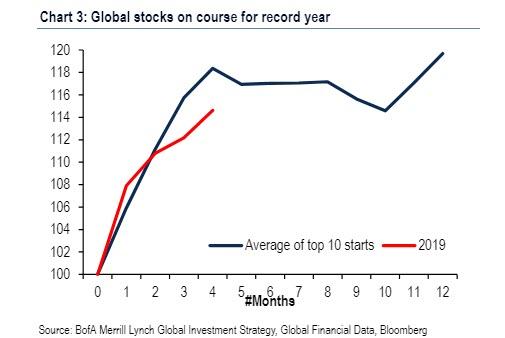

Last Friday, when commenting on what BofA has called a year that is “on track to be the best year in capital markets history“, we reminded readers of January 2018, when during the infamous stock market meltup and right before the Volmageddon implosion of inverse VIX ETFs when sellers of volatility saw years of accrued paper profits wiped out in seconds on February 5, 2018 and when the S&P tumbled by 10% in a couple of days, the financial press greeted readers with article such as this one.

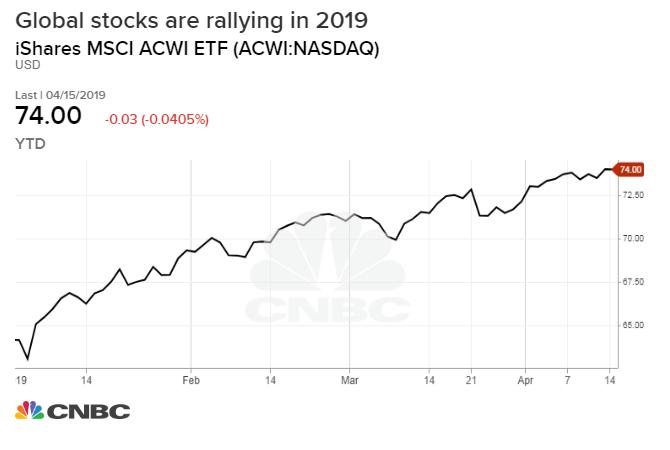

And with the performance of the S&P in 2019 similarly euphoric, and “melting up” each and every day, with the S&P now up over 25% from its Christmas Eve low when Steven Mnuchin infamously called the Plunge Protection Team to rescue the market…

… we were wondering just what soundbite would cement the fate of the current rally and end the euphoria this time.

The answer emerged earlier today when during an appearance on CNBC,

The rally in global equities may have further to go as more money jumps back into the market, Larry Fink, the CEO of the world’s largest asset manager who is eager to grow his AUM even more, shameless talked his passive investing book and urged mom and pop to give their savings to him for safe ETF keeping, when he said that – just like in January 2018 – “we have a risk of a melt-up, not a meltdown here. Despite where the markets are in equities, we have not seen money being put to work,” echoing something we have repeatedly pointed out.

“Many people thought we were going to be in a period of rising rates. We were not and we saw huge underinvestment and people had to rush into fixed income,” Larry Fink says. “We have not seen that in equities yet” and probably for good reason as we note below.

