IBM is back to its revenue declining, non-GAAP-EPS-beating-through-low-tax-gimmick ways. Or rather, it never left.

With Wall Street expecting IBM to report (non-GAAP) EPS of $2.22 in Q1, the company “beat” by the tiniest of margins, reporting non-GAAP, adjusted EPS of $2.25, a dramatic 8% drop from last year.

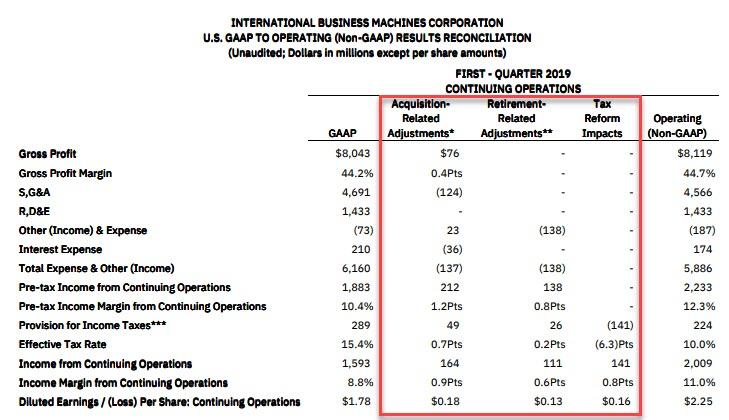

So far so good, but as usual, there was a gaping difference between GAAP and non-GAAP, and in this case it was material, with the company reporting a paltry $1.78 in GAAP EPS, roughly a quarter below the Non-GAAP number. Unfortunately for IBM, unlike prior quarter when at least non-GAAP pre-tax and net income managed to post modest increases thanks to tax rate gimmicks and stock buybacks even as their GAAP equivalents dropped, this quarter, non-GAAP net Income declined by 12% Y/Y while GAAP Net Income dropped by 5%.

How did IBM bridge the traditionally lower GAAP EPS number to the higher non-GAAP? “Simple” – here is the full breakdown.

Of course, this brings us to our favorite topic: namely that for yet another quarter, non-GAAP EPS only beat because the company reverted back to its tax gimmick ways, as IBM’s effective non-GAAP EPS once again managed to tumble to only 10%, the lowest since 2017, and far below what Wall Street expected. Had IBM used an even slightly realistic effective tax rate, it would have instantly missed Wall Street estimates.

Meanwhile, far more troubling than the company’s bottom-line gimmicks, IBM reported Q1 revenue of just $18.2 billion, down 4.7% Y/Y and missing the $18.5BN estimate. Just as bad, quarterly revenue was the lowest in 17 years: indeed one has to go back to Q1 2002 for a worse top-line quarter.

This also means that not long after IBM reported three consecutive quarters of top-line growth – which followed 22 consecutive quarters of declines – IBM’s Q1 revenue once again dropped after a similar decline in Q3, and Q4, sliding by 4.7% Y/Y and reminding investors that for all its non-GAAP and tax fudges, IBM remains a melting ice cube.

But while in the past the market was willing to overlook IBM’s misses, this time it was far more concerned as the revenue drop was driven by a decline in the all important cloud-computing, artificial intelligence and cognitive software unit that the company is hanging its future on.

IBM reported a 2% drop, to $5.0 billion, in sales from cloud and cognitive software; and while cloud revenue alone grew 10% over the last 12 months, that was a slower pace than the previous quarter. Revenue across all of IBM’s business units either fell or was little changed.

Stepping away from the income statement and looking at the cash flow, IBM announced that it generated Q1 cash from operations of $2.3 billion (excluding Global Financing receivables). And as has been the case for the past several years, the company returned all of its cash, or $2.3 billion, to shareholders through $1.4 billion in dividends and $0.9 billion in stock buybacks. At the end of March 2019, IBM had $2.4 billion remaining in the current share repurchase authorization; for new readers, IBM has repurchased billions and billions of its stock in the past decade, which is the only reason non-GAAP EPS hasn’t imploded.

IBM ended the first quarter with $18.1 billion of cash on hand, up from $12.2 billion in Q4, however most of this was thanks to new debt issuance, with IBM reporting $50.0 billion in debt, up from $45.8 billion last quarter. Of course, both of these numbers will change drastically once the Red Hat deal is completed.

In short: after several strong quarters, IBM’s Q3, Q4 and Q1 results – when in addition to everything IBM decided to purchase Red Hat and massively overpaying at that – saw the return of all that investors had grown to loathe about big blue. And worst of all, for all its gimmicks, the stock is tumbling after hours as investors finally realized just how great of a melting ice cube this company is in danger of becoming unless it impresses the market with some new, and marketable, technology.

via ZeroHedge News http://bit.ly/2V2haBI Tyler Durden