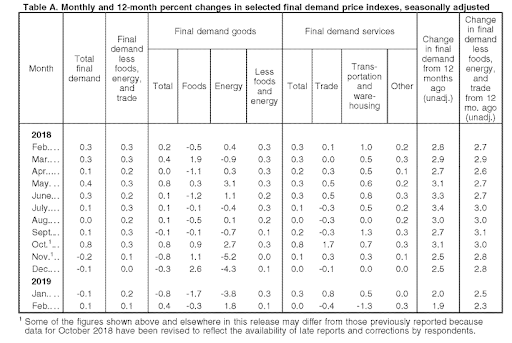

Following disappointing (for inflationists) CPI data earlier in the week, US producer prices also rose at a slower than expected rate in February.

While Final Demand PPI printed as expected at +1.9% YoY, that is the weakest growth in prices since June 2017 (and back below the key Fed-mandated 2.00%)…

Core PPI (ex Food and Energy) slowed more than expected (+2.5% YoY vs +2.6% YoY exp).

-

The index for final demand services was unchanged in February .

-

The index for final demand goods increased 0.4 percent in February following three consecutive declines.

Over 80 percent of the advance can be traced to prices for final demand energy, which rose 1.8 percent. The index for final demand goods less foods and energy edged up 0.1 percent. Conversely, prices for final demand foods fell 0.3 percent. Forty percent of the increase in the index for final demand goods is attributable to a 3.3- percent rise in gasoline prices. The indexes for diesel fuel, jet fuel, integrated microcircuits, residual fuels, and beef and veal also moved higher. In contrast, prices for fresh and dry vegetables declined 12.8 percent. The indexes for iron and steel scrap and for residential natural gas also decreased.

In February, prices for traveler accommodation services rose 5.3 percent. The indexes for machinery, equipment, parts, and supplies wholesaling; food retailing; portfolio management; and legal services also moved higher. Conversely, margins for fuels and lubricants retailing fell 10.5 percent. The indexes for apparel, jewelry, footwear, and accessories retailing; airline passenger services; health, beauty, and optical goods retailing; and nonresidential real estate services also declined.

More comforting data for The Fed to remain “patient” – the question is, is ‘bad’ news still good news for the stock market?

via ZeroHedge News https://ift.tt/2HBBkeT Tyler Durden