Andy Hall is arguably the most successful oil trader of his generation. His career spanned nearly 45 years and he amassed himself a fortune while earning a reputation for being on the right side of some of the largest price swings in the market’s history (at least until the last one). He also helped play a role in creating the modern oil trading industry. Despite rarely talking to the press, he made headlines when, during the financial crisis, he fought for a $100 million bonus at Citigroup.

Hall recently told the Financial Times: “I always thought speaking to the press would be an act of hubris. Whenever you start reading about people on the front page of the Financial Times or Wall Street Journal, it’s usually the top. So, I just thought, one way of avoiding that is just to avoid any publicity and, also, who needs it?”

Hall is now less worried about jinxing himself by talking to the press, two years after shutting down his hedge fund. At the annual FT commodities summit, he finally opened up about the oil market and some of his biggest trades.

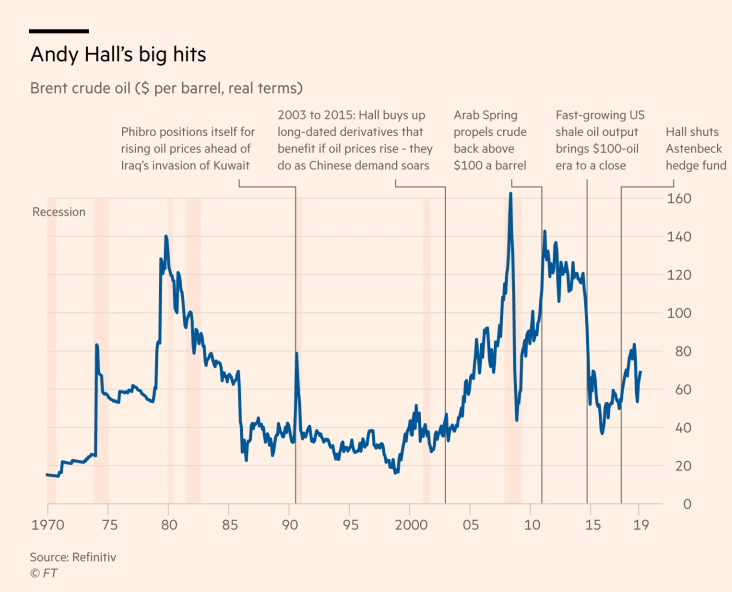

One of his most memorable trades earned him the nickname “God” among his peers and took place during 1991, when Iraq was planning to invade Kuwait. Hall was working at commodity trader Phibro at the time. Oil prices were down and tension among OPEC members was high. Hall was working on using the low price to pioneer a method of trading that’s now common: loading up tankers at seas to store crude, while locking in higher prices for later delivery in the futures market.

Hall said of his strategy while at Phibro: “It was a no-brainer but people weren’t set up to do this. We [however] had probably the biggest chartering operation in the world at that time.”

And this was exactly the strategy he employed: “I don’t know exactly how many tankers we had. But I know I got a call from John Gutfreund [chief executive of Salomon, Phibro’s then-parent group] saying, ‘Hey, Andy, you guys never normally use any capital, and they’re telling me you’ve got hundreds of millions of dollars of working capital usage this month.’”

After sitting on tons of cheap oil, Hall recognized that Saddam Hussein was likely going to invade Kuwait and realized he had the potential for a career defining trade. He removed a portion of his hedges against the trade, leaving his cargoes fully exposed to the volatility in oil prices. The losses would have been astronomical if he was wrong.

But he wasn’t. And Hall recalled the catalyst playing out in front of his eyes: “And, then, he invaded. I remember the night very well. I got a call at one o’clock in the morning from either our Tokyo office or our Singapore office saying there are Iraqi tanks in Kuwait City. ‘So, what’s the oil market doing?’ And, he said, ‘Well, there are bids $6 a barrel above New York’s close.’ ‘And where are the offers?’ ‘There aren’t any offers.’”

Oil jumped 10% the next day in New York. Within months, it had doubled. By the time it fell, Phibro and Hall were long gone from the trade.

15 years later, Hall’s Phibro, now a part of Citigroup, had become its own institution. Hall once again decided to bet big around the turn of the century: he saw China’s economy and its 1.4 billion consumers as an opportunity. Seeing that new demand was going to need to be met, Hall bought hundreds of millions in long dated oil contracts, believing the price would rise.

The trade was another grand slam. Between 2003 and the summer of 2008, oil went from $25 to an all-time peak of $147. Hall nearly top ticked the trade, cashing out at about $140, just as the financial crisis was becoming clear.

“It’s all very well identifying the point to get in, but then you’ve also got to identify the point to get out,” he told FT.

And Hall continued to be successful despite the fact that Citigroup needed a $45 billion bailout from the government. He bought back into the market around $30 in early 2009, before crude rebounded to $80. But the $100 million bonus Hall had earned from his success during the austere environment of the crisis wound up backfiring and turning him into a target.

Hall was unrepentant about his bonus and fought for his $100 million from Citigroup, which he got:

“The problem for them was that I had a contract with Citigroup and there was no obvious way for Citigroup to break it, and I think Ken Feinberg was smart enough to figure that out. So he came up with a sort of nifty solution to the problem which was, ‘All right, well, Mr Hall can get his money because he’s contractually entitled to it but, you, Citigroup, are going to have get rid of Mr Hall and the company he runs.’ I’m a relatively wealthy person but I will tell you this, I doubt whether many people of my wealth have paid as much in taxes as I have.”

Citi ultimately wound up selling Phibro to Occidental Petroleum in 2010, a move that impinged on the freedom Hall was accustomed to.

“Frankly, after 20-odd years of benign neglect, to suddenly have a weekly management call, I think, was killing me,” Hall recalls. At the same time, Hall was managing a hedge fund for Blackstone, Astenbeck Capital, which he helped grow to $4 billion.

But then, as it eventually happens to everyone, Hall’s luck ran out. In 2017, Hall shocked the market one last time: he hung up his “oil trading spurs” and shut down his flagship Astenbeck Master Commodities Fund II after it was creamed 30% through June of the year. Hall told his investors in July 2017 that the global crude market had “materially worsened” and blamed his poor performance on the fact that OPEC had little control of the oil markets.

“If I was put in a time machine, would I choose to do it all again? Probably not. I guess I should have built a computer in my parents’ garage. Or perhaps become an art dealer in my late twenties. I guess I enjoyed it, though. At times it was quite stressful. But it allowed me to pursue my passions. But I’m not looking back. I’m looking forward. I’ve got a lot more things to do. I don’t see my career as over by any means.”

via ZeroHedge News http://bit.ly/2KeYuud Tyler Durden