Ever since tumbling into a bear market in the fourth quarter of 2018, the Nasdaq has exploded higher, surging more than 30% since Christmas, trading just shy of all time highs and nobody on Wall Street can explain why…

… because as Bloomberg puts it, aside from the stock price itself, “everywhere else you look in the industry, bad news is overwhelming the good.”

Here’s why Wall Street is puzzled: even as tech stocks soar, with the Nasdaq up 5 of the last 6 trading sessions, tech profits are shrinking “at an alarming pace”, valuations are reflating and politicians want to break the companies up. Worse, as we reported last week, Samsung previewed a dismal quarter for semiconductor orders which have collapsed, while spending on infrastructure to support the all-important “cloud” is off. And yet, as Bloomberg puts it, “the addiction won’t break.”

Of course, it is hardly news to anyone that fundamentals no longer matter in a market where central banks have greenlighted a scramble into the riskiest of growth stocks, and where too much money has been lost by sitting out, and where as Morgan Stanley chief equity strategist Mike Wilson warned that groupthink – and FOMO- has taking over; it is this FOMO that while creating furious rallies, also precedes a cycle’s peak.

“I can’t remember a time in my career when institutional investors have been so preoccupied with what everyone else is doing,” Wilson said, who for the second time in the past year is advising investors to avoid tech stocks. “When investors are more focused on what everyone else is doing, rather than what the fundamentals are doing, it’s probably the end of a trend.”

And yet, as Bloomberg points out, “if this is the end, it’s been a tough one to miss”. Consider the following:

- the Nasdaq 100 just rose for the 14th time in 15 weeks and is about one big day away from its August record

- Fourteen companies, among them chip standard-bearer Advanced Micro Devices Inc. and Lam Research Corp., are up more than 50 percent from their Christmas lows,

- only seven stocks in the gauge are down over the stretch.

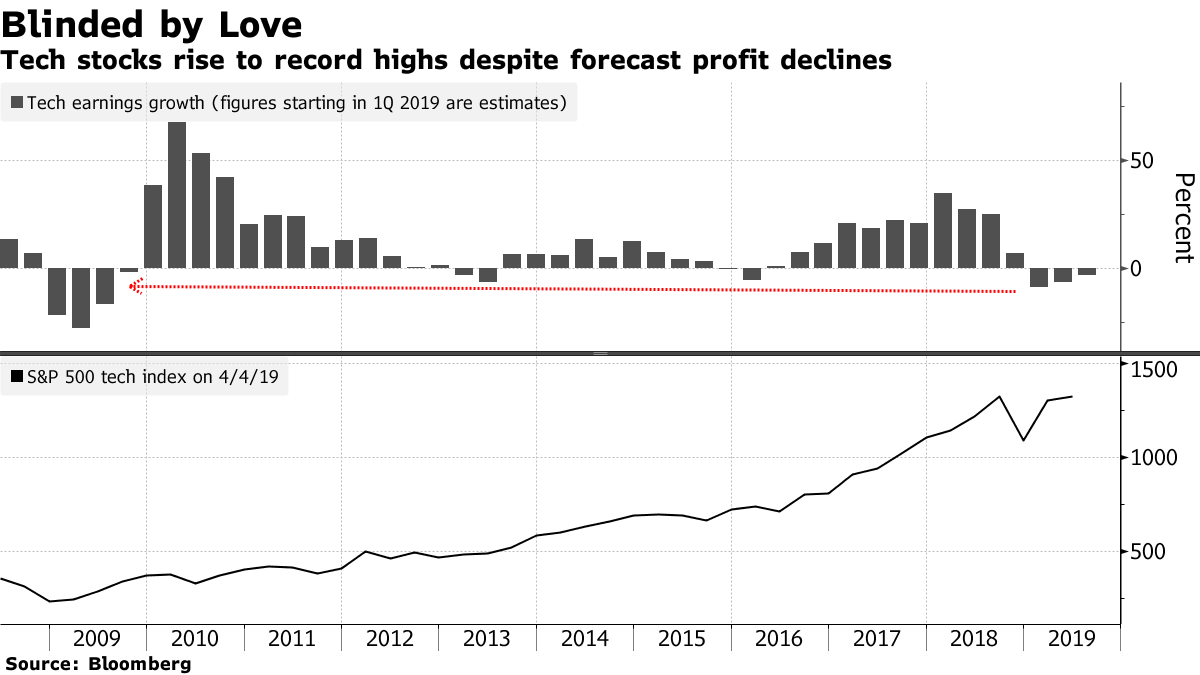

Looking at the above, one might expect tech companies to report blockbuster result in Q1. They will do the opposite – in fact, software and electronics makers are expected to report an 8.7% plunge in Q1 profit, which would mark the worst income decline since 2009.

