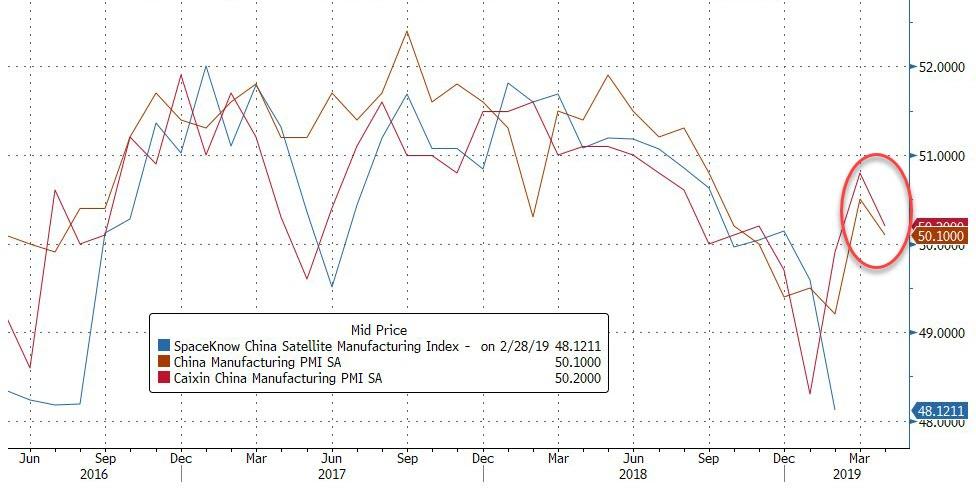

Nasdaq futures – already hammered by Google’s results – legged lower along with Yuan after China’s PMI prints for April disappointed the green-shoot-believers, slumping back towards contraction.

After all the excitement sparked by the March PMI bounce, China’s April data is big disappointment with China’s official manufacturing and non-manufacturing prints both sliding back (from 50.5 to 50.1 and from 54.8 to 54.3 respectively) with the Caixin China manufacturing PMI tumbling back to 50.2 from 50.8 (and 50.9 expected).

Commenting on the China General Manufacturing PMI™ data, Dr. Zhengsheng Zhong, Director of Macroeconomic Analysis at CEBM Group said:

“The Caixin China General Manufacturing Purchasing Managers’ Index eased to 50.2 in April, down from a recent high of 50.8 in the previous month, indicating a slowing expansion in the manufacturing sector.

1) The subindex for new orders fell slightly despite remaining in expansionary territory. The gauge for new export orders returned to contractionary territory, suggesting cooling overseas demand.

2) The output subindex dropped. The employment subindex returned to negative territory after hitting a 74-month high in March. According to data from the National Bureau of Statistics, the surveyed urban unemployment rate remained at a relatively high level despite edging down in March, suggesting that pressure on the job market remained.

3) While the subindex for stocks of purchased items returned to contractionary territory, the measure for stocks of finished goods fell more markedly. The gauge for future output edged up, pointing to manufacturers’ desire to produce and stable product demand. The subindex for suppliers’ delivery times rose further despite staying in negative territory, implying improvement in manufacturers’ capital turnover.

4) Both gauges for output charges and input costs edged down. There were only small changes in upward pressure on industrial product prices. We predict that April’s producer price index is likely to remain basically unchanged from the previous month.

“In general, China’s economy showed good resilience in April, yet it stabilized on a weak foundation and is not coming to an upward turning point. The Politburo meeting signalled that in the first quarter of this year China had adjusted its countercyclical policy marginally. As pressure on the economy remains in the second quarter, we expect that there will be minor adjustments to the policy but not a turnaround.”

The reaction was a dip in yuan and leg lower in US futures…

via ZeroHedge News http://bit.ly/2LlVL2W Tyler Durden