Back in January, when Netflix reported unexpectedly poor Q4 earnings, what surprised most investors was the company’s unexpectedly weak outflook, especially on the international side, where Netflix warned of a decline in International sub growth, a very concerning development for a company which has largely saturated the local market and is growing almost entirely offshore. Which is why everyone’s attention was focused on just how bad subscriber growth Netflix would report after the close today.

In retrospect, nobody was prepared for just how bad the final number would be, because moments ago while Netflix reported some rather impressive top and bottom line results, it was the collapse in subscriber growth that is the reason why the stock is tumbling after hours.

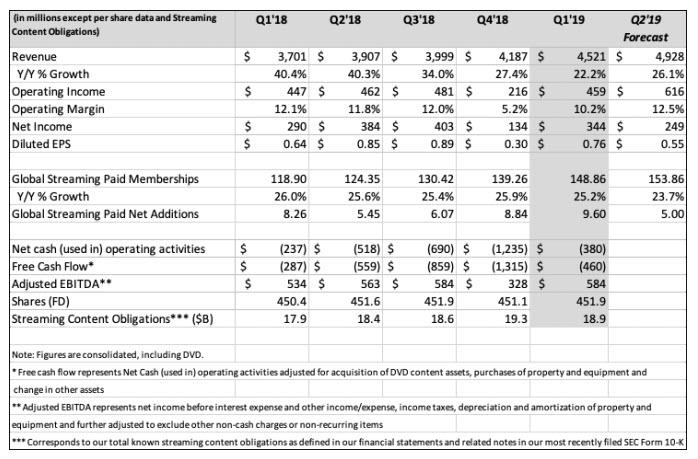

First the good news: EPS of 76 cents was above the 58 cents expected, with revenue of $4.521 right on top of the expected $4.51. Additionally, the company reported a rather impressive Q1 EBITDA of $584 million, well above the $328MM in Q4. Of course, if that was the extent of it, NFLX stock would be surging. Looking ahead, Netflix reported that Q2 forecast revenue would be $4.928BN, a 26.1% increase Y/Y, which however is below the consensus estimate of $4.95BN, a number which would generate EPS of $0.55.

Looking again at the financials, Netflix said that operating margin of 10.2% exceeded our beginning-of-quarter expectation, as spending was shifted from Q1 to later in the year. The company also revealed that streaming content obligations dipped sequentially in Q1 to $18.9 billion from $19.3 billion, “due in part to the timing of run-of-series commitments” however the company cautioned that as it shifts to more original content, “there will be greater variability in content obligations.”

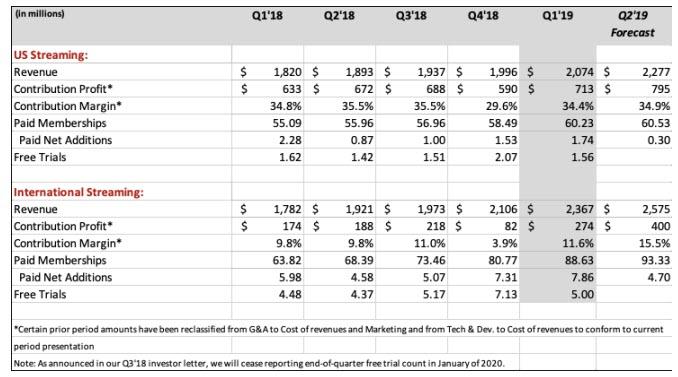

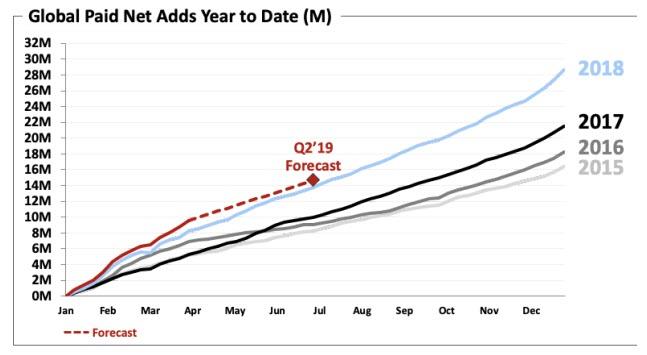

However, the reason why Netflix is tumbling after hours is because just like one quarter ago, the growth story is once again in jeopardy as a result of the company’s surprisingly weak subscriber forecast: to wit, whereas Wall Street expected Q2 subscribers to rise by 6.09 million, Netflix projected just 5.00 million (0.30MM US and 4.7MM international subs), a sharp slowdown from the 9.6 million paid net subscribers added in Q4, which incidentally was well above the 8.94 million estimate.

In total Netflix now expects total US paid subs of 60.53MM in Q2, and global paid subs of 93.33 million, up 5 million from a total paid subscriber base of 148.9 million in Q1.

