As we start Q2, this week will contain a barrage of key events for markets.

As DB’s Craig Nicol writes in his weekly preview, politics will remain on the agenda, both with the latest trade talks between the US and China, as well as any further Brexit developments. Looking at upcoming data releases, PMIs at the start of the week are already setting the agenda, while March’s US jobs report will also be a highlight, along with the Eurozone’s CPI inflation reading. From central banks, there’ll be decisions from the Reserve Bank of Australia and the Reserve Bank of India, while we’ll also get the minutes from March’s ECB meeting.

Aside from the interminable Brexit fiasco, there are a number of critical data highlights this week. Monday’s manufacturing PMIs for March can be expected to set the agenda, with readings from the UK, Italy, South Korea, Indonesia, China, and Canada all coming out, along with final readings from Japan, the Eurozone, France, Germany and the US. On Wednesday, we’ll then get the services and composite PMIs from a number of countries as well, including China, Japan, Italy and the UK and the final readings for the Eurozone, France, Germany and the US.

The other main highlight will be Friday’s US jobs report. In February, nonfarm payrolls rose by just 20k, the smallest increase since September 2017, but the consensus expectation is that employment growth will bounce back in March to show a 175k increase. Another reading to watch will be average hourly earnings, which last month reached 3.4% yoy, the highest since April 2009.

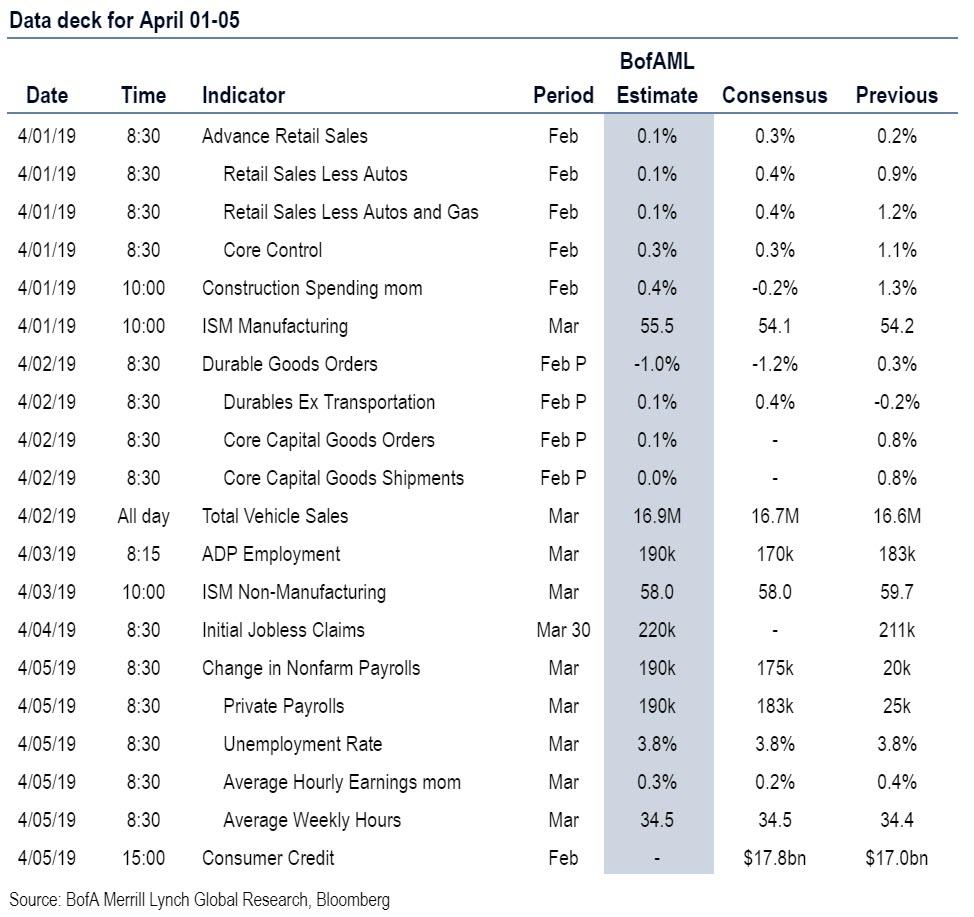

Looking at other US data of note, Monday will see February’s retail sales figures, where consensus expectations are for a 0.3% mom increase, as well as the ISM Manufacturing PMI, which in February recorded its lowest reading since November 2016. We’ll also get durable goods orders on Tuesday, while on Wednesday the ADP Employment reading will be released.

