The U.S. casino industry has been in a 61-month slump since topping out in March 2014.

Alantic city has been hammered the hardest, with five of the city’s 12 casinos closing their doors between 2014-16.

New data Monday from the New Jersey Division of Gaming Enforcement show profits collapsed by 15% in FY18, to $582 million, at a time when the city’s gaming industry is contracting as two new casinos reopened, reported AP.

During the 40% reduction of the city’s casinos between 2014-16, the market stabilized with less competition. However, the gaming commission made a disastrous mistake last June by allowing Ocean Resort Casino and Hard Rock to open new gaming facilities, which, once again, saturated the market – leading to a decline in gross operating profits for five of the seven casinos.

The report said Tropicana and Golden Nugget were the only casinos that increased operating profits last year.

The reopening of the two casinos, in a declining market, has resulted in a smaller slice of the pie for the seven operators.

James Plousis, chairman of the New Jersey Casino Control Commission, told the AP that “profit margins were tighter” for the year.

Meanwhile, Golden Nugget had the largest operating profit for 2018, up 12.5% to $45 million. Tropicana was up 1.4% to $93.4 million.

The Borgata reported the most significant decline in profits, down 18.8% to $206 million. Caesars dropped by 15.4% to $79.6 million; Harrah’s was down 6.5% to $109.3 million; Bally’s was down 5.7% to $40.1 million, and Resorts was down 2.7% to $22.5 million.

Among online-only casinos, Resorts Digital was down 75% to $3.6 million, and Caesars Interactive-NJ was down 13.3% to $9.3 million.

Out of the gate, the new casinos [Ocean Resort Casino and Hard Rock] each reported an operating loss for the year.

During 4Q18, Atlantic City’s casinos collectively saw a decline in gross operating profit of 41.1%, to $75.1 million.

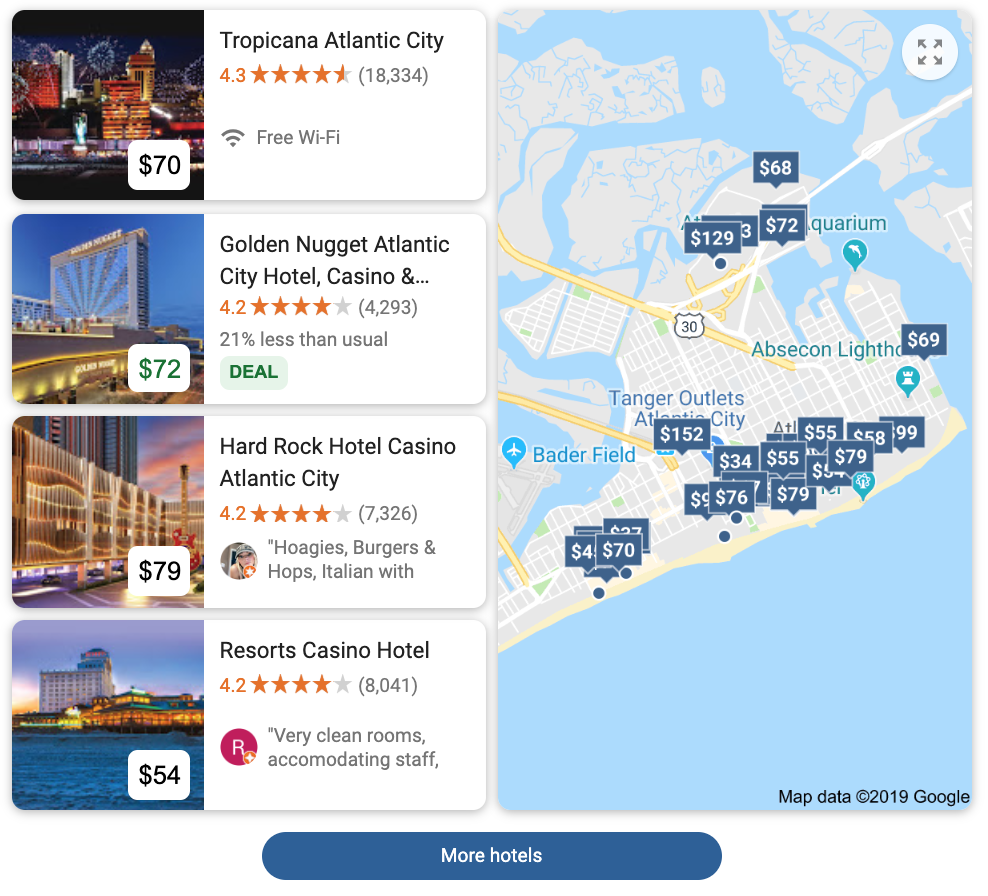

The report mentioned that hotels rooms were only 80% full in 2018. Resorts had the highest occupancy rate at 86%; the Golden Nugget was lowest at 74%.

From Las Vegas to Macau, gross operating profits have been slipping, with JPMorgan analysts expecting that Macau could be hit the hardest in 2019.

A global synchronized slowdown could be responsible for declining profits at casinos stateside and overseas.

Casinos are not recession-proof. Their profits tend to rise in expansions and contract in recessions. So, maybe, Alantic City, is yet, another ominous sign that the global business cycle is turning.

via ZeroHedge News http://bit.ly/2D4f75W Tyler Durden