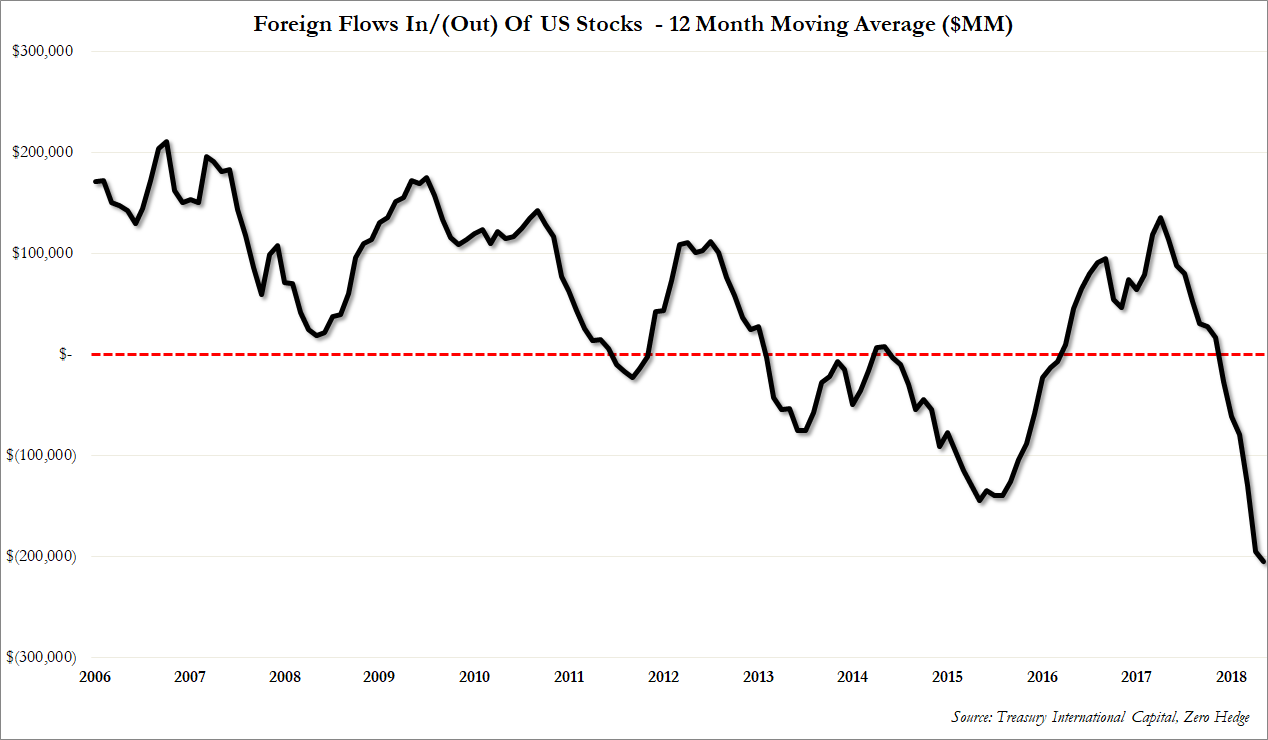

Underscoring the paradoxical nature of what is already a melt-up, one which has been driven entirely by corporate buybacks, short covering and dealer gamma imbalances, even as institutional and retail sellers have been aggressively dumping shares, especially since as we reported, we now know that foreigners have not only sold a record amount of US stocks in the past 12 months, but have been aggressively sellers for the duration of this rally…

… Fink pointed out that “we have record amounts of money in cash. We still see outflows in retail in equities and in institutions.”

Fink, is of course, correct. The bigger issue is that this mountain of money on the sidelines has been boycotting the stock market for the past 4 months even though asset managers are desperate to catch up to the S&P due to FOMO. And, ironically, the higher the market goes, the less likely it is that it will see participation from retail or institutional investors who will instead opt to wait for the inevitable December retest before they allocate money to the market, if then. Meanwhile, as the excess cash from Trump’s tax cuts and repatriation holiday dwindles, corporate buybacks will begin to shrink, until eventually they become a trivial factor and can no longer prop up stocks.

And confirming that investors no longer trust a market where not only the Fed, but the president and the Treasury secretary are all doing their best to artificially levitate it to new all time highs, Fink noted that while investors no longer trust stocks, they are rushing into the safety of yield instead: “We’re seeing huge excitement in fixed income” but investors aren’t rushing into equities.

To justify his case for a coming melt up, Fink also pointed out another obvious feature of this rally, namely that central banks are “more dovish than ever … there is a shortage of good assets” for investors, which could ignite the melt-up in the global equity market.

Here one has just two questions: how much of Fink’s CNBC appearance was the result of Blackrock’s latest disappointing results which saw revenue drop 7% from a year ago, and also where on this chart does Larry not think that a melt up has already taken place.

Because no matter how one defines a melt up, a 25% move in three and a half months most certainly fits the definition.

And now we await for the final signal to sell which will come when Bloomberg’s Millennial writers publish the 2019 version of their infamous “The Stock Market Never Goes Down Anymore.”

via ZeroHedge News http://bit.ly/2UCBWZg Tyler Durden