Authored by Michael Lebowitz via RealInvestmentAdvice.com,

“The problem with the war (Vietnam), as it often is, are the metrics. It is a situation where if you can’t count what’s important, you make what you can count important. So, in this particular case what you could count was dead enemy bodies.” – James Willbanks, Army Advisor, General of the Army George C. Marshall Chair of Military History for the Command and General Staff College

“If body count is the measure of success, then there’s a tendency to count every enemy body as a soldier. There’s a tendency to want to pile up dead bodies and perhaps to use less discriminate firepower than you otherwise might in order to achieve the result that you’re charged with trying to obtain.” – Lieutenant Colonel Robert Gard, Army and military assistant to Secretary of Defense Robert McNamara

Verbal Jenga

In recent press conferences, speeches, and testimony to Congress, Federal Reserve (Fed) Chairman Jerome Powell emphasized the Fed’s plan to be “patient” regarding further adjustments to interest rates. He also implied it is likely the Fed’s balance sheet reductions (QT) will be halted by the end of the year.

The support for this sudden shift in policy is obtuse considering his continuing glowing reports about the U.S. economy. For example, the labor market is “strong with the unemployment rate near historic lows and with strong wage gains. Inflation remains near our 2% goal. We continue to expect the American economy will grow at a solid pace in 2019…” The caveats, according to Powell, are that “growth has slowed in some major foreign economies” and “there is elevated uncertainty around several unresolved government policy issues including Brexit, ongoing trade negotiations and the effect from the partial government shutdown.”

Powell’s juggling of monetary policy and economic projections is a form of verbal Jenga with the blocks delicately stacked. Powell hopes to avoid saying anything to disrupt the structure without regard for veracity. To read more on our perception of his authenticity, read our latest article: Jerome Powell on 60 Minutes: Fact Check.

Jerome Powell’s policy rationale and politics is not entirely logical. Does it make sense to manage U.S. monetary policy to the self-inflicted BREXIT risks associated with the U.K., a country with a productive output about one-tenth that of the United States? Or with concerns about growth in China, which has never produced reliable public economic data? Or the residual effects of the U.S. government shutdown, which had an impact of less than 0.1% of GDP?

The Fed’s mandate, as legislated by Congress, is to manage the economy to full employment and stable inflation. Nothing about Powell’s recent comments justify policy change based on those guidelines. The change in policy is primarily speculative conjecture. It was also speculative conjecture that was behind Bernanke’s speech in January of 2008, where he confidently stated that a recession was not in the cards and his earlier comments that a national housing recession was implausible.

Mandates that Matter

What if the Fed had goals that really mattered like productivity and prosperity metrics that offer a genuine gauge of the health of the nation? What if they focused on the long-term cause and effect of their actions as opposed to becoming the day-traders they are, with a focus predominately on the markets and the wealthy?

The tiny world the Fed currently occupies is hyper-focused on “inflation” (which they cannot measure), unemployment (which is backward looking) and “financial stability” which is a catch-all for rationalizing whatever they choose to do at any given moment, namely propping up the stock market. These are undefinable goals which allow the Fed to move the goalposts as frequently as necessary to accommodate whichever constituent is least satisfied at the moment (President Trump, the stock market, the banks, etc.).

Markets and economies, like nature itself, are beholden to a cycle, and part of the cycle involves a cleansing that allows for healthy growth in the future. Does it really make sense to prop up dead “trees” in the economy rather than allow them to fall and be used as a resource making way for new growth?

The Fed’s War

The Fed’s version of economic assessment is like the metrics used to justify military action in Vietnam. Footage of Huey helicopters lifting nets full of dead “enemy soldiers” supported the optics of an American military campaign making progress in the war against Soviet-style communism. The “kill ratio”, calculated as the ratio of dead “gooks” divided by the number of dead American boys, was an important measure of success (The highly offensive term “gooks” was an all-encompassing, common slang term used by U.S. military forces to make soldiers think of all Vietnamese as sub-human and therefore easier to kill men, women, and children).

