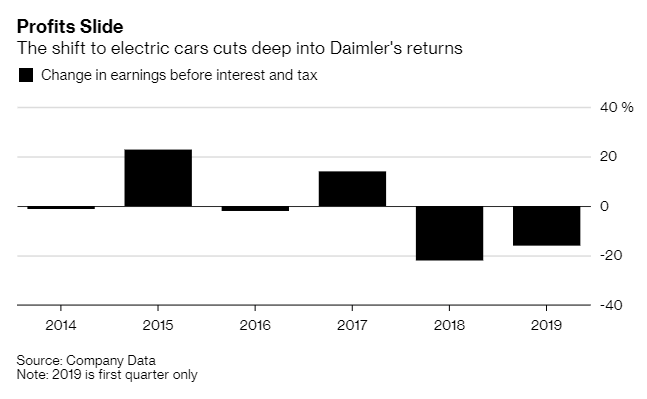

The global auto industry, which has been grinding to a painful slowdown for the better part of the last two years, just claimed its latest victim. On Friday, German auto giant Daimler AG said that its guidance is going to be harder to achieve after a rough start to 2019, forcing it to try to cut costs, according to Bloomberg.

Daimler saw its first quarter profit tumble 16% due to a decline in deliveries mixed with the rising cost of developing new models. Even though earnings met analyst estimates, CEO Dieter Zetsche said the quarter fell short of the company’s expectations and had tempered outlook for the future.

“Achieving the financial targets for 2019 has not become easier since the first quarter,” Zetsche said Friday.

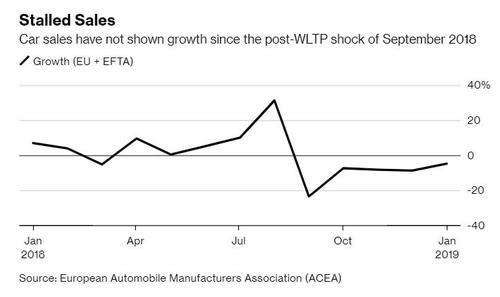

Like many car companies, Daimler is dealing with slower sales in the United States and Europe while maintaining significant costs associated with investing in electric vehicles. Other automakers saw similar rocky starts to the first quarter. Renault reported a 4.8% drop to Q1 revenue and Nissan Motor said earlier this week it would miss its annual profit goal.

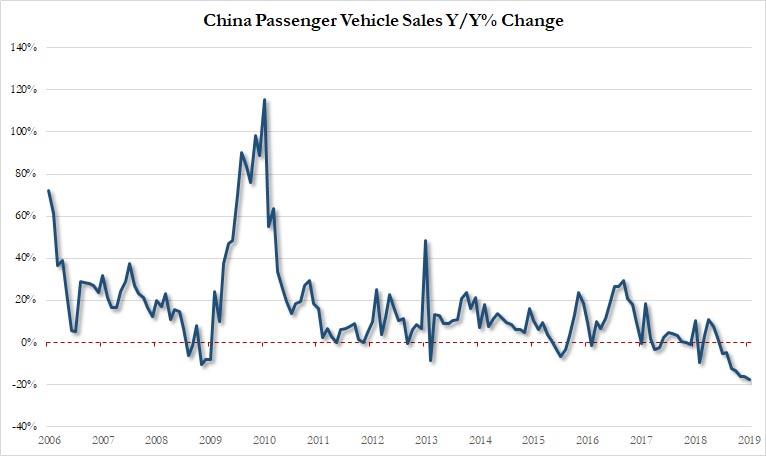

Back in February, Daimler had already said it was looking to cut costs in order to offset falling profits. A 5.6% drop in Mercedes-Benz deliveries through March had been another negative headwind that the company has faced. The company offered little additional detail on Friday on its plans to reverse a profitability decline in its main cars unit. Despite Mercedes-Benz holding up in China, the country is mired in a broader slump that makes the environment for a profound turnaround difficult.

Investors are looking forward to incoming CEO Ola Kallenius taking over in May, according to Bloomberg Intelligence analyst Michael Dean. “We anticipate his new strategic plan will be unveiled this summer,” Dean said.

Daimler says it still expects its earnings to “rise slightly” this year. Shares were down about 1% trading in Frankfurt on the news on Friday. After a an ugly 2018, the stock is up 25% since the beginning of the year. Jefferies analyst Philippe Houchois said the outlook for the company “seems slightly optimistic given the weak start of the year.”

CFO Bodo Uebber said that business is expected to improve during the second half of the year. He added that currency headwinds have also worked against the company. These currency headwinds are forecast to cut between €500 million and €1 billion from earnings this year.

Restructuring moves and efficiency measures “will hopefully push the cars unit margin back to between 8% and 10% and trucks to between 7% and 9% by 2021,” according to the CFO. He declined to elaborate more on what cutbacks the company is making.

The company is reportedly also considering a reduction of about 10,000 jobs through voluntary measures as part of a €6 billion savings target. Outgoing CEO Zetsche said that a weak first quarter margin in the cars unit was due to the cost of upgrading the GLE sport utility vehicle and a joint venture in Mexico with Nissan. High inventory levels resulted in negative cash flow of €2 billion compared to a positive €1.8 billion in the first quarter of last year for the company.

Evercore ISI analyst Arndt Ellinghorst said:

“Daimler is blaming supplier bottlenecks and quality issues pretty much across all divisions for its poor financial performance. To be clear: it is management’s job to manage its supply chain and relationships with partners. Other companies do not complain about similar issues.”

Well, except Tesla of course…

Going forward, Daimler slashed its margin guidance for its vans unit, which swung to a loss in the first quarter, to between 0% and 2%. Previously, the company had targeted a return on sales between 5% and 7%, but expenses associated with cutting capacity in Argentina and Russia, as well as building a new U.S. factory, have weighed on these targets.

via ZeroHedge News http://bit.ly/2IYrtAj Tyler Durden