Authored by Erik Lytikainen via RealInvestmentAdvice.com,

A week ago, I wrote an article discussing how the options markets can provide clues to future price direction and/or volatility in the crude oil market. In particular, we addressed the question, “how can a trader spot these option clues in advance?”

This morning, we got a signal which may indicate volatility is in the cards again for crude oil.

As crude oil has continued its upward advance from late December, call sellers have become increasingly off-sides with their hedging and position taking. In fact, our measure of sentiment in the options market is now off the charts in the 99th percentile. Simply, all investors appear to be on the bullish side of the boat.

We recently saw a similar situation play out in the natural gas market. When the level of market neutral gamma spiked out of its recent trading range (or it becomes incalculable), natural gas experienced a short squeeze and rallied substantially.

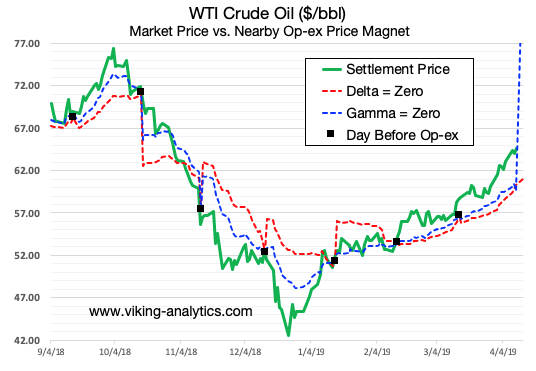

Current NYMEX crude oil options expire next Tuesday, April 16th. While today’s level of neutral gamma is in range, we have forecasted that the level of market neutral gamma will spike on Sunday night – unless market conditions change. This forecasted spike is shown in the graph below (blue line).

Source: Viking-analytics.com

What Does it Mean?

The safest conclusion to arrive at is to expect volatility ahead. The market may experience a form of a short squeeze as options traders scurry to cover their off-sides net short. Or, the market will correct lower towards our calculated Price Magnet in the low $60 range. Based on our research, we would not be surprised to see a $5 move in either direction by the end of next week.

via ZeroHedge News http://bit.ly/2VOiDIM Tyler Durden