The problem was that the government and military manufactured numbers that made it look as though they were making progress in the war. They did not actually “manufacture” numbers so much as improperly include dead Vietnamese civilians in with the count of actual North Vietnamese soldiers and Viet Cong militia. These metrics were a guise for a true measure of success or failure. Need more enemy dead to boost the kill ratio? Use less discriminating firepower to get a broader sweep of destruction to boost the number.

The Fed, however, cannot even pretend to count what is important – productivity and inflation – so they make it up as they go along. They use pieces of economic data that tell whatever tale they need to retain the confidence of leadership, banks, and citizens. They give speeches, hold press conferences and even go on 60 Minutes to advance the spin. It is the current-day equivalent of “counting corpses” to get the numbers needed.

As with the Vietnam War, the game-theory of monetary policy being applied today is intended to obfuscate and demoralize those who argue against it. Unlike Vietnam, however, where body count became the important metric, the Fed concocts metrics and analysis such as r-star, fabricated inflation statistics, and questionable labor composites.

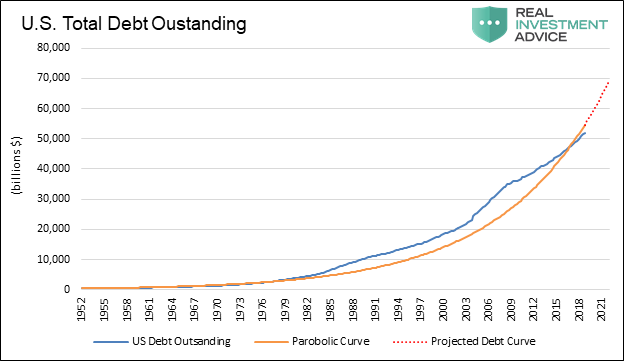

They have, as firepower, the support of the established government, which depends on the Fed to serve its complicit role in support of government spending and rampant national debt accumulation. As the graph below reflects, the trajectory of U.S debt outstanding is the pure mathematical definition of a parabolic curve. Having greatly reduced any possibility of true organic growth, debt has become the backbone of economic growth.

Data: Flow of Funds – Domestic Non-financial

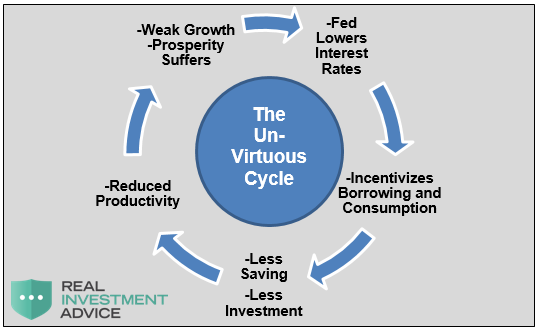

In coordination with the U.S. Treasury Department, the Fed acts in a manner that incentivizes the very behavior they should discourage. The Fed punishes savers by manufacturing lower interest rates to spur consumer and corporate borrowing and spending at a time when both are heavily burdened by existing debt. As a result, savings are diminished and investment suffers. When investment is reduced, productivity, the main source of economic dynamism and advancing standards of living, suffers.

Fed policy advances debt-driven consumption and spending before savings and investment, which puts the economic cart before the horse. Eventually, as we are now seeing, this destructive cycle causes prosperity to deteriorate. Citizens become fed up with the establishment rule and begin to elect radical politicians with radical ideas about how to fix the system.

Reactionaries

The Fed has shown themselves to be more worried about the stock market than the long-term well-being of the populace. Unlike Paul Volcker, who took on enormous career risk in his handling of monetary policy in the late 1970s and early 1980s, it appears there is no one with a similar level of character or integrity at the Fed today. There is no one willing to sacrifice in the short run for the long run health of the nation. Volcker was, at the time, vilified for making difficult and painful decisions in his time at the helm of the Fed, but ultimately, he set the stage for one of the greatest periods of growth and innovation in American history. Today, the Fed is held hostage by the fluctuations of the stock market and the protestations of the President.

