantly faster. We are going to have to spend less or raise more revenue. And to the extent that people are talking about using the Fed — our role is not to provide support for particular policies. Decisions about spending, and controlling spending and paying for it, are really for you (the congress).”

MMT doesn’t work because our currency outstanding is tiny compared to our debts

In debates about MMT, I’ve heard a lot of analysis around unemployment, inflation, aggregate demand, taxation and other complicated macroeconomic concepts. My biggest problem with MMT is a simple one. The theory boils down to using the printing press as a last resort to fiscal troubles and if we look at how we’d practically go about using the printing press to pay for obligations, we’d find that MMT is completely implausible. This is perhaps why anyone not stuck in economic theory-land, but understands the US monetary system like an actual business with dollars in and dollars out will not accept MMT.

The magical printing press on which MMT relies is far too small in reality compared to the size of our obligations. Below I show to scale the relative size of our projected government liabilities to the size of our currency outstanding.

Our currency is not meant to be a rainy day fund but rather a medium of exchange. As a result, it is tiny compared to the size of our economy and our obligations. For every $1 of currency there is almost $70 of liabilities. It would take a massive amount of printing by historical standards to make any kind of a dent in the liabilities. For example, to pay for just 10% of our current liabilities with the MMT approach, we’d have to print so much money that the number of dollars in circulation goes up by 700%.

The US is the reserve currency of the world because we have been extremely disciplined about money printing

To get context around what such a large spike in US dollar would do to the economy, we need to look back at the history of money printing in the US. Today, US is the reserve currency of the world and a huge part of the world economy depends on the stability of the US dollar. For example, 90% of all foreign exchange trades include the dollar as one of the pair, 1/3 of the global GDP comes from countries that are directly pegged to the dollar and a substantial other portion comes from countries that are loosely tied to the dollar.

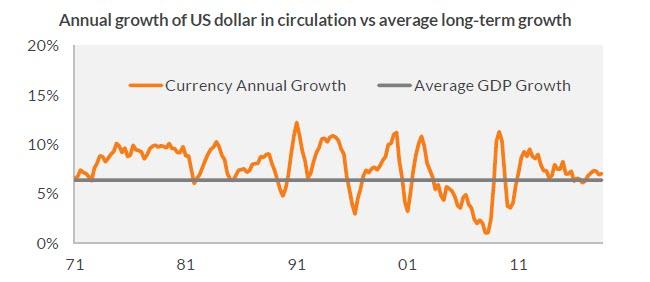

We’ve achieved this privileged status because we’ve earned the trust of the global markets through decades of discipline. Below I show the annual growth of US dollars in circulation compared to the long-term average economic growth. While the growth rate of our money supply fluctuates in the short-term along with the business cycle, we have been extremely disciplined about keeping the long-term currency growth rate in tandem with the economic growth rate. It is inflationary to have money supply grow substantially faster than the economy itself (and deflationary to have money supply grow slower than the economy). Even in the depths of the Financial Crisis, we resisted the temptation to directly print and inject currency into the economy, which is why the currency in circulation did not dramatically change through our recent quantitative easing. Interestingly, proponents of MMT often mischaracterize our recent quantitative easing as an example of how money printing is a free lunch that didn’t cause inflation.

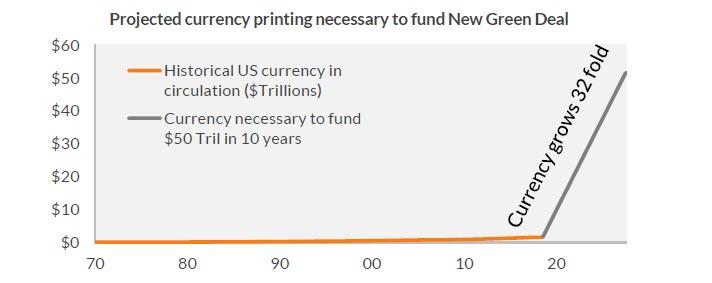

To print enough money at the scale necessary to fund some of the recently discussed initiatives like the New Green Deal, we’d have to massively depart from history. To give you a sense of how much we’d have to print relative to history, below I show the amount of currency in circulation necessary in order to fund the $50 trillion over the next 10 years (the low end of an estimate from a think tank led by a former Congressional Budget Office director). The number of dollars in circulation would have to go up 3200%.

