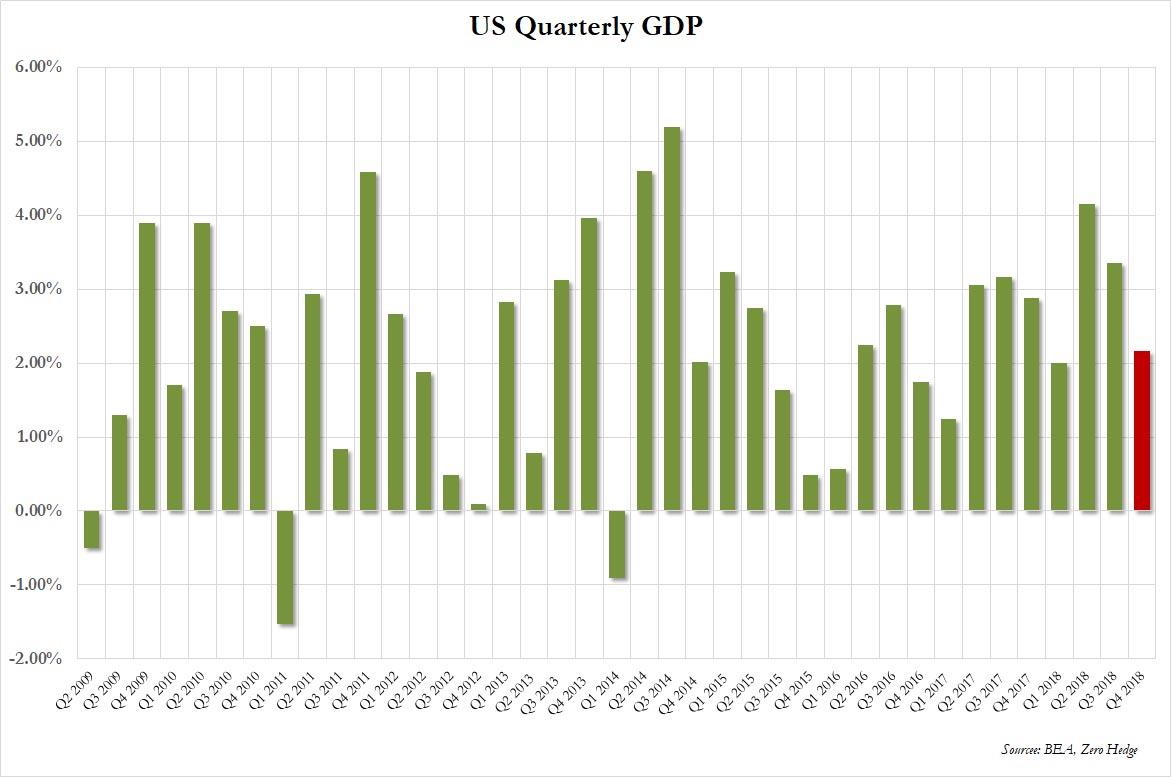

After one month ago the BEA reported that the US economy ended 2018 stronger than expected, with US GDP rising at a 2.6% annualized rate, moments ago the BEA released its third revision to the GDP which was revised modestly lower to just 2.2%, below the 2.3% expected.

