The tremors unleashed by Google’s earnings debacle and China’s disappointing PMIs just over 24 hours ago are now long forgotten as trader focus shifts to Apple’s strong guidance (if not 17% drop in iPhone sales and 22% plunge in China revenues), helping push the global rally into a fifth month and US equity futures to a fresh record high, even as potential disappointment looms should the FOMC come out more hawkish than expected. At least there will be fewer traders to be disappointed: most of Asia and Europe was shut for the May day holiday. Meanwhile, out of equities, bonds continue to disagree with the algos’ optimism as treasury yields slumped below 2.50% again, while the dollar dipped ahead of the Federal Reserve’s policy decision.

The MSCI world equity index was up 0.1% in early trading after rising to its highest since early October, although May Day holidays across Asia and Europe meant trading was thinner than usual with China, Hong Kong, India, Japan, Singapore, South Korea and Taiwan all shut, and only the UK and Denmark open in Europe.

In a sign of the growing appetite for riskier assets, Australian shares ended just shy of an 11-year peak and London’s blue chip FTSE 100 was up 0.2 percent after solid earnings from supermarket chain Sainsbury’s.

Apple’s strong guidance which came against a disappointing background of the second consecutive revenue decline…

… helped rally US index futures and Apple’s global suppliers and pointed to a rebound for American technology shares, which had slumped in the wake of Google’s revenue miss. Stocks in the U.K. turned lower after data showed manufacturing growth slowed in April, though the pound held gains. Australian equities climbed, while the New Zealand dollar fell after unexpectedly weak labor data. In the UK, Pearson fell after US textbook peers McGraw-Hill Education and Cengage Learning were said to plan a merger. The pound rose to fresh gained to fresh 2 week highs against the dollar.

For those traders who did make it to work today, there is plenty to keep them busy: Beijing and Washington began their latest talks aimed at ending a bitter trade war and Fed chairman Jerome Powell was due to speak later following the central bank’s two-day policy meeting.

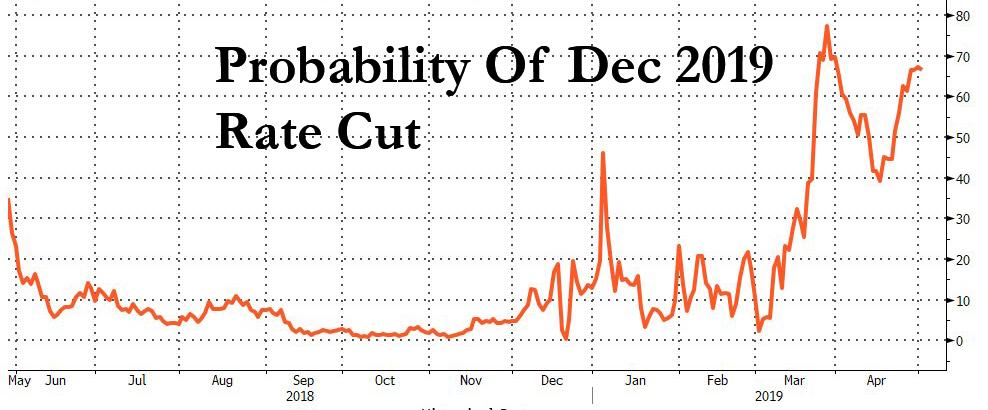

Indeed, all eyes turn to the Marriner Eccles building at 2pm today, and Powell’s subsequent press conference following the U.S. rate decision. “The risk for this Fed meeting is that, unless the FOMC meets the market’s dovish expectation for their stance, we would expect another leg higher in USD,” Mizuho strategists said in a note. As we previewed last night, the Fed expected to leave US rates unchanged amid a “goldilocks” economy, although there is a modest chance of an IOER cut. That said, the market remains convinced a rate cut is coming by December 2019.

A call from U.S. President Donald Trump for a cut in interest rates will likely be unheeded when the results of the Fed’s two-day meeting are released, but the unorthodox comments made on Twitter will increase focus on Powell at his press conference shortly after.

“We expect the Fed to reiterate their still patient stance, as they announced at the start of the year,” Stifel chief economist Lindsey Piegza told Bloomberg TV. “We also expect the Fed to re-characterize their expectation for growth at a somewhat tempered level, but still very positive.”

