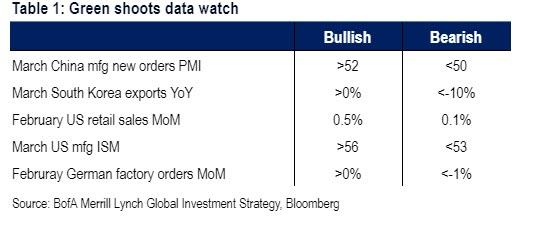

In previewing the “green shoots” catalysts to watch for the second quarter after a dismal for the economy first quarter, BofA’s Michael Hartnett listed five key data points which he thought would set the quarterly mood early, and which included US retail sales and manufacturing ISM, South Korean export orders, February German factory orders and, last but not least, China’s manufacturing new orders PMI

And, as we reported over the weekend, late on Saturday we got arguably the most important one when China confirmed prior speculation of a rebound in its economy, when the National Bureau of Statistics reported that China’s manufacturing PMI jumped from a contractionary 49.2, printing at 50.5, its first expansion since September 2018, and beating estimates of a 49.6 reading.

This set the euphoric mood as early as the first day of the quarter with stocks around the globe soaring, and even this morning big miss in retail sales, which printed at -0.2%, well below the 0.2% expected and deep in the “bearish” column in the table above, failed to dent the market’s optimism.

But can this bullish sentiment continue?

That’s the topic of Charlie McElligott’s latest “talking points” note, ahead of what the Nomura strategist calls a massive week of global data which can “make or break” this latest “end-of-cycle” spasm in start “growth scare” fashion. Here are the main highlights:

- China PMIs get the joy going, although as Nomura’s China expert Ting Lu pushes back — while “Rest of World” data continues lower in the meantime.

- The “Fed Rate Cut Panic of March 2019” sees the overshoot now mean-reverting (as negative convexity crowd now looks appropriately “adjusted”), with front-end curves steepening to reverse part of the “stop-ins” seen early last week, while Reds / Greens see profit-taking / downside bets layered-in over the past few sessions.

- Watch for a period of very bullish seasonality- and hedge fund underpositioning, a set-up for strong S&P performance at the start of April

* * *

Below we present the full list of McElligott’s “hot takes” covering everything from this weekend’s key Chinese data (which Nomura is far more cautious on than the rest of the market), as well as his preview of the main catalysts – both fundamental and technical – that will shape market optimism over the first days of the second quarter.

Equities are ”foaming at the mouth” to start the week (SZCOMP +3.6%, SHCOMP +2.6%, NKY +1.4%, DAX +1.4%, Spooz +0.8%–while yields on Chinese 10Y bonds rose the most since Oct 2017) following the weekend release of Chinese Manu PMIs, with both “official”- and Caixin- kind reaccelerating into “expansionary” territory (“official” PMI saw the largest increase since 2012)—indicating that policy easing begun last year is now beginning to positively impact growth again

However, Ting Lu has had the best China call on the Street and remains cautious despite the PMI rebound:

“The rise in the March PMI and incoming activity data could be partly the result of the lunar new year (LNY) holiday distortion and the anti-pollution campaign. Final demand exports, new home sales and passenger cars remain weak, and could limit the upward momentum of the PMI. Though we believe sentiment has improved and Beijing’s stimulus has been gradually kicking in, we remain cautious in interpreting the 50.5 PMI reading for two reasons.

First, the official PMI has occasionally been poor gauge of growth momentum over the past five years, especially in spring. For example, in spring of 2014 and 2015, amid slowing growth, the manufacturing PMIs actually rebounded in March. One factor behind these false signals from the manufacturing PMI in spring is the LNY holiday distortion, which make applying an appropriate seasonal adjustments challenging.

Second, the jump in new credit in January this year could indicate some restocking activity, as evidenced by the jump in the raw material inventory sub-index (up to 48.4 in March from 46.3 in February). However, real final demand could remain weak as growth in exports, new homes and passenger cars remain in negative territory.”

The net / net for Ting—this PMI print does nothing to change his long-held view on the sequencing of the Chinese recovery (bottoming in 2Q), which will only ultimately recover if / when Chinese authorities ease their prior tightening measures in the Property sector:

“We believe there is limited room for a further rise in the manufacturing PMI and see a substantial likelihood that the PMI could dip again. We maintain our view that a stabilization could take place in mid-year followed by a moderate recovery in H2, and that the key factor is a property market recovery in Tier 1 and Tier 2 cities driven by an easing of property tightening measures.”

