Authored by via Guerilla-Capitalism.com,

(My fledgling audiobook company just released an audio version of Eugen Richter’s 1893 work “Pictures of the Socialistic Future”. In order to have an audiobook version of a public domain work accepted into Amazon’s Audible store, you have to first make a kindle version and add some unique original content to it, such as a foreword. What follows is my foreword to the 2019 audiobook edition of this work).

This remarkable little novella posits a fictional socialist sweep into power in Germany towards the end of the 19th century, anticipating the Bolshevik and Marxist revolutions of the subsequent decades. It follows the arc of a family as narrated by its patriarch as he initially enthuses over the socialist ascension to the seat of government.

Quickly, however, he progresses through various stages of disenfranchisement that inevitably ensue: first tempering his expectations, then ratcheting them downward, followed by grappling with cognitive dissonance brought about by the internal contradictions of the new system. When those conflicts are inescapable, he finally spirals into angst and despair as he comes to fully comprehend the horrors of socialism.

Realizing it is too late for himself, with his family and livelihood largely destroyed, he commits one final act of repudiation against the socialist future.

In writing this warning, the author, Eugen Richter, a politician, journalist and a leading liberal (in the classic sense of the word), transmits to us a highly plausible, credible account of where socialist experiments unwaveringly go under their own volition.

Richter died in 1906, but the socialist experiments of the 20th century are a matter for the history books now. Even today in Venezuela we are witnessing a “Mad Max” style collapse in realtime within the country that has the highest proven oil reserves in the world.

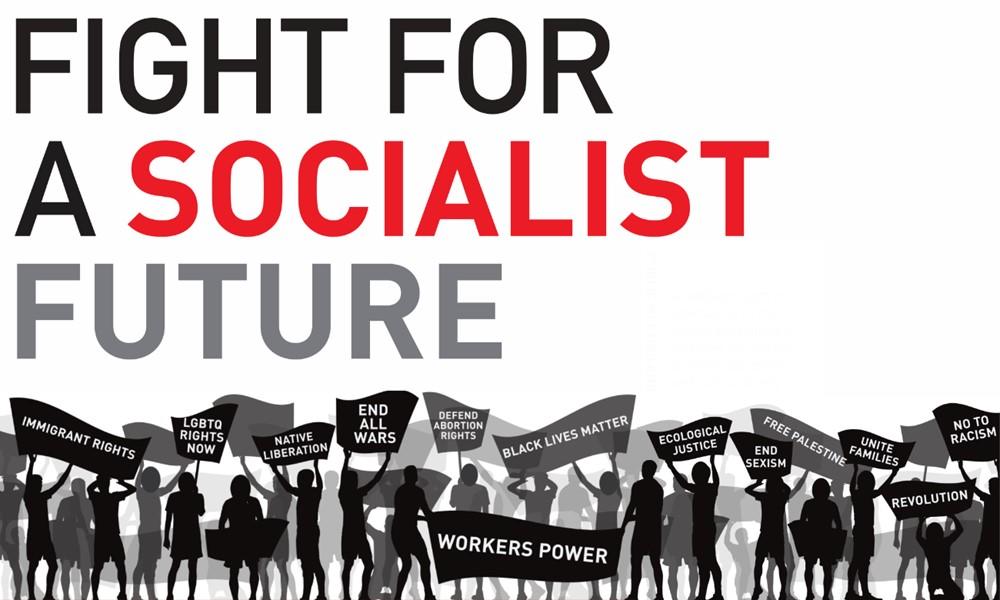

Despite overwhelming evidence that the only problem with socialism is that it doesn’t work, this idea is finding new traction in the 21st century. Apologists point at previous failures as “not real socialism”.

Meanwhile they compound that fallacy by mistaking the wealth inequality, recessions, and financial crises as indicators of capitalism and free markets run wild, when the reality is that they are instead a direct consequence of state and central bank interventions. This point is an important one, which we’ll return to shortly.

In another audiobook we’re producing, Dr. Kristian Niemietz, in “Socialism: The Failed Idea that Never Dies” laments that:

“The not-real-socialism defence is only ever invoked retrospectively, namely, when a socialist experiment has already been widely discredited. As long as a socialist experiment is in its prime, almost nobody disputes its socialist credentials. On the contrary: practically all socialist regimes have gone through honeymoon periods, during which they were enthusiastically praised and held up as role models by plenty of prominent Western intellectuals. It is only after the event (i.e. once they have become an embarrassment for the socialist cause) that their version of socialism is retroactively redefined as ‘unreal’.

Richter anticipated this dynamic wonderfully as his protagonist undergoes this arc personally as he narrates his story.

