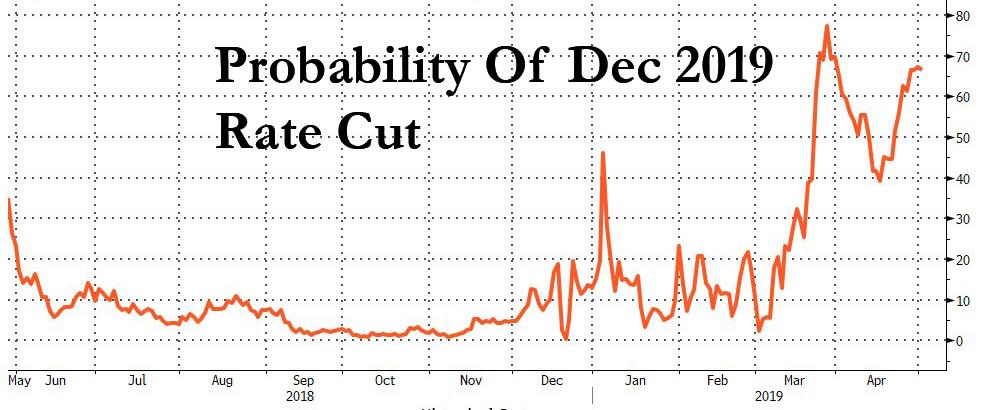

With the Fed set to announce its rate decision in under 6 hours, markets are confident that the non-data dependent Fed will cut rates by the end of 2019, despite continued strength in GDP and payrolls, in line with president Trump’s demands for a 1.00% rate cut and/or QE, and will provide further tailwind for risk assets.

But what if the market – whose discounting capacity has been destroyed by a decade of central planning – is wrong? That’s the thesis of Bloomberg macro commentator Garfield Reynolds, who writes overnight that this year’s “goldilocks” rally in stocks and bonds will likely be derailed by a far more hawkish than expected Fed.

Here are his arguments:

Rates markets have taken Fed Governor Jerome Powell’s dovish inch and mistakenly run a mile. The FOMC isn’t likely to deliver any rate cuts in the next year.

The U.S. economy isn’t in distress. Unemployment has barely ticked up from the half- century low touched in September, and 1Q GDP beat forecasts handily. Yes, inflation is nowhere to be seen, and there were plenty of devils lurking in the details of those national accounts, but a 2019 growth forecast of 2.4% is far short of a “break the emergency glass” situation.

Stocks at record highs are helping to boost financial conditions to their easiest since September and levels more often associated with robust economic expansion.

It’s fair to argue that there’s no present justification for further Fed hikes, but rate cuts have usually only come when the outlook was much darker. And yet, eurodollar futures and Fed fund futures suggest traders are convinced cuts are coming.

A shift in perceived policy bias toward easing has made bets on cuts a good reward-to-risk proposition that feeds on itself. Look at Australia where money poured in to RBA futures as markets anticipated its switch to a neutral bias — regardless of the fact it was crystal clear no move was coming for months.

What adds to the danger for stocks and bonds — which have each benefited from expectations for easing — are money- market quirks that exacerbate the message from those rate cut bets. Due to the impact of balance sheet reduction, the effective Fed funds (EFF) rate has climbed 5 basis points above its supposed policy-set ceiling of the interest on excess reserves (IOER). That’s potentially a 20% head-fake for anyone looking to gauge market expectations for rate moves.

Usually, 60% odds at the very least should be needed before investors can bank on a move coming. If we price off the IOER “ceiling” instead of the “rogue” EFF level, the odds for a cut this year drop from 67% to just under 50%.

That’s still too high a probability given the economic reality, but it at least favors Powell’s wait-and-see rhetoric instead of the perception that one-or-more cuts are priced.

Unfortunately, stocks and bonds both appear ripe for disappointment from an overly aggressive front-end rates market, potentially setting off fresh volatility spikes and a stocks meltdown.

via ZeroHedge News http://bit.ly/2GNKxP1 Tyler Durden