Authored by Tim Knight via SlopeOfHope.com,

Allow me to start off what is intended as an economic musing by referring to a favorite comic of mine, Patton Oswalt. He has a fairly new bit in which he explains the Trump phenomenon as a totally understandable response to the Obama presidency.

The political pendulum in America, deep in the throes of the financial crisis, had swung so far that the United States elected its first black President, and a rather progressive one.

After eight years of that, the “mirrored” response was to elect a political novice known principally as the billionaire star of a reality television show.

Oswalt conjectures, probably quite accurately, that the next President will probably be an equally hard swing to the left (perhaps the first gay President) and, following his administration, a Klansman with the ass cut out of his jeans. America is a very centrist country, and the ideological moving average of our Presidents has to adhere to some kind of median, even if that median is comprised of wild swings to the left and right.

This oscillation applies to economic thought as well. Nothing is ever perfect, and given whatever circumstances are going in a given era, there will eventually be a critical mass of people who decides that something else must be better, so they give that a try instead. And the something else isn’t perfect either, so eventually yet another thing is tried, probably quite different, and probably fairly close to whatever system was in place two attempts ago. Back and forth, left and right, to and fro it goes.

The economic pendulum in the United States has likewise swung fairly regular. I’ll broadly characterize these movements as to the “left” (push for economic equality, higher taxes, anti-business, anti-rich) and “right” (low taxes, pro-business, pro-rich). For a while it was almost like clockwork:

-

RIGHT – 1900s – Gilded Age;

-

LEFT – 1910s – Trustbusters, income tax begins, Federal Reserve;

-

RIGHT – 20s – Roaring 20s, Hoover tax cuts;

-

LEFT – 30s – Pecora Commission, New Deal, growth of unions;

-

RIGHT – 40s/50s – American prosperity, Eisenhower, soaring stocks;

-

LEFT – 60s/70s – heavy regulation, powerful unions, Great Society;

-

RIGHT – 80s/90s – Bull market; Reagan revolution; deficit prosperity;

-

LEFT – 2000s – Sarbanes-Oxley, Obama election, Dodd-Frank;

-

RIGHT – 2010s – Quantitative easing, 0% interest, Trump tax cuts

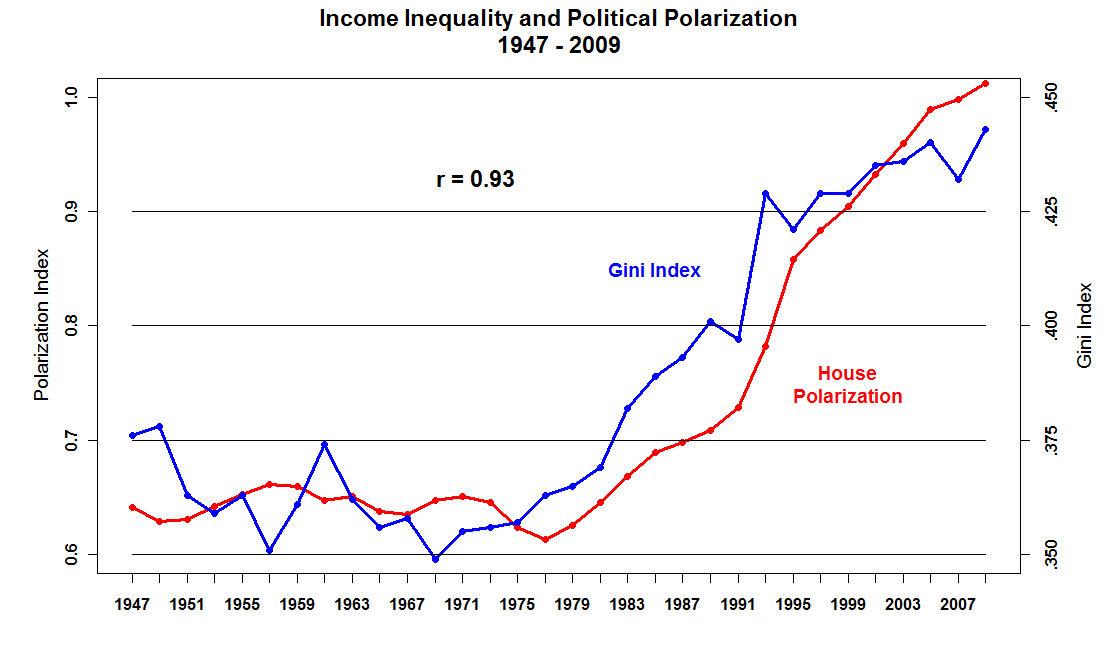

I would argue, however, that the swing to the left in the 2000s was extremely muted. Economic equality peaked around 1971, and we’ve been swinging to the right pretty hard since then, almost half a century now. The chasm between rich and poor has been becoming wider by the year. If it weren’t for government employees, unions would be almost non-existent. Taxes are 15% for the rich. And the Federal Reserve appears to be permanently “accommodative”. In short, the rich have never had it better than right now, and this divide has accompanied political polarization hand-in-hand.