Instead of stopping investors, investors are rushing back to an industry that was the market’s favorite as recently as last summer. At 4.4x sales according to Bloomberg, tech stocks trade at a multiple that is twice as high as the rest of the market. That’s close to the highest premium since 2000.

One reason for the relentless pursuit of tech names: the continued slowdown of the global economy, coupled with a Pavlovian response from global investors. After all, for 15 straight quarters through last June, tech profits outpaced the S&P 500, with the growth gap averaging 6.3% points; that outperformance, however, is ending, if only for the next quarter.

“Everybody is trying to find growth at all costs and there’s not a plethora of options,” said Mark Lehmann, president of JMP Securities. “People are willing to pay more.”

One other reason behind investor optimism: the benefit of the doubt. In previous growth slump, the industry has managed to innovate itself out of growth slumps in the past, and it still remains unclear if the tech sector will be able to make any profits off everything from self-driving cars and artificial intelligence in coming years. But right now, tech indeed has a growth, or rather profit problem: as Bloomberg notes, products such as smartphones have entered a maturing phase and parts makers like semiconductor companies have seen weak demand from a range of end markets including data centers. The biggest culprit behind it all: China, whose slowdown has rippled across the entire tech supply chain, hurting everything from iPhone sales to semiconductor demand; it’s also why tech names soared after last week China reported a far stronger than expected manufacturing PMI. Perhaps that’s the inflection point so many had been waiting for.

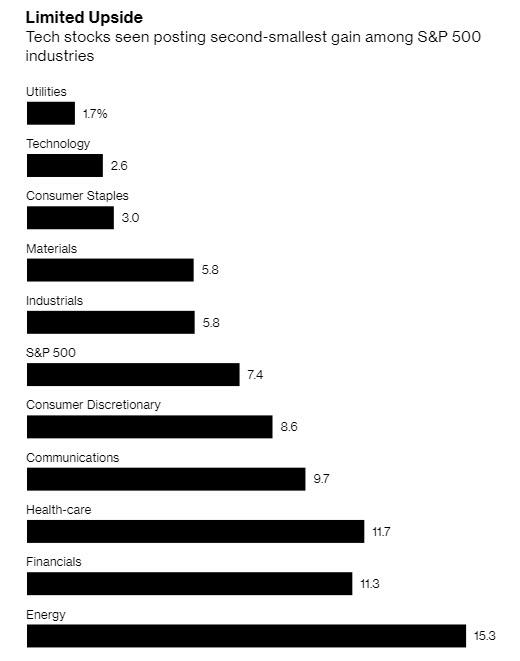

Or perhaps not: analysts don’t see any quick rebound in tech profits, projecting essentially flat sales through the third quarter of 2019. Reflecting the bleak outlook, price targets for tech stocks point to just 2% gain over the next 12 to 18 months: “that rate of expected returns trails all other S&P 500 industries except for utilities.”

So with micro challenges pointing at continued weakness, there can be only one answer to the great tech stock puzzle: central banks and overall optimism. Indeed, to Edwin Davison, an analyst with DuPont Capital, the resurgence in tech shares reflects an improved macro backdrop – the Federal Reserve has turned more dovish, the Sino-U.S. trade talks are progressing and China has introduced another round of economic stimulus.

However, that may be a two-edged sword because once companies start rolling out their financial reports, investors will focus on whether all the positive developments translate into gains for individual businesses.

“People are starting to bake in some of these things: trade, the Fed, China stimulus,” Davison said. “Things have stabilized. I think there are still questions about exactly what the second half looks like.”

The persistent love for tech stocks is reminiscent of the 1990s Internet frenzy to Leuthold Group. Granted, the excitement today pales in comparison and is motivated by nothing other than the fact that the industry is a default choice when growth is scarce. Still, the danger of crowding is no less pronounced, said Doug Ramsey, the firm’s chief investment officer.

“In the late 1990s, it was the carrot. In this cycle, it’s been the stick,” Ramsey said. “Different paths, but each has led to similarly precarious portfolio bets.”

To one recent, and quite notorious Wall Street bear, however, there is far less doubt what the second half will be: as Morgan Stanley’s chief equity strategist Michael Wilson wrote in his Sunday Start note, “the Fed has fixed the tight financial conditions which were largely responsible for December’s overshoot to the downside. However, it can’t roll back the corporate cost pressures created by the fiscal stimulus. These pressures now have to play out in what we’ve been calling for since last fall – a profits recession.”

If he is right, the recent 30% surge in the Nasdaq may prove to be the biggest bear trap in recent history: “it’s misguided to assume that the profits recession has magically ended, and I see an increasing chance that it turns into an economic one if companies decide they want to protect profits by cutting labor, capex and inventory. Perhaps the Fed understands this better than investors, who may be merely experiencing a serious bout of FOMO.”

via ZeroHedge News http://bit.ly/2G54Wjs Tyler Durden