Corporate earnings and developments in the trade conflict between America and China are also on the radar, with U.S. Treasury Secretary Steven Mnuchin calling the latest round of meetings “productive.” Bullish investors are looking for fresh reasons to push the S&P 500 Index higher after it closed Tuesday at another record.

Additionally, with the whole “sell in May” mantra at their backs, trader caution is building ahead of the summer lull with investors questioning how much longer the rally across global equities can last with better economic data and a stabilization in earnings priced in. “Historically the more difficult half of the year starts today,” said Ian Williams, economics and strategy research analyst at Peel Hunt. “The next six months will present plenty of geo-political challenges.”

In FX, the U.S. dollar was down slightly, trading in a tight range after hitting a one-week low ahead of the Fed news. The Swiss franc and pound led gains among G-10 currencies as the dollar reversed an earlier advance ahead of the FOMC decision. Moves were muted as many markets in Europe and Asia were closed for holidays and traders were in a holding pattern before the Fed. The New Zealand dollar fell after weaker-than-forecast labor-market data caused investors to increase bets on an interest-rate cut as soon as next week.

Elsewhere, commodities were mixed with base metals prices rising on hopes of a breakthrough in the U.S.-China talks, while crude oil prices eased as data showed a rise in U.S. inventories. Brent crude oil futures were at $71.55 per barrel, down 0.8 percent, while U.S. West Texas Intermediate (WTI) crude futures were down 1.1 percent at $63.23 per barrel.

The Federal Reserve’s policy decision is due, along with manufacturing data from ISM and Markit. Scheduled earnings include Qualcomm, CVS Health and Estee Lauder.

Market Snapshot

- S&P 500 futures up 0.4% to 2,959.25

- STOXX Europe 600 up 0.09% to 391.70

- MXAP up 0.2% to 162.60

- MXAPJ up 0.3% to 539.76

- Nikkei down 0.2% to 22,258.73

- Topix down 0.2% to 1,617.93

- Hang Seng Index down 0.7% to 29,699.11

- Shanghai Composite up 0.5% to 3,078.34

- Sensex down 0.09% to 39,031.55

- Australia S&P/ASX 200 up 0.8% to 6,375.89

- Kospi down 0.6% to 2,203.59

- German 10Y yield rose 1.0 bps to 0.013%

- Euro up 0.1% to $1.1227

- Brent Futures down 0.8% to $71.48/bbl

- Italian 10Y yield fell 2.9 bps to 2.184%

- Spanish 10Y yield fell 1.2 bps to 1.001%

- Brent Futures down 1.8% to $71.48/bbl

- Gold spot down 0.2% to $1,281.13

- U.S. Dollar Index down 0.04% to 97.44

Top Overnight Highlights

- The latest round of U.S.-China talks wrapped up in Beijing, with U.S. Treasury Secretary Steven Mnuchin calling the meetings “productive” in a tweet. Negotiations will continue in Washington next week, Mnuchin said after Wednesday’s round concluded slightly later than scheduled

- Fed policy makers may decide Wednesday that falling inflation reinforces a message of caution on interest-rate moves, rather than bowing to President Donald Trump’s demands for drastic action to boost the U.S. economy

- U.S. Attorney General William Barr will face new scrutiny from lawmakers on Wednesday after a revelation surfaced that he misrepresented Special Counsel Robert Mueller’s findings about whether Trump obstructed justice

- The U.K.’s main opposition Labour Party predicted Prime Minister Theresa May will have to accept a customs union with the European Union as the price for getting her Brexit deal ratified in Parliament

- New Zealand hiring unexpectedly fell in the first quarter and wages rose at a slower pace, adding to signs that the jobs market isn’t generating significant inflation pressure

A quiet tone was observed in Asia-Pacific amid closures in nearly all the major regional bourses for Labour Day, although US equity futures were underpinned after-hours following Apple earnings in which the tech giant beat on top and bottom lines, authorized an additional USD 75bln share repurchase and raised its dividends by 5%. ASX 200 (+0.8%) was positive with the index led higher by tech on contagion from Nasdaq futures and with financials buoyed as ANZ shares rallied nearly 3% after its H1 results, while reports that the US dropped a key demand regarding cyber theft in an effort to accelerate a trade deal with China also added to the optimism although most of the region failed to capitalize with China, Hong Kong, India, Japan, Singapore, South Korea and Taiwan all shut.