In a wiser world, the financial crisis of 2008 would have been a huge wake-up call, and there would have been a very hard swing to the left. But there’s no point in arguing hypotheticals, because the modest response (in the form of Dodd-Frank, now largely neutered to the point of non-existence) hardly constituted a pendulum swing to the other side. It was more of a brief bobble, principally because there wasn’t enough political will to do more. The public has become so utterly snowflake-ized that there’s no way they could dare suffer, so trillions and trillions of dollars of QE were rained down upon them.

The “spoiling” of the public has basically cheated them out of any wisdom that might have been garnered by the financial crisis, but instead, they have become so accustomed to government aide that both rich and poor really, really like it and want it bigger and better than ever. This had led to many insanities, the pinnacle of which are the malformed twins of Universal Basic Income and Modern Monetary Theory.

These will both, in the end, be decried as abject lunacy, but it’ll be a while.

There has been virtually no pushback against such madness thanks to three simple words that almost everyone has embraced: Deficits Don’t Matter. Why should they? After all, what harm are they causing? Inflation? What inflation? The trillions of new money have hardly caused a blip. So keep those presses rolling!

Well, we all know there has been inflation – – massive amounts of it – – but it’s the kind of inflation that the rich love. Specifically, asset inflation.

The general public doesn’t want to see bread and meat go up 500% in price. But those who own assets – – especially the small percentage of the public that owns a lot of assets – – has no problem at all with this kind of inflation. The higher, the better!

The old style of thinking was along these lines:

-

If the government goes deeper into debt and creates a lot of new money…

-

…then people will have a lot more money to spend…

-

…and prices of everything will go up…

-

…so eventually it’ll even out, so what was the point of all that new debt? Because the inflation will rob people of purchasing power.

But in this new gilded age:

-

The government goes deeper into debt and creates a lot of new money…

-

…the highest echelon of businesses and private citizens are the beneficiaries of that new money, which they spend on assets…

-

…the assets go up in price, which encourages them to buy even more assets at even higher prices (with triple-digit P/E ratios)…

-

…so a virtuous cycle is created, and the stuff soaring in price are things like high-end real estate, objects of fine art, and other luxuries

The end result being a larger and larger gulf between the rich and the poor. But as long as the poor aren’t starving and rioting in the streets, what difference does it make, right? Bread and circuses, baby.

For the purposes of this thought experiment, let’s make one assumption. Let’s dust off some old sayings that seem to have been true for human history: “there’s no such thing as a free lunch”; “you can’t print your way to prosperity“; and anything else appropriate.

Let’s say, just to be crazy, that human wisdom still holds true today. Put more directly, let’s suppose the shit actually hits the fan one day, and all this QE and 0% interest stop working. In fact, that they start causing harm. The economic cycle grabs hold again. Rates go up. Jobs go away. The lower 95% of the public starts to get pissed off.

I would suggest that, sooner or later, a revenge mentality is going to take place. I would further speculate that placations about more QE aren’t going to cut it anymore, because the public (at long, long last) will see through such tricks.

But the fact is that the debt is there (which, by then, will be – – $30 trillion? $50 trillion? Depends on when this all happens) and it needs to be serviced. And where’s the money going to come home? The rich, perhaps? And why would the government pursue the rich in order to get funds to service the debt? To quote Willie Sutton: “Because that’s where the money is.“

And the public will back them up. The swing to the left, both politically and economically, will be far more severe than normal, because there is a certain “pendulum payback” waiting in the wings. White collar prisoners. Confiscatory tax rates. Luxury and asset taxes. And a push toward socialism that few of us can imagine.

And I think that’s a shame. Because such a hard reversal will, in the end, hobble America. But my supposition is that there’s a certain price to be paid for indulging America’s highest classes for a few decades, and that price is going to be borne by everyone.

It won’t have been worth it. At least not for most of us.

via ZeroHedge News http://bit.ly/2OUPiKm Tyler Durden