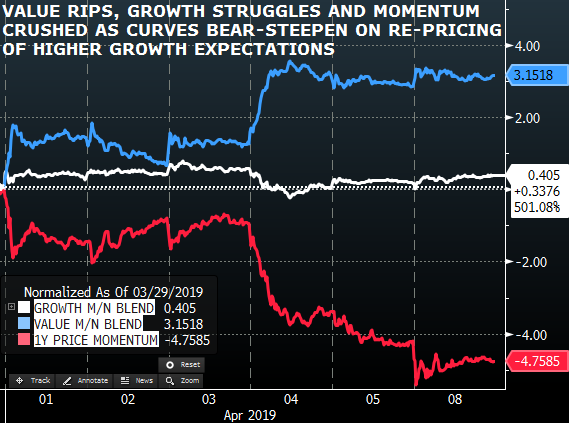

Last week, we described how as a result of the recent violent move away from momentum and growth stocks and into value names, momentum traders got crushed in a sharp drawdown, which Nomura’s Charlie McElligott described as a 4 sigma move.

It has only gotten worse since then.

As a reminder, while on one hand most institutional investors have stayed on the sidelines so far in 2019, those who did take the plunge, ended up buying up the traditional “slowdown” favorites: growth and momentum names, while shunning or outright shorting value. This was a mistake.

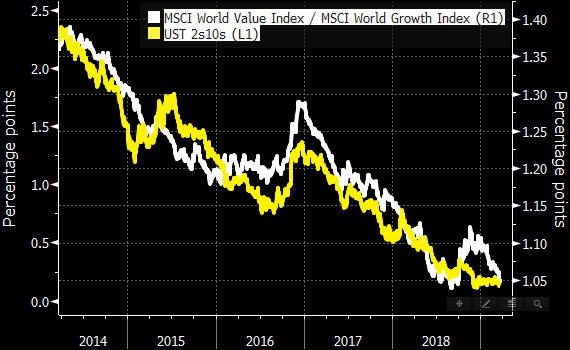

As McElligott writes in his daily note, as the Fed pivoted violently away from the 2018 volatility-inducing regime of “QE to QT,” the collective embrace of outright “QE” thinking of lower rates and flatter curves, saw equities investors go back to their “Slow-flation” comfort blankets—as + Sec Growth + Defensives / (-) Cyclicals has been a massive positive performance driver for the majority of the past 5+ year period.

However, do note that the latest move higher in markets was not precipitated by further weakness, or “bad news is good news”, but rather sizable beats in economic indicators, starting with China’s dramatic Manufacturing PMI rebound; as a result, we have now seen global growth getting re-priced higher in the nine days since the peak of the Rates “overshoot” following beats in China Mgf PMI, US ISM, EZ Retail Sales and Service PMIs, US NFP and Claims all last week). This sent the “value” factor exploding higher in conjunction with the latest US yield curve “bear-steepening” (which has seen the front-end EDM9EDM0 cut in half, from -42bps on March 27th to today’s -23.5bps, while the long-end has again steepened with 5s30s back to 60bps from 56bps last week, as per McElligott.

And as global growth re-priced higher, we have seen the “perpetually underweighted/placeholder shorts of predominantly “Cyclical” sectors” ripping higher in April (Materials +4.3% MTD, Financials +3.5%, Energy +2.8%, Industrials +2.2%) while the “Slow-flation Barbell Longs” act as a relative “source of funds”: “Secular Growth” high flyers like “Tech Momentum Longs” are -4.2% MTD extending on the momentum carnage discussed last week; some more details on this violent reversal of the most crowded positions:

- Sofware 8x’s EV / Sales -1.5% (after being +36.4% YTD); and

- “R&D / Sales” factor struggles -0.4% MTD (after being +29.7% over the past year),

… with “Low Vol” Defensives languishing as well (Utilities -0.9% MTD vs +8.9% YTD, Staples -0.6% MTD vs +10.5% YTD, Healthcare +0.2% MTD vs 6.4% YTD, REITS +0.4% MTD vs +17.1% YTD).

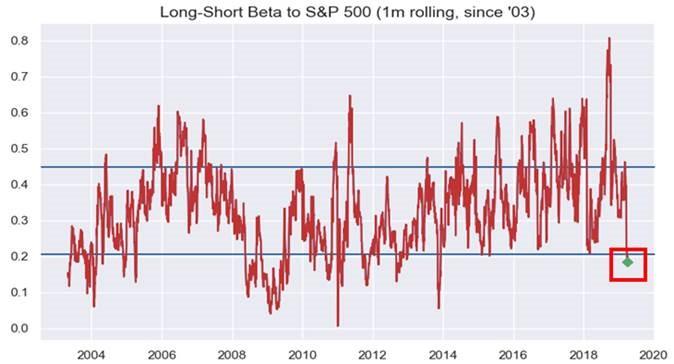

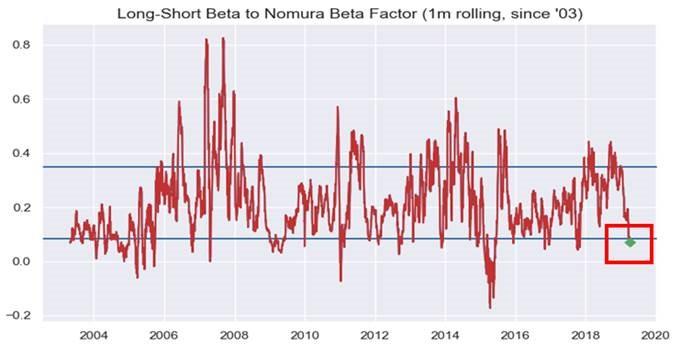

Meanwhile, another relevant topic is that while investors have been positioned incorrectly in the context of the recent growth/value reversal, many have stayed out of the market in the first place, with hedge and macro funds barely responding to market moves. Or, as McElligott points out, “you still don’t have many market players “participating” in this equities move to the extent they want, especially in the leveraged-fund space”:

Equities Long-Short HF “Beta to S&P” is down to 12th %ile since 2003

“Cyclical Beta / Value” discussion, Long-Short “Beta to Nomura Beta Factor” is down to just 9th %Ile since 2003

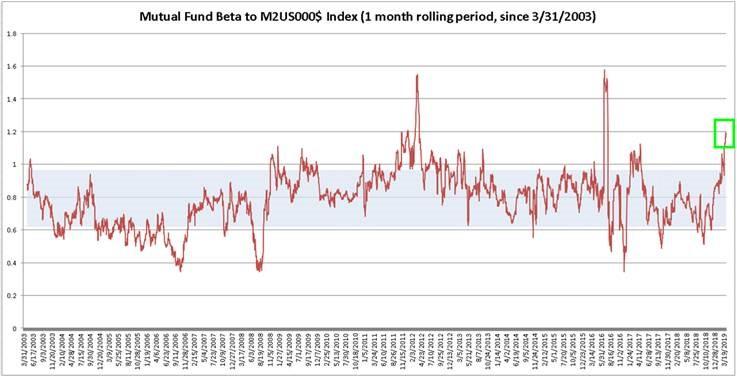

Conversely, the crowding into Long Growth and Quality / Defensives, Short Value is incredibly extended—particularly with Mutual Funds—and thus, susceptible to “tipping-over” even on just a modest “rebalancing”: in fact, Mutual Fund “Beta to Momentum Longs” is up to the 98th %ile since 2003

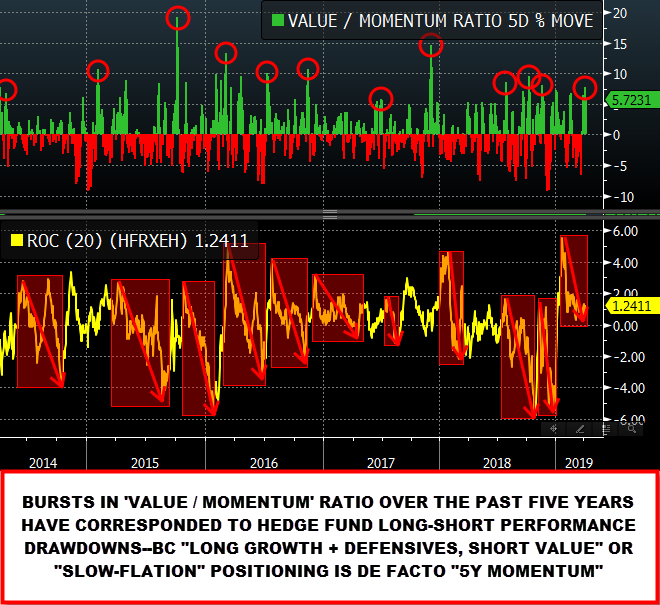

These exposures, and the precarious positioning discussed above is especially dire for hedge funds, which have once again missed much of the recent move in stocks, and as McElligott puts it, the recent moves have been “just another pain trade as bursts in the “value/momentum” ratio have tended to correspond with hedge fund performance drawdowns over the past five years.”

But wait, there’s more (pain for momentum chasers): as the Nomura strategist furhter adds, as-opposed to what is a very positive seasonal backdrop for Cyclicals and thus Value, “seasonality is a massive NEGATIVE PERFORMANCE DRIVER for “Momentum” factor in April as it is the worst month of the year for the factor since 1984: “1Y Price Momentum” shows April on average -2.2% / median return of -0.5% and “just” with a 43% “hit rate”—as the “Momentum Shorts” (i.e. “Cyclical Beta” / “Value Longs”) tend to EXPLODE higher, +3.3% on average since 1984.”

Finally, there is the possibility that the upcoming Fed announcement of a “Reverse Twist” will only add to the suffering of “growth/momentum” longs. Specifically, the last twist in the knife to momos, and the latest boost to the “macro/technical” tailwind to this “Positive Value, Negative Momentum” dynamic could come in the form of an expected “Reverse Operation Twist” from the Fed, which as the Nomura strategist explains is “by definition, a curve “Steepener” as reinvestments are moved “across the curve” but by-and-large concentrated into the front-end in order to shorten the weighted average maturity of the SOMA portfolio”, which as shown in the charts below will further boost Value factor (especially Banks / Financials)…

… and act as a further headwind to Momentum factor, as said legacy positioning is forcibly rebalancing to a more pro-cyclical/reflationary worldview.

via ZeroHedge News http://bit.ly/2Vvibit Tyler Durden