Top Asian News

- Mnuchin, Lighthizer Conclude ‘Productive Meetings’ With China

- Japan’s New Emperor Naruhito Ascends World’s Oldest Monarchy

- China Further Opens Financial Industry on Eve of Trade Talks

- Qantas CEO Alan Joyce Commits to Three More Years at the Helm

Mass closures in Europe have extended the quiet tone seen across Asia, with only UK and Danish markets open today in the EU. The FTSE 100 (-0.1%) is relatively flat with sectors also showing no clear standouts. In terms of movers, Sainsbury’s (+4.7%) rose to the top of the index amidst optimistic revenue and profit numbers, alongside a net debt reduction which is ahead of target. To the downside, Persimmon (-1.8%) shares suffer after fire issues were found in houses developed by the company, the company is addressing the issue. State-side, Apple reported earnings aftermarket wherein the tech giant topped estimates on both top and bottom line, whilst Q3 guidance was also above analyst consensus, despite a sharp drop in Q2 iPhone sales. Apple shares spiked higher in excess of 5% post-earnings.

Top European News

- Lloyds Gets Capital Relief From Bank of England Risk Change

- Sainsbury Gets Boost as CEO Clings On After Asda Failure

- U.K. Mortgage Approvals Decline, Consumers Rein In Borrowing

- U.K. Manufacturing Growth Slows as Firms Reduce Stockpiling Pace

In FX, Cable extended gains through more chart resistance levels on the way to circa 1.3073, like the 30 DMA (1.3052), a Fib (1.3053) and daily tech formation (1.3065), eyeing 1.3090 next (55 DMA) before the 1.3100 handle. A broadly in line and less stockpile-inflated UK manufacturing PMI amidst mixed BoE mortgage and consumer data was largely shrugged off, but Sterling also eked more upside vs the Euro as the cross eased a bit further below 0.8600 to test bids just ahead of a 50% retracement (0.8583) following more reports about constructive cross party Brexit talks as discussions are put on hold due to Thursday’s local elections. More immediately, focus on the Fed before the BoE tomorrow – see the Ransquawk headline feed for detailed previews of the 2 events. Conversely, weaker than forecast NZ jobs data has raised the stakes in terms of RBNZ rate cut expectations for next week and Nzd/Usd retreated in response through 0.6650, as the Aud/Nzd cross rebounded firmly from around 1.0560 to just over 1.0600. However, the Kiwi has pared some losses since with the probability of an ease still close enough to 50% for reasonable doubt.

- CHF – Another major outperformer or rather beneficiary of a deeper pull-back in the Dollar ahead of the FOMC, as the Franc edges towards 1.0150 and DXY slips to 97.359, very close to a 97.355 Fib and nearer the 30 DMA (97.216).

- AUD/EUR – Also firmer vs the Greenback as Aud/Usd consolidates recovery gains around 0.7050 and the single currency builds a foothold above 1.1200. Eur/Usd has eclipsed Fib resistance at 1.1217 and is now approaching convergence at 1.1242 (another Fib and 30 DMA) before 1.1250 and 1.1275 (latter roughly coincides with the 50 DMA).

- JPY/CAD – Both narrowly mixed vs the Usd, as the Yen attempts to breach the 30 DMA (111.40) and retest Tuesday’s peaks, while the Loonie continues its recovery from yesterday’s post-Canadian GDP lows within a 1.3400-1.3375 range in advance of the manufacturing PMI and more from BoC’s Poloz and Wilkins.

In commodities, the energy market had a stellar performance in April as the benchmarks climbed over 6% amidst intensifying tensions in Venezuela, tightening US sanctions on Iran and ongoing OPEC supply cuts. Ahead of the end of Iranian oil waivers later, oil Journalist Reza Zandi notes that Iranian officials are reportedly discussing three potential Iranian scenarios in OPEC: 1) Iran suspends its membership in OPEC until sanctions are removed, 2) Iran departs from OPEC and 3) Iran continues its membership. In today’s trade, oil prices have reversed a bulk of the April gains following a much wider-than-forecast build in API crude stockpiles (6.8mln vs. Exp. 1.5mln), marking the 4th stock build in April. PVM analysts also highlight the uptrend in US stockpiles which is described as a “deepening pocket of weakness” amid a host of a bullish catalysts. WTI and Brent futures have thus retreated back below/around USD 64/bbl and USD 72/bbl respectively ahead of today’s EIA data wherein the market is geared for a headline build of 1.485mln barrels. Elsewhere, gold remains within a relatively tight range around 1280/oz ahead of the FOMC rate decision (preview available in the Research Suite) whilst copper mirrors the humdrum tone with most the region away on holiday. Finally, aluminium prices remain pressured following on from the weaker-than-forecast Chinese manufacturing data coupled with producers revising down their demand growth estimates for the year.