Some more details: in Q1, paid net adds were 9.6 million (with 1.74m in the US and 7.86m internationally), up 16% year over year, and above the 8.94 million expected, a new quarterly record. However, as noted above, it was the Q2 forecast that disappointed investors, as the company now projects total paid net adds of 5.0m (-8% year over year), with 0.3m in the US and 4.7m for the international segment. This would result in 14.6MM paid net adds for the first half of 2019, up 7% year over year.

In other words, the recent torrid growth pace now appears to be moderating sharply.

Which brings up the question – why did Netflix just announce a price hike, to which we bring up the answer provided by Anthony DiClemente last quarter, who was worried that the market is “pricing in perfection” and wondered if the real story behind this week’s price increase is that the company sees revenue coming more from fee increases than subscriber growth.

Considering the relatively light subscriber growth forecast for Q2 it appears he may have been right, and the risk is that the price increase alienates even more existing subs, even though the company itself disagrees, saying that price increases in the U.S., Brazil, Mexico and parts of Europe will slow subscriber growth for a brief period, but won’t affect growth in the long run. Netflix is also seeing “some modest short-term churn effect” (people dropping their subscriptions) as the company’s price increases take effect.

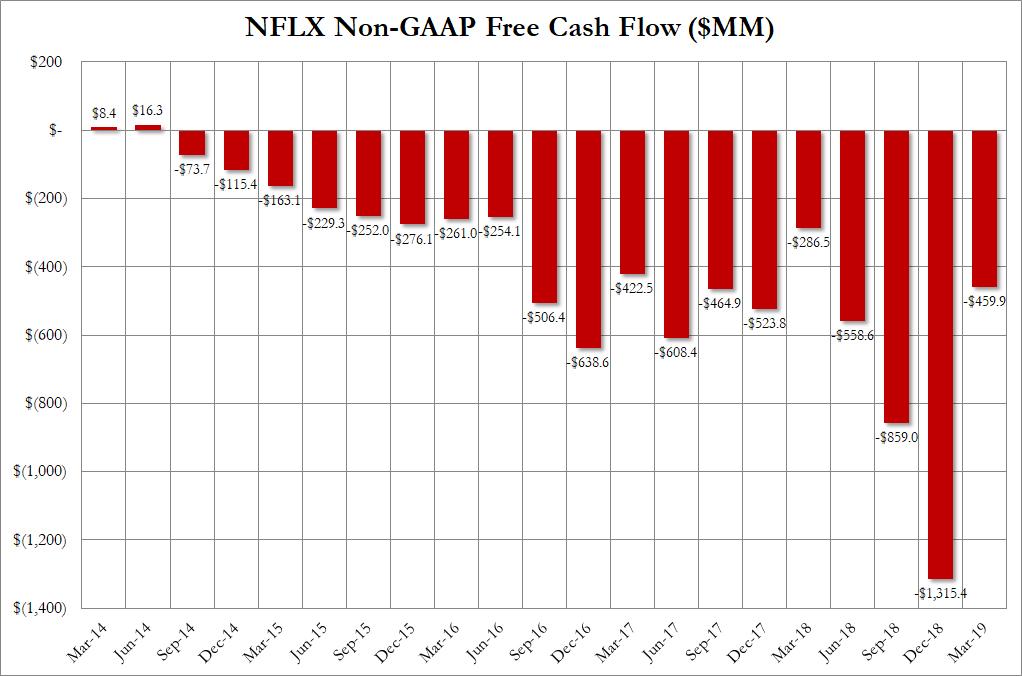

And then there was Netflix’s Free Cash Flow, or rather Free Cash Inferno, which last quarter nearly tripled from a year ago, rising to $1.315 billion. In other words, Netflix burned $15 million in cash per day. In Q1, things improved somewhat, with Free Cash Burn moderating somewhat, to just $460 million, which however was still 60% more than a year ago.

Which leads to the next question: how much will Netflix spend on programming next year, While the company did not address this, it did increase its Free Cash Flow burn by half a billion, from $3 billion as of Q4 to $3.5 billion currently, noting that “we now expect 2019 free cash flow deficit to be modestly higher at approximately -$3.5 billion due to higher cash taxes.“

Of course, with cash burn increasing by $500 million, the company had to give some good news, and said that it is “still expecting free cash flow to improve in 2020.”

Sure, why not. For now, however, Netflix will continue selling junk bonds saying it will “use the high yield market to finance our cash needs” and adding that it recently upsized its revolving credit facility from $500 million to $750 million (which remains undrawn) at the same cost and extended the term from 2022 to 2024. The company finished the quarter with cash of $3.4 billion.

Despite the sharp slowdown in subscriber growth, NFLX stock initially tumbled, then rebounded as it tries to find out just how much of a slowdown management expects, and more importantly, whether that forecast includes Disney’s brand new foray into streaming. We expect many questions on this issue during the earnings call to follow momentarily.

via ZeroHedge News http://bit.ly/2IDenbI Tyler Durden