This would undoubtedly lead to massive inflation, spiking interest rates, and crumbling value of the dollar. While MMT directly addresses inflation, I have yet to see proponents discuss the impact on foreign exchange – the US economy doesn’t exist in a vacuum. Recently our former Fed Chairman Alan Greenspan was also asked about MMT, to which he responded, “You’d have to shut down your foreign exchange markets, people will be trying to fly out of your currency.”

If the government then pursues the MMT recommended strategy of increasing taxation in a massively inflationary economy with plummeting currency value, you’d see additional capital flights, further exacerbating inflation and currency problems. It is also interesting that MMT would reverse the roles of the Fed and the Congress, asking the Fed to keep interest rates low to promote government spending while asking the Congress to adjust taxes as necessary to keep inflation in check.

The US has earned the trust of the global markets over the last century. With the privilege of being the reserve currency comes the responsibility of a disciplined currency management. The leaders of this country have never taken the free lunch of the printing press not because they were dumb or scared, but rather because that free lunch does not exist. Dollars are traded in a free market where both the buyer and the seller need to be incentivized to make the exchange. The markets are not so dumb and naïve to blindly hold on to the dollar while the US prints its way out of fiscal trouble. The moment the US resorts to the printing press, the logical move is to ditch the dollar and all dollar denominated assets and the trust the US has built over decades will evaporate in a moment.

So then why is the world still lending to the US at such low interest rates?

There is no doubt the US has a tremendous amount of debt. If we can’t print our way out of our troubles and our liabilities are going up every year, then why is the market still freely lending to the US at such low interest rates? Didn’t I just say the markets aren’t so dumb and naïve?

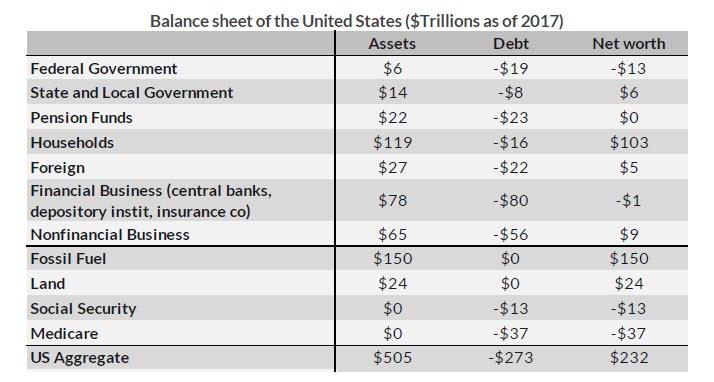

We are blessed with such low financing rates not because of some new theory about money that comes with a magical printing press. Instead, we are like rich kids borrowing on the back of a vast inherited fortune. When assessing borrowers’ credit worthiness, a lender would look at their income as well as total net worth. In the case of the US, we have the luxury of an incredible wealth of infrastructure, intellectual property, land, financial assets and other resources. Below I show the aggregate balance sheet of the entire United States – this is of course an extremely rough estimate that is more for illustration. The first section was collected from a quarterly publication from the Federal Reserve called the Financial Accounts of the United States, which was a fascinating read. The second section is rougher estimates I collected from other sources.

While by normal accounting standards the Federal government is in dire shape with a net worth of -$13 trillion, our nation as a whole is tremendously wealthy. Even with all the liabilities like pension, Social Security and Medicare, our country still sits at over $200 trillion of positive net worth. We’ve had the luck of establishing a country in one of the most productive and resource-rich plots of land in the world and the fortune of having generations of innovative hard workers before us to develop that land and those resources.

From this broader sense, our balance sheet is still reasonable so it is understandable that the markets are still willing to lend us for cheap (though it is up for debate how much of that wealth the US government can really sell or tax). That said, our balance sheet is steadily worsening so the debt may soon lead to higher financing rates if it continues to grow faster than our income. Those higher financing costs will come sooner if politicians don’t recognize the limitations to our finances and rely on a magic printing press to save us.

Final thoughts

I believe that Modern Monetary Theory is naïve and that it would fail, but I do fear that it is like a seductive infomercial that makes hard-to-resist claims and may lead us down a fiscally destructive path. By the time we realize our mistake, it may be too late. I do not know politics well enough to predict which path we’ll end up choosing.

via ZeroHedge News https://ift.tt/2UtUw1n Tyler Durden