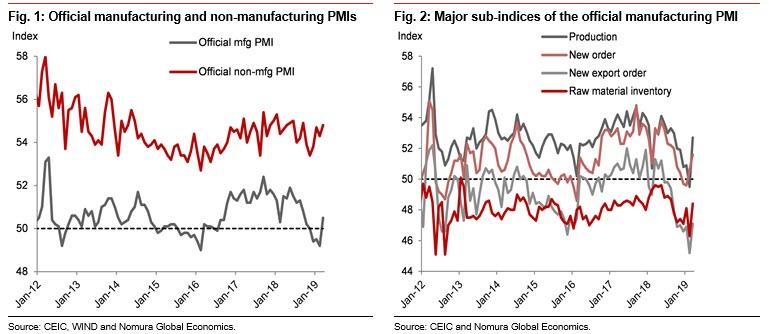

Stocks around the globe are surging on the first day of the second quarter, following what we reported over the weekend were solid prints from both the Chinese official and the Caixin manufacturing PMIs (even as the disappointing US retail sales print this morning showing continued weakness behind the biggest drive of US GDP growth, consumption, was roundly ignored). The former, as a reminder, jumped to 50.5 in March from 49.2 in February, much higher than consensus expectations of 49.6, after remaining in below-50 contractionary territory for three consecutive months. The rise was mainly driven by production (to 52.7 in March from 49.5 in February; average in 2018: 52.7) and new orders sub-indices (to 51.6 from 50.6; average in 2018: 52.0). The new export orders sub-index rose to 47.1 in March from 45.2 in February (average in 2018: 49.1).

As this jump has already provided a big boost to both local (the Shanghai Composite closed 2.6% higher) and global stock markets, the recovery in Chinese data will likely delay a reserve requirement ratio (RRR) cut. However, as Nomura’s Ting Lu writes this morning, there may be less than meets the eye in China’s impressive data: critically, the rise in the March PMI and incoming activity data could be partly the result of the lunar new year (LNY) holiday distortion and the anti-pollution campaign.

Some additional caveats from the report according to Nomura:

- PMIs for smaller enterprises remained below 50 despite the March rise. By enterprise size, the PMI for small enterprises rose to 49.3 in March from 45.3 in February (2018: 49.2) while the PMI for medium-sized enterprises also rose to 49.9 from 46.9 (2018: 49.6). Despite the rises, the PMIs for small and medium-sized enterprises remained below 50.0, suggesting smaller enterprises remain under stress. The PMI for large enterprises fell to 51.1 from 51.5 (2018: 52.0).

- Higher non-manufacturing PMI boosted by the construction sector. The official non-manufacturing PMI rose to 54.8 in March from 54.3 in February (Consensus: 54.3; 2018: 54.4), led mainly by the construction sector, the sub-index for which jumped to 61.7 from 59.2 (2018: 60.7), likely boosted by an acceleration of infrastructure investment. The sub-index for the services sector edged up to 53.6 in March from 53.5 in February (2018: 53.4). The official non-manufacturing PMI remains well above the manufacturing one, which suggests growth continues to rebalance towards the tertiary sector amid the economic slowdown

More importantly, final demand exports, new home sales and passenger cars remain weak, and could limit the upward momentum of the PMI. As a result, Nomura maintains its view that “a stabilization could take place in mid-year followed by a moderate recovery in H2”, however a key factor is a property market recovery in Tier 1 and Tier 2 cities driven by an easing of property tightening measures.

Looking ahead, the incoming activity data could also be upwardly biased: Nomura explains that March activity data in year-on-year terms (to be released in mid-April) could also rebound on two factors: (1) Beijing significantly eased its anti-pollution campaign (note the Chinese government launched an aggressive anti-pollution campaign from November 2017 to March 2018; see China: The anti-smog campaign likely less in force this winter, 19 Sep 2018); (2) Due to the special timing of LNY holiday, the Lantern Festival (the 15th day of the LNY) was on 2 March last year, but was on 19 February this year.

Putting these together, Nomura “remains cautious” on China despite the March PMI rebound: while the Japanese bank concedes that sentiment has improved and Beijing’s stimulus has been gradually kicking in, it remains cautious in interpreting the 50.5 PMI reading for two reasons.

- First, the official PMI has occasionally been poor gauge of growth momentum over the past five years, especially in spring. For example, in spring of 2014 and 2015, amid slowing growth, the manufacturing PMIs actually rebounded in March. One factor behind these false signals from the manufacturing PMI in spring is the LNY holiday distortion, which make applying an appropriate seasonal adjustments challenging.

- Second, the jump in new credit in January this year could indicate some restocking activity, as evidenced by the jump in the raw material inventory sub-index (up to 48.4 in March from 46.3 in February). However, real final demand could remain weak as growth in exports, new homes and passenger cars remain in negative territory.

As a result, Nomura believes “there is limited room for a further rise in the manufacturing PMI and see a substantial likelihood that the PMI dips again” and notes that there are no changes to its views on China’s recovery, to wit: “We believe there is limited room for a further rise in the manufacturing PMI and see a substantial likelihood that the PMI could dip again. We maintain our view that a stabilization could take place in mid-year followed by a moderate recovery in H2, and that the key factor is a property market recovery in Tier 1 and Tier 2 cities driven by an easing of property tightening measures. “

via ZeroHedge News https://ift.tt/2JUPzhn Tyler Durden