In one hour, when the ECB announces its latest decisions, the central bank is expected to leave its three key rates unchanged, to maintain current guidance on rates, reinvestments, growth and inflation, while in the press conference that follows, President Draghi is unlikely to offer much in the way of concrete details on TLTRO3 or tiered rates. In short, unlike last month, this meeting may be a snoozer.

Here is what Wall Street expects, via RanSquawk

- PREVIOUS MEETING: The most recent policy announcement saw the Central Bank stand pat on rates as expected and maintain their guidance on rates and reinvestments. However, policymakers at the ECB caught markets off-guard by announcing a new wave of funding measures for the Eurozone, whilst pushing back expectations for their next rate hike; although these measures were expected to come at some stage, April and June meetings had been flagged as a more opportune time ahead of the release. In terms of the specifics, on the funding front, the ECB unveiled a new TLTRO (quarterly frequency) from September 2019 until March 2021, at the refi rate and no longer at the deposit rate. From a rates perspective, policymakers stated that rates are “to remain at their present levels at least through the end of 2019” vs. Prev. guidance of “through summer 2019”. The Bank’s macro projections saw 2019 growth cut aggressively to 1.1% from 1.7% and 2020 lowered to 1.6% from 1.7%; risks to the Eurozone growth outlook are seen as “tilted to the downside”. On the inflation front, 2019 HICP was cut to 1.2% from 1.6%, 2020 lowered to 1.5% from 1.7% and 2021 lowered to 1.6% from 1.8% and thus notably below the ECB’s 2% target over a two-year time horizon, with Draghi admitting that inflation will take longer to hit target.

- ECB MINUTES: Last week’s account of the March meeting offered little in the way of fresh insight with some policymakers voicing concern over the effect of persistently low rates on bank profitability & intermediation, acknowledging that growth returning to potential through the projection horizon may be optimistic, whilst some argued for guidance to stipulate for steady rates through to Q1 2020 vs. previous guidance of through 2019.

- SOURCE REPORTS: In the immediate aftermath of the March meeting, sources reported that some at the Bank doubted the 2019 outlook was cut by enough with Draghi reportedly pushing for a stimulus package. On the TLTRO front, sources suggested the Bank are not going to be rushing for TLTRO details as soon as April and are mulling the TLTRO rate at a premium over the benchmark rate. More recent reports revealed that ECB staff are working on models for a tiered deposit rate and working on options to return some but not all of the cash it collects from a charge on excess liquidity.

- DATA: Since the prior meeting, one of the most noteworthy datapoints came via survey data with Germany registering an eye-watering manufacturing PMI of 44.1 (revised), which subsequently dragged the Eurozone metric deeper into contractionary territory. This contrasted to a slightly more resilient services report for the region, nonetheless, the overall composite metric was nudged back to levels seen at the start of the year. On the inflation front, headline EZ CPI slipped to 1.4% from 1.5% in March with the ex-food and energy metric slipping to 1% from 1.2%. Following the release, ING noted that “a drop to 1% is possible, meaning that the rate is likely to move away from the ECB target over the coming months before moving closer again”. From a growth perspective, HSBC highlights that evidence suggests that the EZ growth slowdown could persist for a little longer and subsequently forecast 2019 growth of just 1.0%.

CURRENT ECB FORWARD GUIDANCE (INTRODUCTORY STATEMENT)

- RATES: We now expect them to remain at their present levels at least through the end of 2019, and in any case for as long as necessary to ensure the continued sustained convergence of inflation to levels that are below, but close to, 2% over the medium term. (Mar 7th)

- ASSET PURCHASES: We intend to continue reinvesting, in full, the principal payments from maturing securities purchased under the asset purchase programme for an extended period of time past the date when we start raising the key ECB interest rates, and in any case for as long as necessary to maintain favourable liquidity conditions and an ample degree of monetary accommodation. (Mar 7th)

- GROWTH/TRADE: The risks surrounding the euro area growth outlook are still tilted to the downside, on account of the persistence of uncertainties related to geopolitical factors, the threat of protectionism and vulnerabilities in emerging markets. (Mar 7th)

- INFLATION: Measures of underlying inflation remain generally muted, but labour cost pressures have strengthened and broadened amid high levels of capacity utilisation and tightening labour markets. Looking ahead, underlying inflation is expected to increase over the medium term, supported by our monetary policy measures, the ongoing economic expansion and rising wage growth. (Mar 7th)

POTENTIAL ADJUSTMENTS TO ECB FORWARD GUIDANCE (INTRODUCTORY STATEMENT)

- RATES: Given that an adjustment on this front was made at the prior meeting, it is unlikely that policymakers will look to tweak guidance again at this stage. Albeit, market participants will be mindful of the account from the March meeting which revealed that some at the Bank wanted guidance to stipulate for steady rates through to Q1 2020 vs. through 2019.