US Event Calendar

- 7am: MBA Mortgage Applications, prior -7.3%

- 8:15am: ADP Employment Change, est. 180,000, prior 129,000

- 9:45am: Markit US Manufacturing PMI, est. 52.4, prior 52.4

- 10am: ISM Manufacturing, est. 55, prior 55.3;

- 10am: Construction Spending MoM, est. 0.0%, prior 1.0%

- 2pm: FOMC Rate Decision (Upper Bound), est. 2.5%, prior 2.5%

- Wards Total Vehicle Sales, est. 17m, prior 17.5m

DB’s Jim Reid concludes the overnight wrap

Welcome to May, a month which traditionally has been associated with the adage of ‘sell in May and go away’. However, with the S&P 500 having not seen a negative May performance since 2012 and the US expansion now only one more month away from matching the longest expansion ever at 120 months, it feels like it would take a brave person to do that now. The first day of a new month also means we have our latest performance review which you’ll find as a separate document to this and in your inboxes a short while ago. Needless to say April was another strong month for risk assets, and it means we’ve now seen the strongest start to a year through the first four months in the post-GFC era.

The end of the month saw the S&P 500 stick to the playbook after advancing a modest +0.10% yesterday despite some earnings headwinds and intensified concerns over trade. However, the NASDAQ did fall -0.81% as Alphabet tumbled -7.50% and the most since 2012 following that softer than expected earnings report late on Monday. That move erased more than $69 billion of Google’s market cap, which is equal to more than 3x the median S&P 500 company. On the other hand, Pfizer had reported earnings and revenue that beat expectations, propelling the stock up +2.58% and helping the DOW gain +0.15%. After markets had closed, Apple reported strong sales and profits as well, with iPhone sales notably healthy after recent concern over the product’s outlook. The company’s shares were nearly +5% higher overnight, helping NASDAQ futures advance +0.73% this morning. That’s all to report this morning with most of Asia not trading due to public holidays. Meanwhile, the STOXX 600 ended yesterday close to flat (+0.01%) with banks partially retracing their rally from Monday (-0.35%). Peripheral equities and bonds outperformed, led by Spain’s IBEX and Italy’s FTSE MIB, which gained +0.56% and +0.43%, respectively.

Not helping sentiment also was a WSJ article suggesting that the US favoured leaving punitive tariffs in place as a way of enforcing any trade deal. During the US session, Acting White House Chief of Staff Mulvaney said that talks “won’t go on forever” and if they can’t reach a deal soon then “you throw up your hands and say ‘this is never going anywhere.’” So things certainly seem to be approaching an inflection point, but to be fair we’ve heard similar rhetoric before. USTR Lighthizer and Secretary Mnuchin are in Beijing today negotiating, with the Chinese team set to return to the US next week to continue talks. In other US political news, congressional Democrats met with President Trump yesterday to discuss an infrastructure deal and agreed to meet again in three weeks to discuss funding options. That will be the key area of disagreement, since Senate Minority Leader Schumer has already called for a partial rollback of Trump’s signature tax reforms, while Majority Leader McConnell has already rejected that idea. The sides at least agreed that $2 trillion should be the target for the overall plan, which would certainly be a positive for the economy if realized.

While that should hover in the background, the good news is that we’ve got the welcome distraction of a Fed meeting to look forward to this evening. No policy change is expected and our US economists anticipate that the meeting statement and press conference will reflect the dichotomy of improving growth prospects and easy financial conditions on the one hand, and softening inflation pressures on the other. As such our colleagues believe patience in assessing any adjustments to the policy stance will remain the order of the day for the foreseeable future. However the wildcards are further announcements about balance sheet normalization and the potential for a cut to the IOER. The latter became a bit more likely after yesterday’s fed funds fixing rose to 2.45%, which takes it within 5bps below the top of the target range. That’s the level which has prompted the Fed to lower the IOER in the past. For what it’s worth, President Trump was vocal about the Fed again yesterday, criticizing them for “incessantly” lifting rates amid “wonderfully low inflation” and suggested that the US economy would soar “like a rocket” if they cut rates by a full point and did more QE. Anyway, you can see our economists’ full Fed preview here.