From Europe, there are a number of releases on Monday, with March’s CPI inflation and core CPI readings for the Eurozone out (HICP 1.4%, below the 1.5% expected), along with February’s Eurozone unemployment rate (in line with expectations at 7.8%). The consensus expectation is for the unemployment rate to remain at 7.8%, which is the joint lowest reading since October 2008. We’ll also get the Eurozone’s February retail sales data on Wednesday, where the consensus expectation is for a 0.1% mom increase, and on Friday we’ll get German industrial production figures for February, where the consensus expectation is for a 0.5% mom increase.

Turning to central banks, we’ll get the latest decision from the Reserve Bank of Australia on Tuesday, where the consensus expectation is that interest rates will remain unchanged, while on Thursday, the Reserve Bank of India will be announcing their latest decision, where the consensus is anticipating a 25bp reduction in the repurchase rate. On Thursday, we’ll also get the ECB’s account of their March meeting. In terms of speakers, from the Federal Reserve we have Bostic and Kashkari speaking on Wednesday, Mester on Thursday, and Bostic again on Friday. Elsewhere, on Monday the Bank of Canada’s Governor Poloz will be speaking.

In terms of other political developments, following this week’s trade talks in Beijing, Chinese Vice Premier Liu He will be visiting Washington on Wednesday for further discussions. Looking at other events, besides this weekend’s Turkish muni election and Ukraine’s presidential election, an Arab League summit will be taking place in Tunis, while New Zealand’s Prime Minister, Jacinda Ardern, will be visiting Beijing for talks with Chinese President Xi Jinping. In addition, NATO foreign ministers will gather for meetings in Washington on Wednesday and Thursday, and on Thursday the Kenyan President, Uhuru Kenyatta, will be delivering his State of the Nation address to Parliament.

Summary of key events in the week ahead courtesy of DB:

- Monday: It’s a busy start to the week with the key highlight being the release of March manufacturing PMIs in Japan, China, Spain, Italy, France, Germany, Euro-area, the UK and the US. Other important data highlights are the release of the Q1 Tankan quarterly manufacturing survey results in Japan, the February unemployment rate and March CPI reading in the Eurozone, along with the release of January business inventories, February retail sales and construction spending, and March’s ISM manufacturing all in the US. Bank of Canada Governor Poloz will also be speaking.

- Tuesday: It’s a light day for data with releases of note being February’s construction PMI in the UK and February PPI in the Eurozone, along with the release of preliminary February capital goods and durable goods data, and March vehicle sales in the US. The Reserve Bank of Australia will also announce their latest rate decision.

- Wednesday: Again it’s a busy day for data with the key highlight being the release of the services and composite PMIs in Japan, China, Spain, Italy, France, Germany, Euro-area, the UK and the US. Beside that, we will be also getting March’s BRC shop price index and official reserves data in the UK, Q4’s budget deficit to GDP in Italy and February retail sales in the Eurozone. In the US, we will get the latest weekly MBA mortgage applications, March’s ADP employment change and March’s ISM non-manufacturing index. Aside from the data, the Fed’s Bostic and Kashkari are due to speak, while Chinese Vice Premier Liu He will be visiting Washington for further trade discussions.

- Thursday: The only data releases of note for the day are Germany’s February factory orders and March’s construction PMI along with the release of March’s Challenger job cuts and the latest weekly initial and continuing claims in the US. Turning to central banks, we’ll get the latest decision from the Reserve Bank of India, the ECB minutes from their March meeting will be released, and the Fed’s Mester is due to speak.

- Friday: It’s a payrolls Friday with the key release being the March non-farm payrolls data in the US. In terms of other data releases, we will get Japan’s February household spending and real cash earnings data, Germany’s February industrial production, the UK’s Q4 unit labour costs and February consumer credit data in the US. In terms of central bank speakers, the Fed’s Bostic is due to speak.

Looking at the US alone, Goldman notes that the key economic data release this week are the retail sales and ISM manufacturing reports on Monday and the employment report on Friday. There are several scheduled speaking engagements by Fed officials this week.

Monday, April 1

- 08:30 AM Retail sales, February (GS +0.1%, consensus +0.3%, last +0.2%); Retail sales ex-auto, February (GS +0.2%, consensus +0.3%, last +0.9%); Retail sales ex-auto & gas, February (GS +0.1%, consensus +0.3%, +1.2%); Core retail sales, February (GS +0.1%, consensus +0.3%, last +1.1%): We estimate that core retail sales (ex-autos, gasoline, and building materials) rose at a modest pace in February (+0.1% mom sa), reflecting delays in tax refunds. We estimate a 0.1% increase in the headline measure, reflecting a modest decline in auto sales but a rebound in gasoline prices.

- 09:45 AM Markit Flash US manufacturing PMI, March final (consensus 52.5, last 52.5)

- 10:00 AM ISM manufacturing index, March (GS 54.0, consensus 54.4, last 54.2): Our manufacturing survey tracker — which is scaled to the ISM index — remained unchanged at 54.9, reflecting mixed manufacturing surveys in March. Following a 2.4pt decline in February, we expect the ISM manufacturing index to edge down by 0.2pt to 54.0 in March.