- ASSET PURCHASES: No adjustments expected on this front. SGH Macro suggest that any resumption of asset purchases by the Bank would be a ‘break the glass option’ and remains very far away from the Bank’s base case. SGH Macro assess that any future APP would likely centre around securities targeted more directly to the economy.

- GROWTH/TRADE/INFLATION: UBS notes that President Draghi presented the Bank’s latest assessment on 27th March whereby he acknowledged “downside risks to growth and inflation”, however, also stated that convergence towards 2% inflation had been “delayed rather than derailed”. As such, UBS believes that, barring dramatic news (e.g. hard Brexit), this assessment “should still broadly hold”.

TLTRO AND TIERED RATES

TLTRO: At the March meeting, the ECB unveiled a new TLTRO (quarterly frequency) from September 2019 until March 2021, at the refi rate and no longer at the deposit rate. However, the Bank stopped short of providing any further details and stated they would come at a later date. In terms of questions still unanswered following last month’s announcement ABN AMRO asks the following: Will the maximum amount (30% of eligible loan level) exclude current TLTRO borrowings? Will eligible loans include mortgages? Will the built in incentives include a lower rate than the refi rate if a lending benchmark is met? How strict will the benchmark be? That said, Goldman Sachs see the April meeting as too premature for such an unveiling of details and instead foresee June as a more opportune time for the ECB to make such an announcement on the basis that doing so would help policymakers retain optionality on the attractiveness of TLTRO3; a view backed by HSBC, UBS and TD Securities. Therefore, the topic of TLTRO will more likely be a focus for the Q&A segment of the press conference rather than the introductory statement.

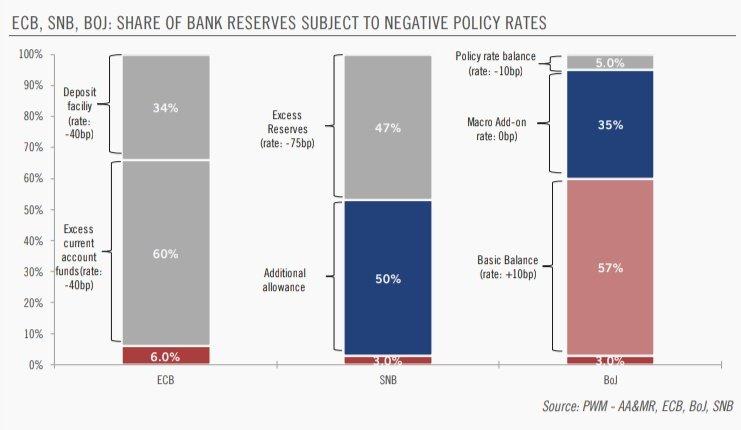

Tiered Deposit Rate System: As mentioned above, recent comments from President Draghi and source reports have stoked speculation over whether or not the Bank will implement a system of tiered rates in order to ease the burden of negative rates on the banking sector. Such a system would be similar to that of the SNB, BoJ and Riksbank, whereby different tranches of bank deposits at their respective central banks are subject to different interest rates.

Rabobank highlights that in its most basic form, a tiered deposit rate system would be a de facto rate hike as the interest rate on the first tier would be higher than that of the ECB’s -40bps deposit rate. However, the Dutch bank argues that such a move would be “unequivocally dovish in nature” on the basis that such a move would be unlikely if the ECB were looking to lift rates relatively soon, i.e. a tiered system would imply that the Governing Council would be looking for the deposit rate to remain at or around current levels for longer. ING suggest that this could even imply that such a move could even open the door up to further rate cuts, however, ING believe that should the ECB act to lower rates further when such a system is in place, this could be seen more as a manipulation of the exchange rate as opposed to providing the bank lending channel with support.

As ING further notes, there are at least four considerations the ECB will have to assess before introducing a tiering system:

- It could be perceived as a sign that the ECB is preparing for a “low for much longer” period and even open the door for further rate cuts

- It could actually complicate the pass-through of monetary policy to the real economy; depending on the technical details of such a system

- Rapid introduction of a tiering system could be perceived as yet another “free lunch” for the banking sector

- While a tiering system would open the door to further rate cuts, these cuts would mainly be seen as exchange rate manipulation rather than supporting the bank lending channel

Still, it is likely too early for the ECB to lay out a full-blown tiering framework:

ECB sources took a bit of excitement out of today’s ECB meeting (no apparent discussion on rate tiering)

– So far there looks to be a lack of unanimity over tiering pic.twitter.com/PZwkHc33QW— Justin McQueen (@JMcQueenFX) April 10, 2019

Ultimately, as is the consensus for details on TLTROs, this week’s meeting is seen as too premature for an announcement on this front and although it might be a hot topic for the Q&A segment of the release, President Draghi is set to offer little in the way of details to the market.

via ZeroHedge News http://bit.ly/2X1wKuF Tyler Durden