“We would do better if we would show ourselves a little more relaxed and less terrified of what happens in… certainly the smaller countries of Asia and Africa, and not jump around like an elephant frightened by a mouse every time these things occur. This is not only not our business, but I don’t think we can do it successfully… I have a fear that our whole thinking about this problem is still affected by some sort of illusions about invincibility on our part.” – George Kennan

George Kennan was an academic who advanced the U.S. policy of pacification during the first 20 years of the cold war. His doctrines were frequently misused in the justification of U.S. foreign policy in Southeast Asia in the 1950s and 1960s. As troop buildup in Vietnam continued in the mid-1960s, Kennan was called to testify before Congress. Despite his warnings of an unwinnable war, politicians seeking re-election could not bring such a message to the American public. Better to sacrifice the lives of less-privileged 19-year-old boys than admit a flaw in the U.S. foreign and the military policy machine. Besides that, building bombs to be blown up in a foreign country boosted economic output even though there was nothing productive or beneficial about it.

Today, Kennan’s comments can easily be mapped to the proclivity of central bankers’ actions and the stock market “mouse.”

Complex System

The United States economy is an extremely complex and dynamic system. Trying to measure the level and pace of economic growth, employment, inflation, and productivity are very difficult, if not impossible tasks. The various government and private agencies bearing the responsibility for such measurement do their best in what must be acknowledged as a highly imperfect effort. Initial readings are always revised, sometimes heavily, especially at key turning points in the economy.

Of greater concern, we are led to assume the methodology used to assess the quality of economic growth is not only proper but precise. However, one glance at the components of GDP shows the inclusion of activities that are questionable and excludes other things that clearly should be included. As a result, economic policy-making focuses on those things which are measured according to their preferences without regard for accuracy or importance. Emphasis is placed on “body count” without proper discernment. For more on this read our article The Fallacy of Macroeconomics.

Summary

In the Vietnam War, General William Westmoreland maintained a strategic emphasis on attacking North Vietnamese troops which supported the Viet Cong guerillas in South Vietnam. Westmoreland referred to something he called “the crossover point.” This was defined as the point at which U.S. military forces were killing more of the North Vietnamese enemy troops than could be replaced. It was truly a strategy of attrition. As a result of this concept, as discussed above, what became important as a grisly gauge of success was “body count.” Since body count was all that mattered, everyone became an enemy soldier whether innocent civilian or North Vietnamese military officer.

You don’t get details with a body count. You get numbers. And the numbers are lies, most of them. If body count is your success mark, then you are pushing otherwise honorable men to become liars. – Joe Galloway, News Correspondent, and Journalist

In the same way that Westmoreland’s approach to executing the Vietnam War failed to produce results, served as a false justification for actions taken, and cost countless young American and Vietnamese lives, the U.S. government and the Fed are engaged in misreading the optics of a series of measures in the economy to justify their actions as evidenced by the following:

-

Fed policy is influenced by the constituents of the Central Bank which includes the federal government, major global banking institutions, and the wealthiest 1%

-

U.S. interest rates, the global benchmark for the price of money, are manipulated by Fed policy

-

Stock market valuations are heavily influenced by manipulated interest rates and currencies

-

Stock market prices are manipulated higher by share buybacks facilitated by low-interest rates

-

The federal government, through advocacy of the Securities Exchange Commission’s (SEC) share buyback Rule 10b-18, endorses stock price manipulation policies

“We tend to fight the next war in the same way we fought the last one. We are prisoners of our own experience. It was a kind of oversimplification of the problem combined with our overconfidence that caused us, I think, to be arrogant. And it’s very, very difficult to dispel ignorance if you retain arrogance.” – Lieutenant General Sam Wilson, Army

Federal Reserve actions and the Vietnam War are worlds apart, but the thinking in the mind of the bureaucrat is very similar. Misleading tactics are often used as a tool for those that need to justify something that makes little to no sense and violates moral code.

via ZeroHedge News http://bit.ly/2uWLWx5 Tyler Durden