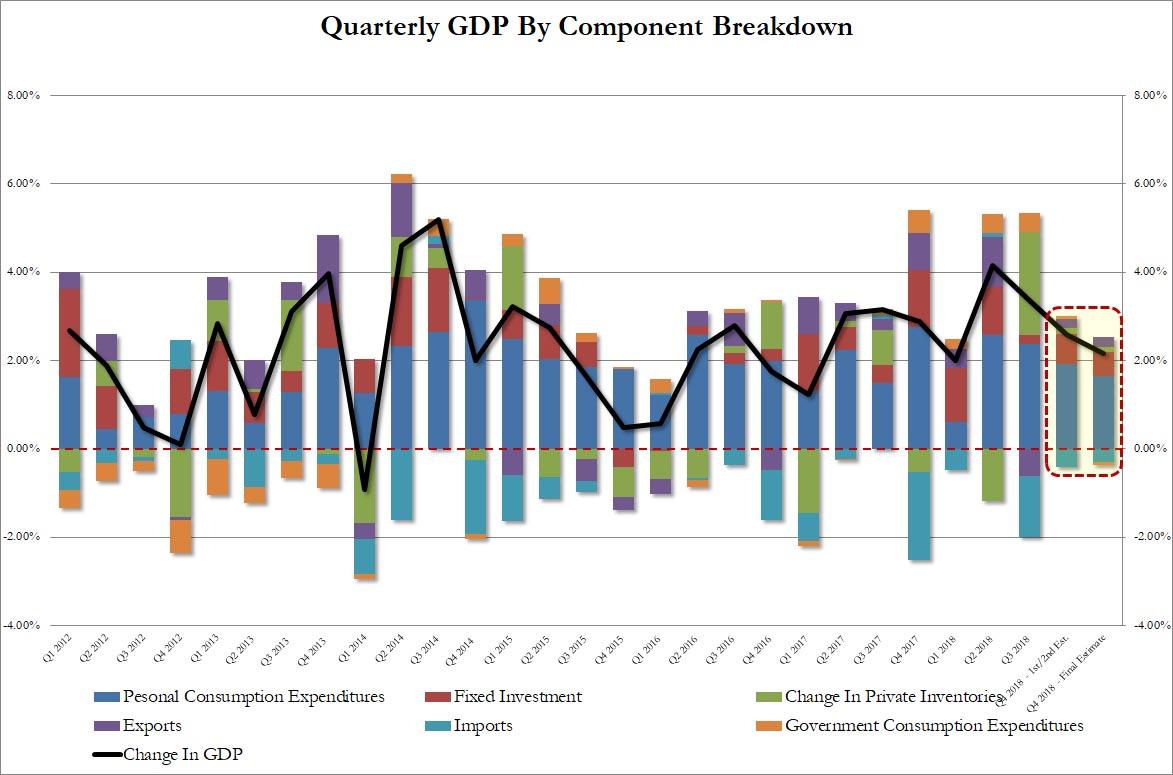

The downward revision to real GDP growth was primarily accounted for by revisions to consumer spending, state and local government spending, and business investment that were partly offset by a downward revision to imports. For additional information see the technical note. Here are the specific revisions:

- Personal Consumption contribution to the bottom line: 1.66% from 1.92%. On an annualized basis, however, the number was 2.5%, which was down from the 2.8% pre-revision, and just below the 2.6% expected.

- Fixed investment was also revised lower, contributing 0.54% to the bottom line, down from 0.69% a month ago

- Private inventories, while barely changed, were also revised lower from 0.13% to 0.11%

- Net trade (exports less imports) shrank less than initially reported, reducing GDP by 0.08%, down from -0.22% as initially reported

- Finally, government consumption ended up being a drag to growth, shrinking by -0.07% vs the initial estimate of 0.07% growth.

Visually:

More importantly for Trump, despite the downward revision, the president can still boast of the first 3% GDP print (on a year over year basis). As the BEA notes, measured from the fourth quarter of 2017 to the fourth quarter of 2018, real GDP increased 3.0 percent during the period. That compared with an increase of 2.5 percent during 2017.

On the inflation front, the GDP Price Index rose 1.7%, below the 1.8% expected, even though core PCE actually surprised to the upside, rising by 1.8% from 1.7% pre-revision, and also above the 1.7% expected.

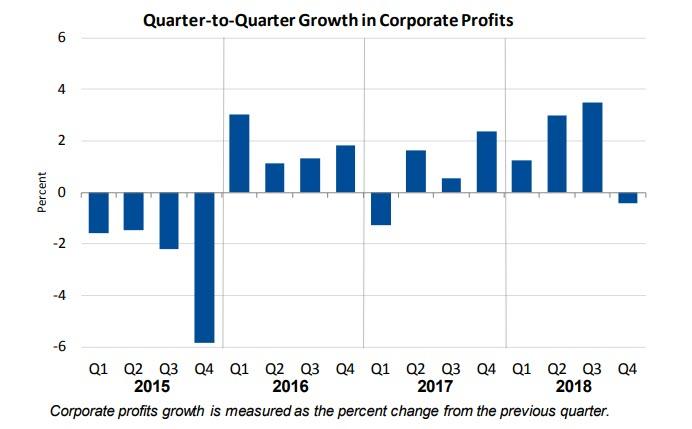

Separately, the BEA reported that corporate profits fell -0.4% after rising 3.5% in prior quarter, with corporate profits up 7.4% on a year over year basis, in 4Q after rising 10.4% prior quarter.

Meanwhile, financial industry profits declined 5.6% Q/q in 4Q after falling 1.3% prior quarter; nonfinancial sector profits rose 1% Q/q in 4Q after rising 6.4% prior quarter. Finally, corporate profits with inventory valuation and capital consumption adjustments increased 7.4 percent from the fourth quarter of 2017.

via ZeroHedge News https://ift.tt/2TF3szS Tyler Durden