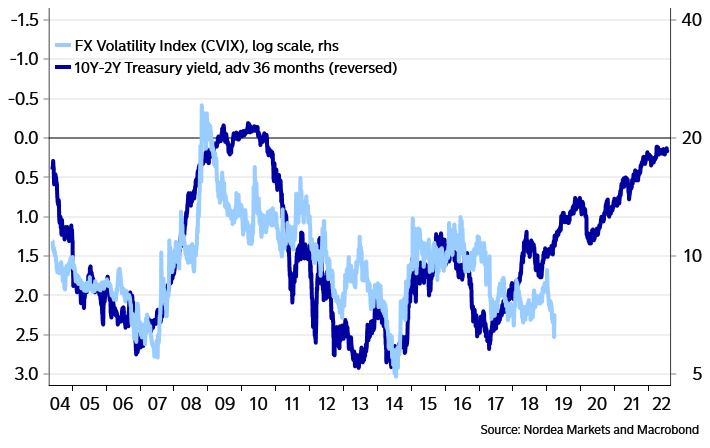

When Soros Fund Management’s CIO Dawn Fitzpatrick slashed the firm’s exposure to macro strategies, pulling money from external managers and limiting the firm’s own in-house allocation, traders bemoaned that this was just the latest indication of the death of macro investing, something former Stanley Druckenmiller, who worked with Soros when he raked in $1 billion after breaking the pound in ’92, readily affirmed.

As it turns out, Fitzpatrick’s cuts to macro exposure, which started a few years back, have proven prescient, as cross-asset volatility has fallen to multiyear lows, leaving little room for winning trades.

Yet, the grumbling about Fitzpatrick’s disruptive strategies has continued. And on Wednesday, the Wall Street Journal ran a lengthy story about how Fitzpatrick, the first woman to run SFM, is “shaking things up” and stepping on toes. Careful not to openly criticize one of the most powerful women on Wall Street, the paper detailed how Fitzgerald has fired managers, withdrawn money from external funds and shaken up the $25 billion fund’s ‘strategic approach’ to the markets. Apparently, her decision to cut macro trading was just the beginning.

Though her employees might grumble, and some, including Adam Fisher, the former head of macro who left the firm in February, are now threatening to sue, Fitzpatrick retains the support of the Open Society investment committee. Indeed, her supporters anonymously insinuated that critics of Fitzpatrick’s aggressive approach might not be so vocal if she were a man.

