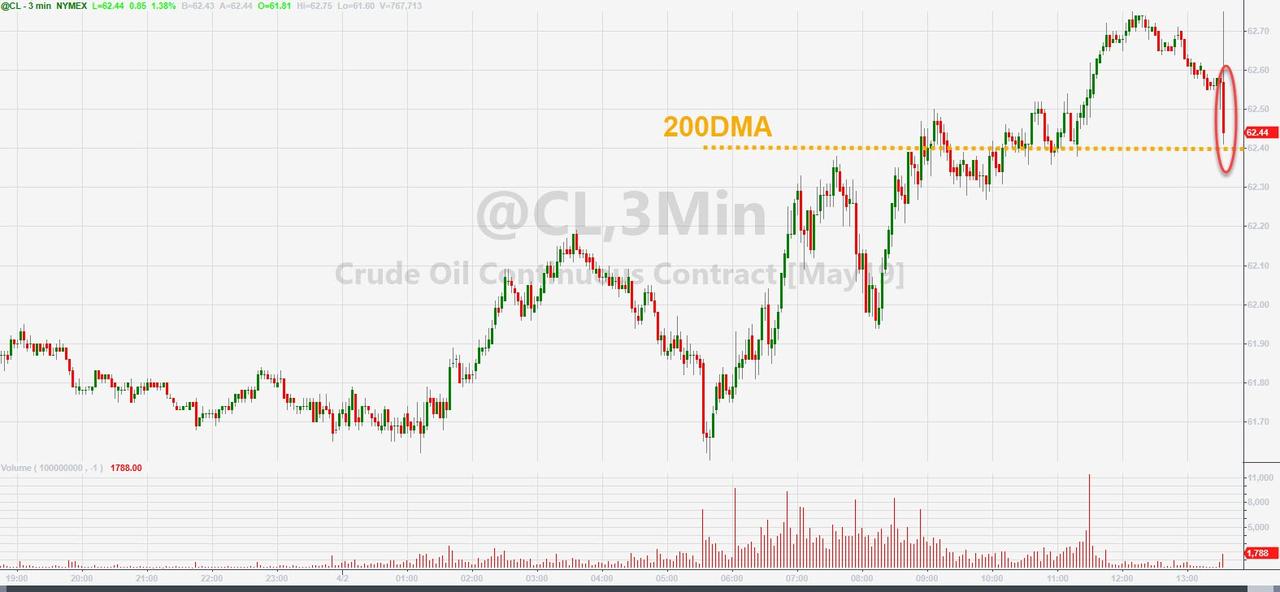

WTI extended its recent run today, breaking above its 200DMA…

While technicals dominated today, “The fundamentals that drove us yesterday — the OPEC production numbers falling, Venezuelan production issues, strong manufacturing numbers and lower U.S. production — all of that is conspiring to take prices higher,“ said Phil Flynn, senior market analyst at Price Futures Group Inc. in Chicago.

But once again all eyes will be on inventories…

API

-

Crude +3.00mm (-900k exp)

-

Cushing +18k

-

Gasoline -2.6mm

-

Distillates -1.9mm

EIA printed a surprise crude build in the prior week and expectations were for a return to draws this week but API reported a second weekly surprise crude build (+3mm vs -900k exp)…

The WTI 200DMA level is $62.40 – which is exactly where it traded ahead of the API data. After a quick kneejerk higher, WTI slipped lower but remained above the key technical level…

Oil has rallied more than 30 percent this year as Saudi-led production cuts, together with receding fears over the global economic growth outlook, appear to be easing investor concerns.

via ZeroHedge News https://ift.tt/2CNdkly Tyler Durden