- 10:00 AM Construction spending, February (GS +0.1%, consensus -0.2%, last +1.3%): We estimate construction spending moderated in February following the previous month’s gain, with scope for a modest rise in private residential construction but a decline in public construction.

- 10:00 AM Business inventories, January (consensus +0.4%, last +0.6%)

Tuesday, April 2

- 08:30 AM Durable goods orders, February preliminary (GS -1.5%, consensus -1.2%, last +0.3%); Durable goods orders ex-transportation, February preliminary (GS +0.1%, consensus +0.3%, last -0.2%); Core capital goods orders, February preliminary (GS -0.1%, consensus +0.3%, last +0.8%); Core capital goods shipments, February preliminary (GS -0.1%, consensus flat, last +0.8%): We expect durable goods orders to decrease by 1.5% in the preliminary February report. We estimate core capex orders (-0.1%) and shipments (-0.1%) both declined due to weak global manufacturing trends and possible drag from timing of Chinese New Year.

- 5:00 PM Lightweight Motor Vehicle Sales, March (GS 16.7m, consensus 16.7m, last 16.6m)

Wednesday, April 3

- 08:15 AM ADP employment report, March (GS +175k, consensus +180k, last +183k): We expect ADP payroll employment growth slowed to 175k, as weak prior month payrolls likely offset the stronger recent jobless claims data. While we believe the ADP employment report holds limited value for forecasting the BLS nonfarm payrolls report, we find that large ADP surprises vs. consensus forecasts are directionally correlated with nonfarm payroll surprises.

- 08:30 AM Atlanta Fed President Bostic (FOMC non-voter) speaks: Atlanta Fed President Raphael Bostic will speak on an American Banker Association panel.

- 10:00 AM ISM non-manufacturing index, March (GS 58.5, consensus 58.0, last 59.7): Our non-manufacturing survey tracker declined by 1.2pt to 55.5 in March, following mixed-to-weaker regional service sector surveys. We expect the ISM non-manufacturing index to lower by 1.2pt to 58.5 in the March report.

- 05:00 PM Minneapolis Fed President Kashkari (FOMC non-voter) speaks: Minneapolis Fed President Neel Kashkari will speak in North Dakota. Audience Q&A is expected.

Thursday, April 4

- 08:30 AM Initial jobless claims, week ended March 30 (GS 215k, consensus 216k, last 211k); Continuing jobless claims, week ended March 23 (last 1,756k): We estimate jobless claims declined by 4k to 215k in the week ended March 30. The claims reports of recent weeks suggest that the pace of layoffs remains low, though it probably remains somewhat higher than in early fall.

- 01:00 PM Cleveland Fed President Mester (FOMC non-voter) speaks: Cleveland Fed President Loretta Mester will speak in Ohio. Prepared text and audience Q&A are expected.

- 01:00 PM 6:00 AM Philadelphia Fed President Harker (FOMC non-voter) speaks: Philadelphia Fed President Patrick Harker will discuss the economic outlook in Philadelphia. Prepared text and audience Q&A are expected.

Friday, April 5

- 08:30 AM Nonfarm payroll employment, March (GS +190k, consensus +175k, last +20k); Private payroll employment, March (GS +185k, consensus +178k, last +25k); Average hourly earnings (mom), March (GS +0.3%, consensus +0.3%, last +0.4%); Average hourly earnings (yoy), March (GS +3.3%, consensus +3.4%, last +3.4%); Unemployment rate, March (GS 3.8%, consensus 3.8%, last 3.8%): We estimate nonfarm payrolls increased 190k in March, which would represent a sharp pickup following the 20k rise in February. Our forecast reflects a boost from weather of around 20k, reflecting a swing from above-average to below-average snowfall during the payroll reference weeks. While we believe trend job growth has slowed from its +223k average monthly pace in 2018, renewed declines in jobless claims and the resilience in employment components of business surveys suggest that the underlying pace remains above-potential. We estimate the unemployment rate was unchanged at 3.8%. While continuing claims have declined somewhat, we believe this in part reflects the reversal of residual seasonality effects that boosted claims in the first two months of the year. Finally, we estimate average hourly earnings increased at a firm pace of 0.3% month-over-month that nonetheless takes the year-over-year rate down a tenth to +3.3%.

- 03:30 PM Atlanta Fed President Bostic (FOMC non-voter) speaks: Atlanta Fed President Raphael Bostic will speak on disruption and opportunity in Atlanta. Audience Q&A is expected.

Source: Deutsche Bank, BofA, Goldman

via ZeroHedge News https://ift.tt/2FNA99k Tyler Durden