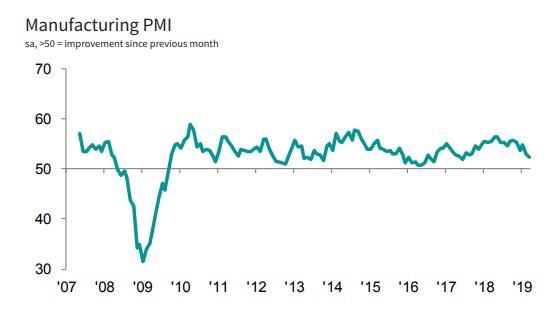

A far cry from this weekend’s optimism unleashed by the latest Chinese manufacturing survey, the US Markit manufacturing PMI for March showed another month of slowdown, with the index dropping to 52.4 vs its flash reading of 52.5, down from 53.0 in February and well below the 55.6 reported a year ago. This was the lowest print since the June 2017, the result of “softer increases in output and new orders.”

According to Markit, the moderate improvement in the health of the manufacturing sector was notably softer than the trend seen for 2018, while the first quarter average of 2019 was the lowest since the third quarter of 2017.

A key factor behind the lower headline figure was a slower rise in output. The rate of expansion eased to a marginal pace that was the weakest since June 2016 and below the series trend. Panellists stated that the slower increase in production was due to softer underlying client demand. Similarly, new business growth eased in March. At the same time, new export orders rose at only a marginal rate that was the weakest for five months, with firms noting that global trade tensions and the ongoing impact of tariffs had dampened foreign client demand.

More ominously, on the price front input price inflation softened further to the slowest since August 2017. Where a rise in costs was reported, goods producers linked this to higher raw material prices, stemming from the ongoing impact of tariffs and greater demand for inputs. The increase was partly passed on to clients through higher output charges. The rise in factory gate prices was nevertheless the slowest since December 2017.

There was a silver lining: as in the broader economy, the rate of job creation remained solid despite broadly unchanged levels of outstanding business. Meanwhile, cost pressures eased further as the rate of input price inflation softened for the fifth successive month. Output charges also rose at a slower pace.

Commenting on the data, Markit Chief economist Chris Williamson said that “a futher deterioraton in the manufacturing PMI suggests the factory sector is acting as an increasing drag on the US economy. The March survey is consistent with production falling at a quarterly rate of 0.6% according to historical comparisons with official data.”

“… things may well get worse before they get better, as the forward-looking indicators are a cause for concern. New order growth has fallen close to the lows seen in the 2016 slowdown, often linked to disappointing exports, tariffs and signs of increasing caution among customers. The ratio of new orders to existing inventory has meanwhile fallen to its lowest since June 2017, suggesting the production trend may weaken further in April.”

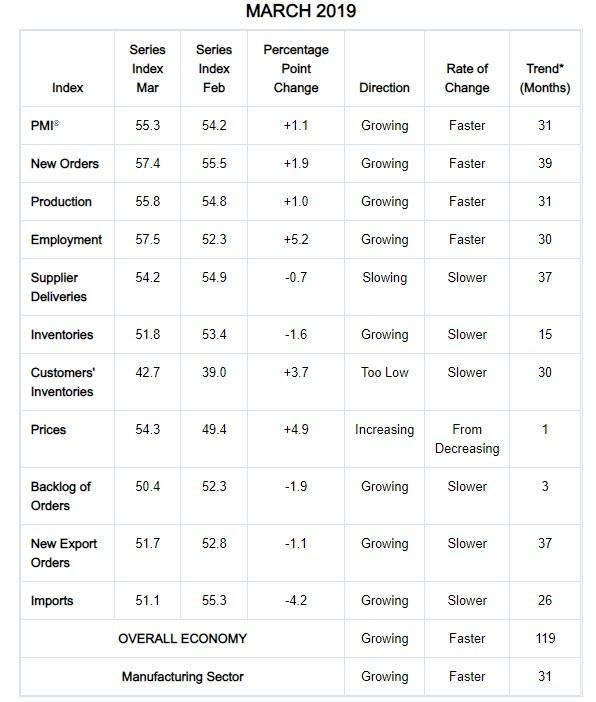

And since it would be frowned upon if the US posted another disappointing manufacturing print, it was all up to the Manufacturing ISM to restore confidence that just like China the US is rebounding, which is precisely what happened when the Institute for Supply Management reported that the March ISM jumped from a one year low of 54.2 to 55.3, beating expectations of a 54.5 number, and the highest since January.

In stark contrast from the dour PMI report, the ISM notes that “comments from the panel reflect continued expanding business strength, supported by gains in new orders and employment. Demand expansion continued, with the New Orders Index returning to the high 50s, the Customers’ Inventories Index improving but remaining too low, and the Backlog of Orders Index softening to marginal expansion levels. Consumption (production and employment) continued to expand and regained its footing with a combined 6.2-percentage point gain from the previous month’s levels, recovering most of February’s loss.”

Of note, exports orders continued to expand, while prices reversed two months of contraction by returning to a robust mid-50s level. The manufacturing sector continues to expand, demonstrated by improvements in the PMI® three-month rolling average, which is consistent with overall manufacturing growth projections,” says Fiore

In short: while PMI showed continued deterioration in manufacturing sentiment, the ISM saved the “recovery narrative” with its own, and far more optimistic take on the US manufacturing sector.

The full breakdown showed a rebound in most metrics, with Prices most notably rising back into expansion, up 4.9 points to 54.3.

A few hot takes from the ISM respondents:

- “Customer orders remain strong.” (Textile Mills)

- “The electronics industry seems to be slowly coming out of crisis mode. Lead times and costs have leveled out in some commodities, and dynamic random access memory (DRAM) prices are actually coming down.” (Computer & Electronic Products)

- “Brexit continues to be a concern, despite the fact that our organization has already rolled out a plan to minimize its impact.” (Chemical Products)

- “Business remains very strong amid rumors of a slowdown, but forecasts do not indicate this. Electronics are at tight capacity from manufacturers, with no [change] in the near future.” (Transportation Equipment)

- “Strong customer orders continue.” (Food, Beverage & Tobacco Products)

- “Current weather conditions causing significant delivery delays [and] diminishing our production capabilities.” (Machinery)

- “Strong business momentum coming into January and early February has slowed to typical seasonal business conditions for our industry.” (Miscellaneous Manufacturing)

And with markets gripped by pervasive euphoria, it’s no surprise that stocks quickly ignored the Markit print and focused on the ISM’s far rosier report.

via ZeroHedge News https://ift.tt/2FNnmF6 Tyler Durden