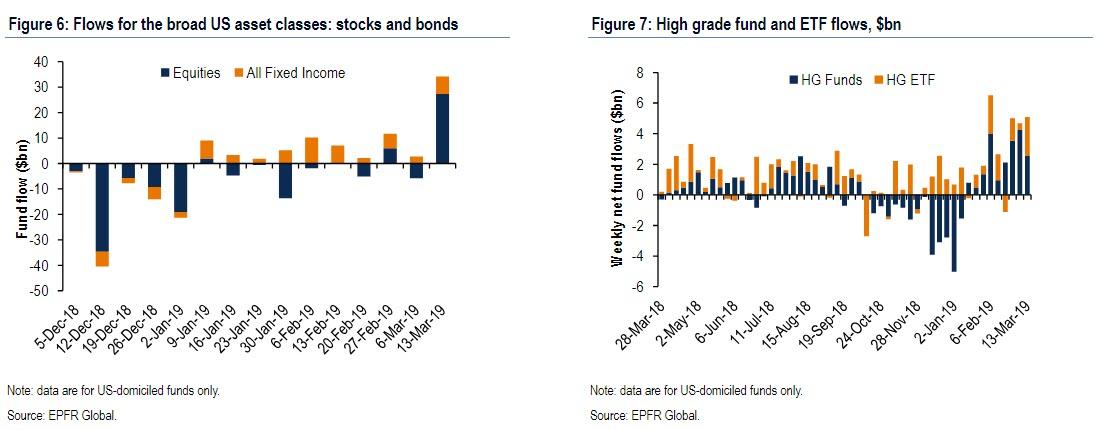

Just how much investor appetite is there for bonds? So much, that even in a week that saw the second biggest equity inflow on record (after a 13 week drought) buying of bonds continued for a 10th consecutive week, rising to $7.01bn from $2.74bn the week prior.

This flood into fixed income continues despite repeated warnings about the dangers of the corporate debt bubble from such investing icons as DoubleLine’s Jeff Gundlach and Marathon’s Bruce Richards, not to mention the IMF and BIS, who have been focusing on the growing risk of mass downgrades in the $3 trillion BBB-space, which could translate into a tsunami of fallen angels during the next recession.

And nowhere was the complacency greater than in today bond offering from Power Solutions, where even though the pricing on $3.7 billion in notes was pushed to Monday, it wasn’t due to a lack of buyers. As Bloomberg reported, the $10 billion total package was 3x oversubscribed as underwriters revealed they had $30 billion in orders already linked up, including $9 billion for a loan deal that allowed the syndicate to raise the offering size to $4.2 billion from the $3.2 billion initial talk at a lower spread (revised to L+350 from L+400-425 originally).

But what was most striking is that, as Bloomberg noted previously, the flood in demand came even after Xtract Research previously described the loan as having the worst-ever covenants “by a large margin.” Still, as a result of the damning designation, the $10 billion debt package behind the buyout of the Johnson Controls unit did get some improvements to the covenants in the debt agreement, according to Bloomberg’s Lisa Lee. In exchange for the tougher documents that govern the borrower, investors gave up roughly 50bps of yield.

What is perhaps most notable is that at least in this one case, it emerged that creditors still have some negotiating power: the bonds and loans, which back the buyout of the Power Solutions unit by Brookfield Management and Caisse de Depot “garnered criticism from analysts for granting the borrower and its sponsor too much leeway.”

After investors complained, a slew of lender-friendly changes were made, including the addition of a quarterly earnings call and limits on dividends for the first year, said the people.

Amusingly, the concessions don’t broadly improve the credit accord, and some investors upgraded the analyst categorization from “the worst ever, to one of the worst ever” with analysts at high-yield research firm Lucror said the documents remain weak for bondholders.

Worst covenants ever, or just “one of the worst”, demand for the 3x oversubscribed financing was overwhelming as investors starved for yield continue to have “limited” options in the high-yield bond and leveraged loan markets after the recent dovish reversal by the Fed.

As a result of the surge in demand, investors agreed for a second time to accept a lower yield on the loan, now offered at 350 basis points above the benchmark interest rate, Bloomberg reported. The original range tabled was 400 bps to 425 bps. The original issue discount was also narrowed to 99.5 cents from 98.5 cents initially.

It wasn’t just the loans with the terrible covenants that got a preferential revision: yields on the bonds were also reduced, with the $1 billion portion of secured notes offered at 6.25% from an initial range of 7% to 7.25%. The $750 million of equivalent euro bonds were offered at 4.375 percent, down from an original range of low 5 percent. Another $1.95 billion unsecured-bond offering is being discussed at a price of 225 basis points above the secured bonds, making further pricing shifts likely.

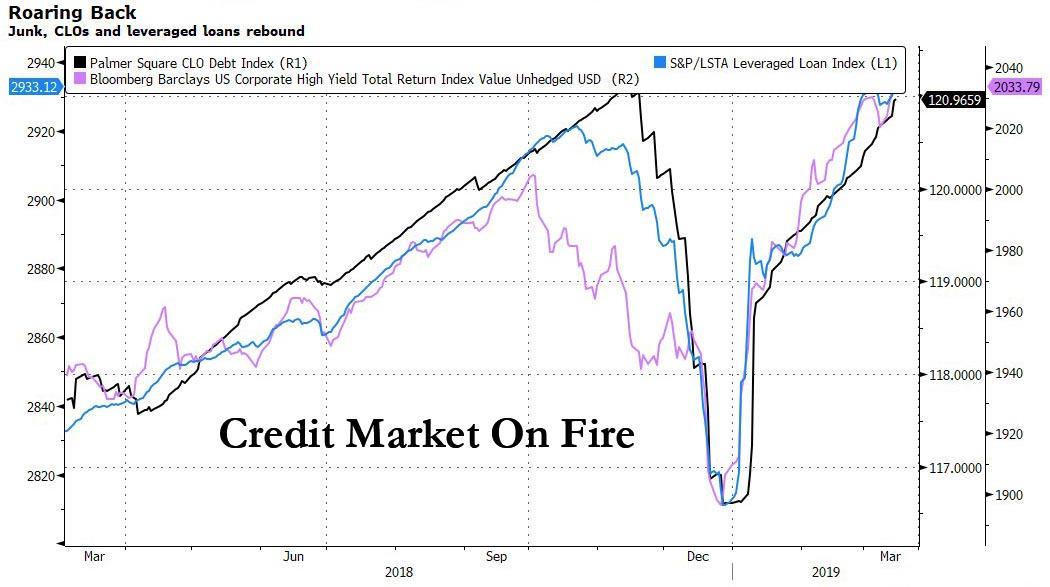

All this takes place in a time when BBG’s Sebastian Boyd reports, junk, leveraged loans and CLOs have all come roaring back this year after an awful fourth quarter. And while flows have been more than supportive (unlike equities, at least until this week), supply just isn’t there.

“It’s a borrower’s market, and that means there’s an increased risk of deals getting financed when they would’ve struggled a few years ago.”

via ZeroHedge News https://ift.tt/2uc1ZGW Tyler Durden