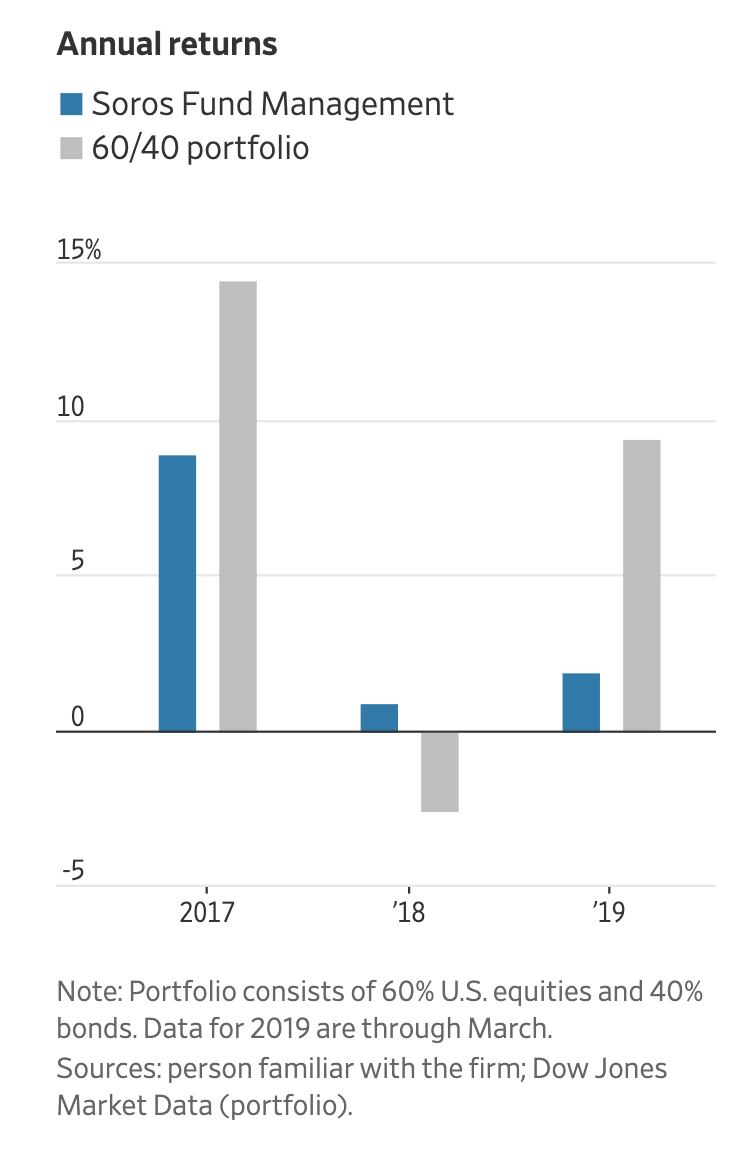

While SFM has lagged the market since the beginning of the year (after eking out a slight profit last year, leaving it well ahead of its benchmark), the investment committee said Fitzpatrick has its “unanimous support” and that it is committed to giving her the time needed to transform the firm’s strategies.

The Open Society investment committee, to which Ms. Fitzpatrick reports, said in a statement it has “unanimous confidence” in her leadership. High returns and an untouched principal were clearly preferable, but Ms. Fitzpatrick’s performance over a longer period would determine her success, committee chair Daniel Sachs said.

“I don’t think we’ve lost a lot of [portfolio managers] we wouldn’t want to lose, frankly,” said Neil Pegrum, a veteran Soros portfolio manager who runs the firm’s European offices. “I think the group we have is a strong one.”

Fitzpatrick’s “strategic overhaul” of SFM began shortly after she arrived in 2017 after leading UBS’s asset management unit. She has fired traders, and taken back money from more than two dozen external funds. Since she arrived, more than three-fifths of the firm’s internal managers have either left or been fired. She has also upended the firm’s compensation practices by making more pay discretionary.

Ms. Fitzpatrick changed many of the firm’s external relationships, too. After starting in April 2017, she concluded the firm had too many fund investments and was paying too much for what it was getting.

She ultimately took money from 27 out of 65 external hedge funds, including Corvex Management LP, Soroban Capital Partners LP and several macro hedge funds, bringing back in house more than $3.5 billion.

In one of her earliest clashes, she tightened oversight of the firm’s private equity group, then sent Soros’ co-heads of PE off in a lifeboat, allowing them to manage billions of dollars as an outside office.

One clash came early.

The Soros firm’s longtime co-heads of private equity, David Wassong and Ravi Yadav, were told soon after Ms. Fitzpatrick joined that she would approve how much they could invest. They left in October after more than a year of negotiations about their exit and now manage billions for the Soros firm at their own shop.

The new firm’s spokesman said their decision to “spin out” was mutual. “We look forward to maintaining our long, close and productive relationship,” he said. Ms. Fitzpatrick said she and Messrs. Wassong and Yadav are friends.

To cut down on fees, Fitzpatrick gave some external managers an ultimatum: Either lower your fees, or return the capital. Some opted for the latter. Keeping more cash on hand is central to Fitzpatrick’s investing strategy. According to her, the firm needs to have capital ready to deploy to take advantage of any market panic. To free up cash, she’s trying to liquidate some $1 billion in illiquid bets.

Hoping to diversify into investments that could provide uncorrelated returns, Fitzpatrick has invested in a lending startup, while making other unorthodox (for Soros) bets.

She is exploring selling a roughly $1 billion portfolio of illiquid bets to help free up cash to spend in a selloff. Ms. Fitzpatrick said she would start buying “when you see the panic,” adding, “Being able to provide capital in a dislocation will be a massive advantage.”

The firm also asked some hedge funds for better terms, including London-based Glen Point Capital LLP and AO Asset Management LP in New York. Glen Point in late February decided to return $400 million to the Soros firm. The hedge fund cited the departure of personnel who had originally invested the Soros firm’s money with Glen Point and the firm’s redemptions from other funds in explaining its decision to clients.

The Soros spokesman said the firm didn’t ask for better terms from Glen Point and AO. Of Glen Point’s returning the firm’s money, he said, “Glen Point’s decision was a simple economic one. We wish them the best success.”

Now, Fitzpatrick needs to generate some alpha to show that her approach is working, or risk joining her former colleagues on the scrap heap. But that shouldn’t be a problem, since studies have shown that women are better long-term investors than men, right?

via ZeroHedge News http://bit.ly/2XHRoAs Tyler Durden