The positive reception to Chinese data overwhelmed the broad negatives from Japan (Tankan “misses” across the board) to Europe, where PMIs bombed (German data particularly ugly, slipping to 44.1 from the flash 44.7 and 47.6 for Feb) AND another “miss” in Euro Area HICP (with “Core” down to 0.8% YoY in March from 1.0% YoY in Feb)—whereas despite the further slowing / disinflationary signs, EU stocks see leadership this morning from “High Beta Cyclicals”—Autos, Miners & Materials and Banks all ripping higher to start the week

The “Fed Rate Cut Panic of March 2019” seems but a memory now, further mean-reverting today with the Eurodollar strip again pounded (Reds and Greens again—part profit-taking with some blocks sold in past two overnights / part being ‘faded’ with downside bets i.e. the large EDZ9 97.375 / 97.25 PS bot in size last wk, along with long-end downside bets via USM9 144 Puts trading overnight) and with front-end spreads extending the end of last week’s steepening (for context, EDM9EDM0 Jun19-Jun20 went from -42bps on March 27th to today’s earlier -29bps steeps)

As outlined in both Thursday’s note and the profiled in-depth in Friday afternoon’s piece (“APRIL SETS-UP FOR A BULL RUN IN SPX…BUT WITH A CAVEAT”), April seasonality for US Equities is a powerful phenomenon: April has posted the best avg monthly return for the S&P over the past 30 years (+1.64%) and actually posts the second-highest % hit-rate of “positive return instances” of any month over the past 90 years

More granularly, the first two weeks of April (dating back to 1994) have shown to be particularly “pro-cyclical” / “reflationary” in nature across seasonal US Equities sectors- and factor- behavior (Sectors: Materials +1.4% on the median over the first 2w of April; Fins +1.2%; Energy +0.8%; Discretionary +0.7%; Factors: Beta L/S +0.5%, Size L/S +0.5%; Cross-Asset: Crude +1.7%)

Perhaps the largest tailwind now for Equities is under-positioning from within the Leveraged Fund universe:

- Long-Short Hedge Fund “Beta to SPX” remains just 15th %ile, while “Beta to Beta Factor” too is just 14th %ile

- When L/S “Beta to SPX” is this low as “trigger,” SPX returns are 1m +3.3% 82% hit rate, 3m +3.4% 84% hit rate, 6m +7.8% with a 84% hit rate

- Macro Funds incrementally adding broad Global Equities exposure last week, but still tilted “low” by historical standards—S&P 21st %ile, Nikkei 43rd %ile, Eurostoxx 41st %ile and EEM 25th %ile

- Futures positioning data shows Leveraged Funds still “net short” -$20.1B of SPX and net short -$2.6B NDX (despite covering +$8.7B SPX and +$800mm NDX on the week)

- The Nomura QIS CTA model shows systematic trend followers having sold futures across Russell, Nikkei, DAX, Hang Seng CH and KOSPI last week—and while still “Max Long” SPX and NDX futures, the actual $allocation is just 1/3 the “size” of the position “highs” made into Feb 2018

- The Nomura QIS Risk-Parity model estimates that funds remain holding their lowest $allocation to US Equities since Mar / Apr 2017 (across S&P 500, S&P Midcap and Russell)

Additional catalysts for “higher SPX” over the month of April:

- Current “negative revisions” into EPS tends to mean a lower bar to beat–which investors then tend to reward: per Anthony Antonucci, SPX is +2.7% over the six weeks after the commencement of corporate earnings when earnings revisions are negative with a 76% hit-rate since 2005

- The oft-mentioned “Extreme Quarter-End Pension Rebalancing OUT-trade” analog, where last quarter’s 90th %ile Stock vs Bond outperformance as a trigger posts VERY positive short-term returns following the end-of-quarter “turn”—the 4d median return is +3.1%; 5d +3.4%; 6d +2.8%

- Mid-month we see further “demand flows” pick-up again from the Corporate side as companies begin to emerge from their blackouts (Banks first), with 75% of S&P 500 corporates having emerged from their “Buyback Blackouts” by 4/30/19

via ZeroHedge News https://ift.tt/2CKazkY Tyler Durden