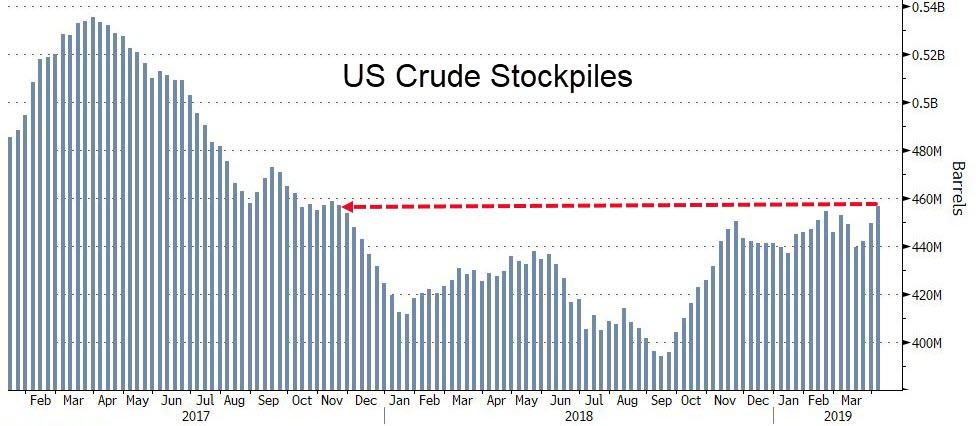

WTI rebounded from a brief and unusual losing day, as investors tended towards tightening global supplies and against soaring inventories, but, as Bloomberg notes, stockpiles, already at the highest since 2017, are set to rise for a fourth week, according to a Bloomberg survey ahead of government data due Wednesday.

Gasoline inventories, however, are forecast to fall for a ninth week.

“Everybody’s waiting to see what happens with inventories,” said Ashley Petersen, an oil analyst at Stratas Advisors LLC in New York. “We’ve run out of good news to reinforce the momentum of the market right now.”

API

-

Crude -3.096mm (+2.3mm exp)

-

Cushing -1.561mm

-

Gasoline -3.561mm – 9th draw in a row

-

Distillates +2.33mm

After last week’s huge drop in gasoline inventories, all eyes will be on products as expectations for 2.3mm build in crude would make it the 4th in a row, but API reported a surprise crude draw of 3.096mm barrels and gasoline continued to draw too (9th weekly draw in a row)…

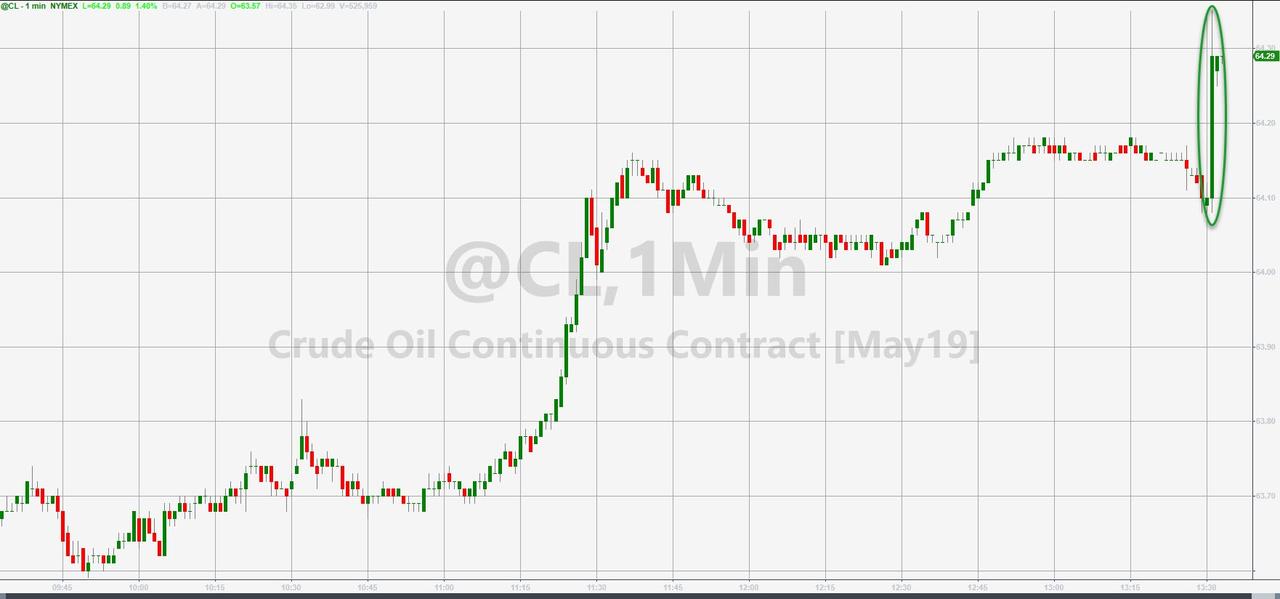

WTI hovered just above $64 ahead of the API print and kneejerked higher after the surprise crude draw

‘‘The market has taken a little bit of a breather,’’ said Kyle Cooper, a consultant at Ion Energy Group in Houston. ‘‘Inventory trends have overall been very bullish. So unless the overall economies collapse, and given the risk for lower production out of Venezuela and still lackluster supply outside of the U.S., I think it’s an uptrend.’’

via ZeroHedge News http://bit.ly/2ZfQm05 Tyler Durden