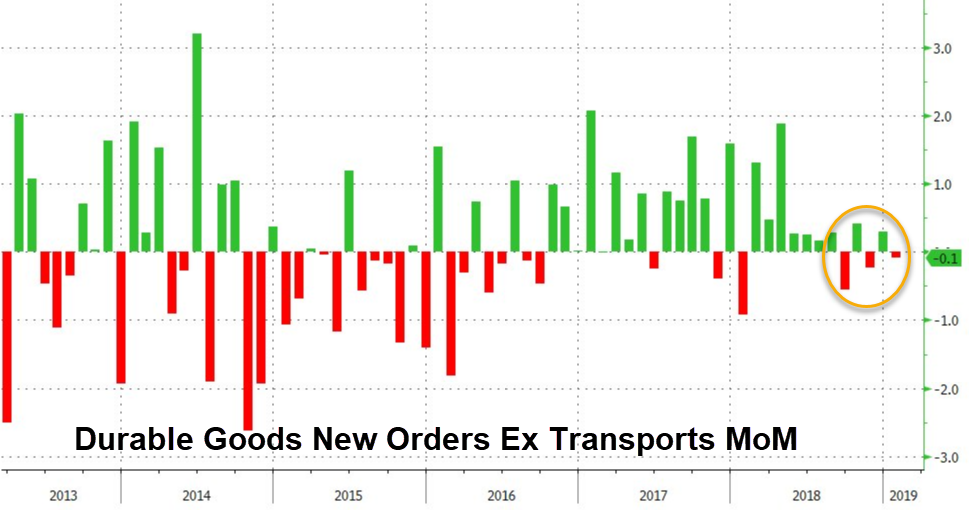

Headline durable goods orders beat expectations notably in preliminary (delayed) January data (rising 0.4% MoM vs expectations of a 0.4% decline), however, excluding transportation-equipment demand, which is volatile and can move wildly on large orders in any given period, orders fell 0.1% – confirming the last six months of very modest growth (if any).

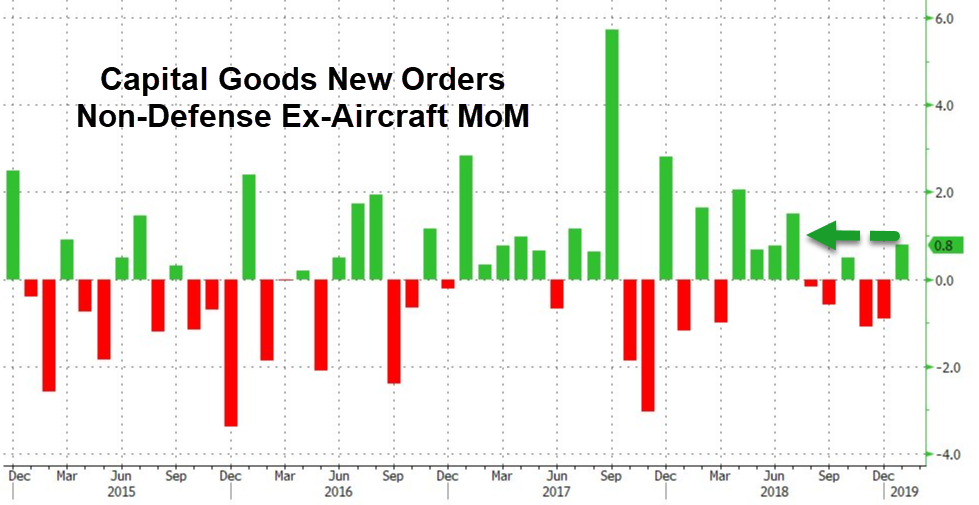

On the bright side, non-military capital goods orders excluding aircraft – a proxy for business investment – notably outperformed expectations – rising 0.8% MoM vs +0.2% expectations – the biggest jump since July.

As Bloomberg notes, the improvement in demand, underscored by orders for machinery and communications equipment, suggests a solid start to the year for manufacturers that should support economic growth in the first quarter. At the same time, other data for February give a more muted picture, with the Institute for Supply Management’s factory index falling to a two-year low in February and manufacturers adding the fewest workers since 2017.

Finally, we note that amid the ongoing Boeing debacle, total durable-goods orders, which gained 0.4 percent from December, got a boost from the volatile transportation category, reflecting a 15.9 percent rise in bookings for civilian aircraft and parts. Separate data showed Boeing’s aircraft orders fell in January to less than a quarter of the prior month’s total.

via ZeroHedge News https://ift.tt/2u2fvgt Tyler Durden