When Thomas Mackay wrote his introduction to the English translation, he observed that when the book was written (1893) it was just an idea and there was no appreciable socialist yearnings within Imperial Germany. By the time the English translation was ready in 1907, there was a socialist party contingent in parliament. By 1920 it was a full on battle between socialists and fascists for the soul of Germany.

History not only rhymes, it accelerates.

When I came across this novella in the summer of 2018 I had never heard of Democratic Socialism and Alexandra Ocascio Cortez was still a bartender in The Bronx.

I had heard of ideas with names like Libertarian Socialism, Left Libertarianism and Libertarian Communism but like most free market and liberty-minded people, I dismissed these as libertarian in name only and entirely oxymoronic.

In the intervening mere months since I had the good fortune to discover this wonderful little book, the rallying cry around socialism in the US has become deafening, and eerily similar to the enthusiasm experienced in the opening chapters of Richter’s parable.

I am chagrined to report that “socialism” is the new buzzword among my own social circles and in my online media timelines. It is truly astonishing and frightening to see how fast a bad idea is becoming palatable to the populace.

The basic requisites of socialism’s core ideology include confiscation and redistribution of private property combined with enforced collectivism and a strong central planning apparatus that quashes individual liberty. The suggestion that it can be democratic or libertarian is pure propaganda. Although, circling back to Dr. Niemietz’s observation that today the democratic socialism moniker hopes to deflect this reality noting that:

“Contemporary socialists appear to assume that a democratised, participatory version of socialism would not just be more humane, but also economically more successful. Autocratic socialism failed, but democratic socialism would have worked just fine, in terms of economic performance.”

We find yet another stab at socialism that is supposed to look good on paper, however, as I write this foreward we’ve just seen the first iteration of a legislative proposal for a so-called “Green New Deal”, also being dubbed “GreenLeapForward” by people who aren’t actually satirizing the Maoist genocide that took place under a similar label.

Under the Green New Deal, the economy would be transformed utterly, every structure in the USA would be rebuilt or retrofitted, and by the end of it there would be no need for cars or air travel (I suspect, however, exceptions would be made for party elites who need cars and planes to conduct important affairs of state). All jobs created would be unionized, and every family given a guaranteed income, paid vacations, paid retirement, even those unwilling to work.

The stated ideals of the early bill cannot possibly be accomplished, and even if so, they could not be accomplished under any democratized, participatory socialism because many citizens don’t want to be unionized, they don’t want to rebuild their home, or give up their car, or never fly anywhere again; let alone fund the living expenses, vacations and retirement of other people who are “unwilling to work”.

In short, the New Green Deal posits a complete centralized command economy, which is not participatory and certainly not democratic.

But even with the repeated failures of socialism there for all to see…

Where is this impetus toward socialism coming from?

We need look no further than the Global Financial Crisis of 2008, and in particular, the bailouts of the banks who had over-leveraged themselves with bad loans and untenable derivatives.

This act, of socializing the losses, backstopping the failed “banksters” under guise of saving the global economy, from which they paid themselves exorbitant bonuses for their abysmal stewardship was the single-most damaging act to the credibility of free market capitalism, ever.

It bears emphasizing that what happened was anything but free markets in action or an example of capitalism. Under capitalism, you reap the profits by bearing the risks. That is the entire point. If you are not on the hook for the risk, then it’s not capitalism.

The rationalizations that the global economy was on the verge of collapse have been examined by less hysterical personalities in the aftermath, and found to be lacking in substance.

Former congressman and Director of Office of Management and Budget under President Regan David A. Stockman wrote exhaustively on this topic in his voluminous “The Great Deformation: The Corruption of Capitalism in America” he wrote that:

“A handful of panic-stricken top officials, led by treasury secretary Hank Paulson and Fed chairman Ben Bernanke, proclaimed that the financial system been stricken by a deadly “contagion” that had come out of nowhere and threatened a chain reaction of financial failures that would end in cataclysm.

That proposition was completely false, but it gave rise to a fateful injunction—namely, that all the normal rules of free market capitalism and fiscal prudence needed to be suspended so that unprecedented and unlimited public resources could be poured into the rescue of Wall Street’s floundering behemoths.

And further, that:

The Main Street banks were never in danger.

There was no logical or factual basis for the incessantly repeated claim of Washington high officials that Wall Street’s losses would spill over into the nation’s $12 trillion commercial banking system and from there ripple outward to infect the vitals of the Main Street economy. Owing to the composition of its asset base, the Main Street banking system was never remotely risk, and it had no need for capital infusions from TARP.

The actual evidence shows the “run” on the wholesale money market was almost entirely confined to the canyons of Wall Street. During the heat of the fall 2008 crisis, there were no runs on the nation’s eight thousand commercial banks and thrifts, save for a handful of clearly insolvent higher fliers like Indy Mac and Washington Mutual.

