Fleet sales – those to rental companies – have been for a long time the dirty little secret of the automobile industry. They are often times where automakers can bolster numbers that would otherwise looks dismal based only on organic, showroom sales. And according to Bloomberg, this is exactly what has been happening over the last couple of months.

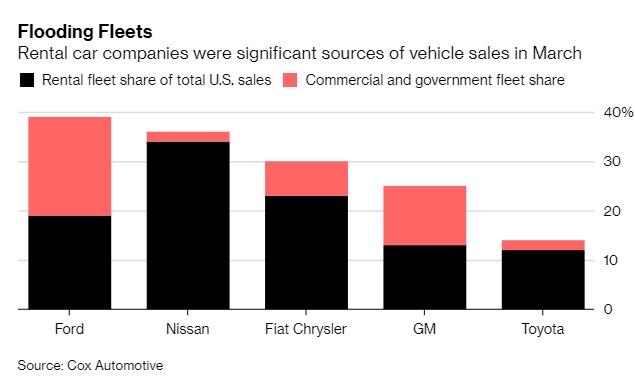

Rental car deliveries and other non-retail buyers have accounted for more than 33% of total sales last month for Ford and Nissan, according to data from Cox automotive. In fact, deliveries to rental companies alone in March and in the first quarter were the highest that they’ve been in two years.

There is, of course, a catch: rental car sales have lower profit margins and generally erode used vehicle prices once they hit the resale market. It seems as though automakers are now, more than in the past few years, leaning on fleet deliveries to make up for demand in the showroom as economic growth in the US and worldwide, is collapsing.

Zohaib Rahim, manager of economics and industry insights at Cox, told Bloomberg: “Any favorable view we have of the market is because of sales into fleets. The market peak of 2016 is behind us and retail sales are softening more and more now.”

Automakers sold 550,000 vehicles to rental car companies in the first quarter, the most since the first quarter of 2016 and up 6% so far this year. This increase comes on top of a 7% gain in 2018 to 2.7 million. This surge helps explain the resilience of the auto market of late: sales have been down every month this year, but the annualized selling rate has improved to 17.45 million.

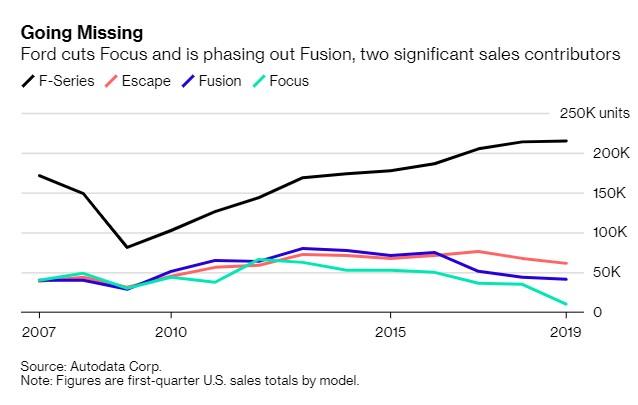

Of all auto makers, Ford leaned on fleets the most in March, with its fleet deliveries accounting for 39% of sales, including 19% from rental car companies. The automaker is discontinuing models like the Focus that used to be significant volume contributors.

Ford says it expects these fleet sales to “smooth out over the course of the year” and that they were “dictated by the timing of orders from rental companies”. Oh, but of course, we’re sure it’s all just one big coincidence.

Mark LaNeve, Ford’s U.S. sales chief, said: “Our plans are to end 2019 down slightly in the rental channel. The retail performance was strong where it needed to be, in trucks and new SUVs.”

Nissan’s total fleet share was equally as significant, at 36%, with “most” of the volume going to rental lots.

- General Motors saw deliveries drop 7% for the quarter, with all four brands falling

- Chevy Silverado was down 16%

- Chevy Suburban dropped 25%

- Fiat Chrysler sales fell 7.3% (estimates were for a decline of 6.4%)

- Jeep sales fell 11%, continuing the February trend of SUV demand drying up

- Toyota sales fell 3.5%

- This beat estimates for the month, but still showed softness

- Toyota also fell 5% for the first quarter, hurt by a decline in demand for its Corolla

- Nissan sales were down 5.3% in March

- Nissan’s first quarter sales were down 11.6%

- Deliveries fell 23% for its Infiniti brand

- Ford sales were down 5% in March, according to industry data

- The company is expected to show a 2% decline for the quarter

- Honda saw a 4.3% percent increase, as passenger car sales rose more than 4%.

- Accord sales were up 5%

And that’s with the fleet channel stuffing. We can only imagine what happens later this year when the rental companies no longer have capacity to buy whatever the OEMs have to liquidate…

via ZeroHedge News http://bit.ly/2IjImFf Tyler Durden