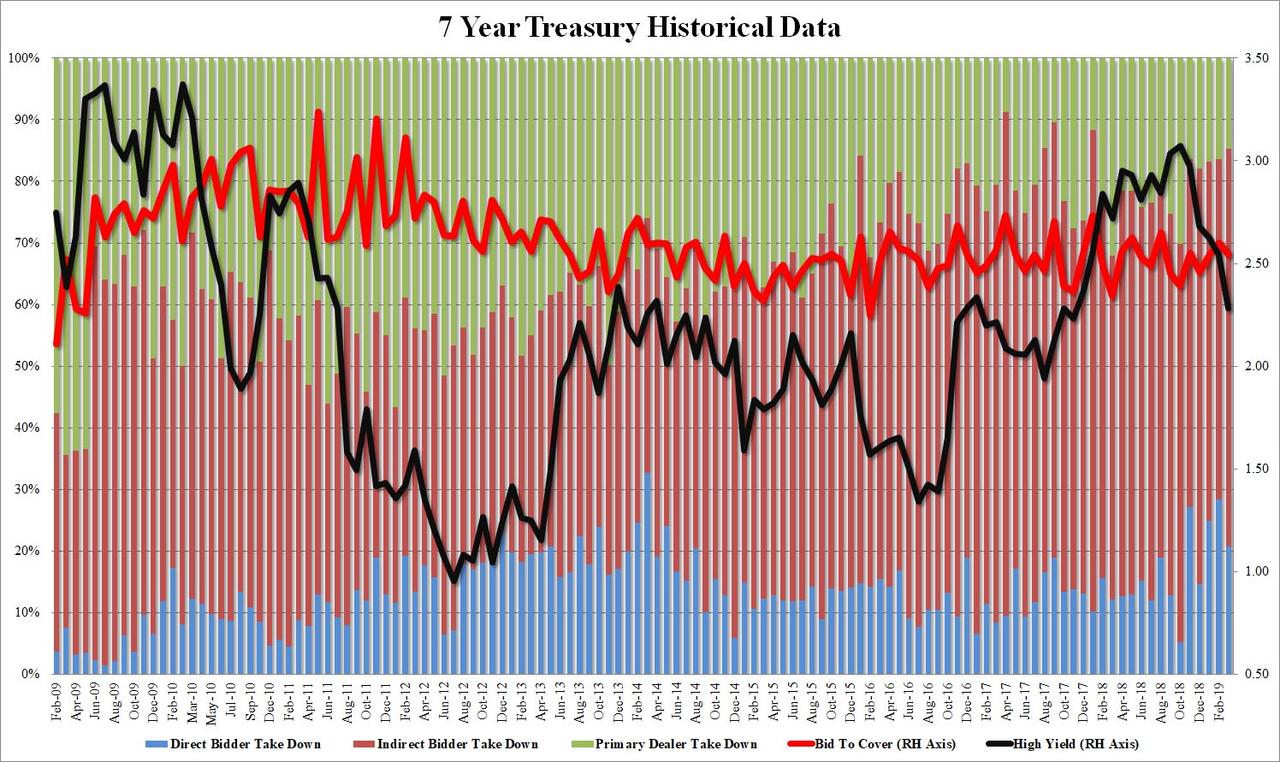

In a mirror image of yesterday’s mediocre, tailing 5Y auction, moments ago the US Treasury sold $32 billion in 7 Year paper in a stellar auction, stopping at a yield of 2.281%, a big drop from February’s 2.538% and the lowest since November 2017, stopping through the When Issued 2.290% by 0.9bps. The bid to cover came in at 2.544, just below last month’s 2.598, if above the six auction average.

The internals were more remarkable, with Indirects taking down 64.5%, 9% higher than the February Indirects bid, and the highest since November; it was also well above the 6 auction average of 60.7%. And while Directs could not match their February enthusiasm, with the takedown dropping to 20.7% from 28.4%, Dealers also ended up holding less of the auction, or just 14.79%, the lowest since January 2018 as there was no stopping the bid side demand.

via ZeroHedge News https://ift.tt/2TFzmw8 Tyler Durden