Nor would there have been one in the absence of TARP and the Fed’s aggressive Wall Street bailout actions.

Despite this reality, the mainstream narrative around the global financial crisis was one of panic and within the financial centres from which the panic originated there was an infantile denial of culpability combined with petulant demands for special treatment as personified by CNBC’s Jim Cramer in his now legendary meltdown on national live television.

As I once noted in a previous writing, when some venerable juggernaut from the non-financial sector like General Motors or Kodak hits on hard times and has to lay off thousands of workers, Jim Cramer dismisses it as “the way of the world, folks” and he’ll hit one of his “Mad Money” noisemaker buttons on TV and that company’s share price might even experience a lift.

But if it’s a huge swath of the financial sector that blew itself up selling each other toxic derivatives, and numerous hedge fund buddies of Jim Cramer are going to go bankrupt as a result, then it’s a veritable crime against humanity.

And so, the financial sector was bailed out. They went on to award themselves lavish bonuses and then embarked on a decade long stock market boom supported by ultra-low, artificially suppressed interest rates, rampant money printing and a phenomenon known as “The Cantillon Effect”.

First observed by the 18th century economist Richard Cantillon, who wrote in his Essay on the Nature of Trade in General, the Cantillon Effect states that newly created money is non-neutral, and wholly benefits early recipients at the expense of later recipients. In other words, when the Fed or the ECB or the JCB print money, which they call “Quantitative Easing”, the parties in closest proximity to the central bank, including the money centre banks, the investment banks, the hedge funds and private equity derive the benefits of the expanded money supply first, and experience that as rising asset prices, stock market booms, and everything bubbles. For everybody else, the new money gets to them later, and they experience it as cost of living inflation.

It is no surprise then, that as the stock markets and asset bubbles around the world hit an uninterrupted string of all-time-highs over the ensuing decade, the middle class felt additionally squeezed, and understandably resentful.

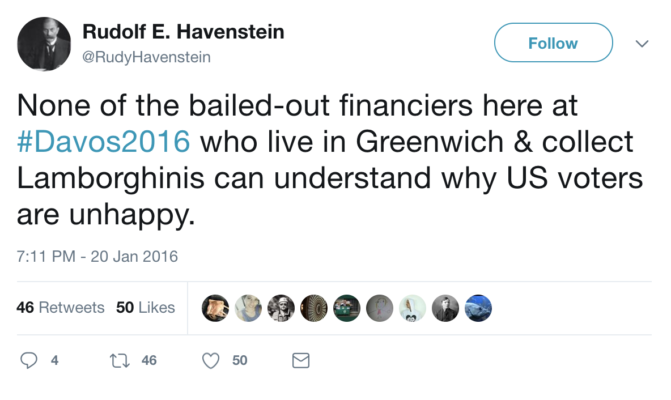

The zeitgeist of the post-crisis decade of the politically connected rich getting richer was captured in one short missive by Twitter humorist @RudyHavenstein, when commenting on the 2016 World Economic Forum, whose theme that year was “Mastering the Fourth Industrial Revolution”.

While the world’s super rich where in Davos discussing how to master that shift, RudyHavenstein remarked:

That resentment turned into populism, with figures like Donald Trump garnering votes on a “drain the swamp” message. But as the central bank policies continue to inflate away purchasing power, push up asset prices, and widen wealth inequality even further, populism is now jockeying with socialism, and the early indications are that eventually socialism will win out or absorb the former. To quote Dr. Niemietz’s title, “socialism: the failed idea that never dies” looks to gaining serious momentum in America.

Richter’s novella, albeit a fictionalized account, does correctly anticipate the stages of these socialist experiments, and contains relevant analogs to what appears to be the next attempt.

When socialism comes to America it will be under the well worn banner “this time is different”, because it will be ostensibly democratic socialism, even though we know now from the text of the New Green Deal bill not to hold our breath for the “democratic” part.

But we’ll purport to have new tools in our repertoire to make it work, such as Modern Monetary Theory, which is gaining traction alongside democratic socialism and exists solely to justify unrestrained money printing and increased central planning.

As the comrades of Imperial Germany found, their international trading partners had something to say about it when they debased their own currency and repudiated their debts, so too will the new experiment in the USA fail to anticipate international trading ramifications of democratic socialism and MMT. Not the least of which is that one should expect to see the US dollar lose its status as the global reserve currency.

I urge anybody flirting with an infatuation with “this-time-its different” democratic socialism to set aside 2 hours to read or listen to this book. As you read it, compare the mechanics of how socialism unfolds in Richter’s Germany with the tenets of the The New Green Deal, for example. I think one will find the resemblances, striking, if not chilling.

via ZeroHedge News https://ift.tt/2T9cqFw Tyler Durden