Coming back to yesterday, where the other story was the contrasting slew of data releases on both sides on the pond. It started in Europe with a better than expected Q1 GDP reading for the Euro Area at +0.4% qoq (vs. +0.3% expected). The unrounded reading was +0.38% qoq with the data getting a boost from country level readings for France, Spain and Belgium before. At the same time the March unemployment rate also ticked down to 7.7% which is in fact the lowest in the current cycle now, having peaked at 12.1% in 2013. For what it’s worth, the 2007 low was 7.3%. So the labour market is seemingly still extremely robust, which as our European economists noted reduces the chances of manufacturing sector weakness being transmitted to services through an income-induced hit to domestic demand. We should note that Italy also reported a +0.2% qoq GDP reading yesterday which officially means it has emerged from recession.

Also generating some airtime yesterday morning were the country level April inflation readings. There wasn’t any great surprises for the data in France, Spain, or Italy, however the big positive surprise came in Germany where the +1.0% mom print smashed expectations for just +0.5%. That left the annual rate at +2.1% yoy compared to +1.4% in March. There was talk of an unusually large increase in prices for packages around the Easter holidays as explaining the upside surprise, which may result in some payback next month. Nevertheless, Bunds got as high as 0.046% intraday before fading slightly to close +0.9bps higher on the session at 0.011%.

In any case, stronger growth and higher inflation is certainly food for thought for the ECB even if the data in Europe remains a bit noisy at the moment. Meanwhile, there was no shortage of data in the US yesterday either. It started with a +0.7% qoq reading for the employment cost index which matched expectations, while the breakdown didn’t reveal any great surprises, however the private wages and salaries component was a little firmer at +0.8%. Overall, another fairly benign inflation reading however. Even softer though was the April Chicago PMI which tumbled -6.1pts to 52.6 compared to expectations for 58.5. That is the weakest reading since January 2017 which perhaps paints some downside risk for the 55.0 consensus for today’s ISM print, though it’s interesting to note that the Chicago reading has moved in the opposite direction as the ISM in every month so far this year.

The other data out in the US yesterday included consumer confidence, which rose +5pts to 129.2, remaining near its cyclical high. Pending home sales rose +3.8% mom versus expectations for +1.5%, which is the second highest rate since 2010, only eclipsed by January’s print. Some further evidence of firming activity in the housing market, though on the other hand an index of US house prices rose only +3.0% yoy, which was its slowest pace since 2012. Since shelter prices make up 40% of core CPI, this will definitely be an area to watch moving forward.

The end result of all that was for 10y Treasuries to trade in a 4.9bps range but ultimately settle -2.4bps lower at 2.503%. Elsewhere, BTPs rallied -3.0bps. Though there wasn’t a clear driver, euro area inflation expectations also repriced notably higher. The 5y-5y forward inflation swap rate rose +7.2bps, its biggest move since 2015, though it remains somewhat depressed at 1.42%. The USD (-0.39%) faded with EM FX ending +0.18% higher. Speaking of EM, there was some focus on Venezuela yesterday after opposition leader Juan Guadio called for the military to join with him to overthrow the Maduro regime. He was reportedly seen with national guardsmen, but Madura said on Twitter that the military remains loyal to him. Brent crude oil spiked as high as +1.71% before ending the session +1.05% higher, however it has since given up most of that move this morning.

Looking at the day ahead, the obvious focus is on the aforementioned Fed meeting tonight however it’s also another busy day of data releases with March money and credit aggregates data due in the UK this morning along with the April manufacturing PMI, before we get the April ADP employment change reading in the US along with the April ISM and manufacturing PMI, March construction spending and April vehicle sales. Away from that we’re due to hear from the ECB’s Guindos while US Attorney General Barr is due to testify before the Senate on the 2016 election and specifically Russian interference. The earnings highlights today include Qualcomm, GlaxoSmithKline and Kraft Heinz.

via ZeroHedge News http://bit.ly/2GYT7fj Tyler Durden