Following the publication of his ‘capitalist manifesto’ where he called for drastic reforms of the American capitalist system to redistribute wealth and resources more equitably – something he followed up with an unprecedented $100 million donation to the public schools in his home state of Connecticut, putting his money where his mouth is, so to speak – Ray Dalio’s self-published LinkedIn essays have been garnering a lot more attention. It probably didn’t hurt that Dalio’s essay appeared to set off a wave of wealthy capitalists talking about how “capitalism is broken”, placing him at the forefront of a trend that could have profound implications for American politics as Wall Street struggles to confront the rise of populism on the right and the left.

And so it is that late on Wednesday, Dalio published a follow-up where he expanded on a proposal that, as we noted at the time, sounded suspiciously similar to Modern Monetary Theory.

This time around, Dalio argued that, whether we like it or not, the US will eventually be forced to embrace MMT, this has become “inevitable,” he said. Central banking as we know it (which, thanks to rampant money printing in the post-crisis paradigm, has already moved closer to the MMTers ideal) is doomed to eventually collapse under its own weight and unpopularity. In other words, sooner or later, the people will demand MMT, once inequality gets bad enough.

Once the public has accepted that money printing and interest-rate cuts aren’t doing enough to distribute wealth more equally (as we’ve pointed out many times, the Fed’s unprecedented post-crisis easing has been the primary driver in the expansion of economic inequality that Dalio finds so troubling), policy makers will be forced to accept “monetary policy 3” – or MMT.

To me the most important engineering puzzle policy makers around the world have to solve for the years ahead is how to get the economic machine to produce economic well-being for most people when monetary policy does not work. I don’t mean that monetary policy won’t work at all; I mean that it won’t work hardly at all in stimulating economic prosperity in the ways that we are used to having it stimulate economic activity, which are through interest rate cuts (what I call Monetary Policy 1) and through quantitative easing (what I call Monetary Policy 2). That is because it won’t be effective in producing money and credit growth (i.e., spending power) and it won’t be effective in getting it in the hands of most people to increase their productivity and prosperity. Hence I believe we will have to go to Monetary Policy 3, which is fiscal and monetary policy coordination that is of a form that we haven’t seen before in our lifetimes but has existed in various forms in others’ lifetimes or faraway places. It is inevitable that this shift will happen because it is inevitable that central bankers will want to ease when interest rates are pinned at 0% and when quantitative easing will be ineffective in achieving the goal. I recently refreshed my prior exploration of past cases and future possibilities of such coordination, which I will share below.

In the policy prescriptions he introduced during his previous essays, Dalio recommended a closer collaboration between fiscal policy and monetary policy. Now, he’s taken that a step further and advocated placing the monetary policy reins into the hands of elected officials (one of the key tenents of MMT).

For what it’s worth, Dalio acknowledges that this could present a conflict, and that if we embrace MMT, it will need to be done in a way that limits the control of politicians to enact self-serving policies (something that, as far as we can tell, would be extremely difficult)

The big risk of this approach arises from the risks of putting the power to create and allocate money, credit, and spending in the hands of politically elected policy makers. In my opinion, for these MP3 policies to work well, the system would have to be engineered in a way that decision making would be in the hands of wise, not politically motivated, and highly skilled people. It’s difficult to imagine how the system will be built to achieve that. At the same time it is inevitable that we are headed in this direction.

Ultimately, Dalio would favor a version of MMT with automated policy prescriptions to control taxes and stimulus depending on what’s happening with the business cycle, to limit the influence of politics (effectively marrying MMT with a kind of hybrid Taylor Rule).

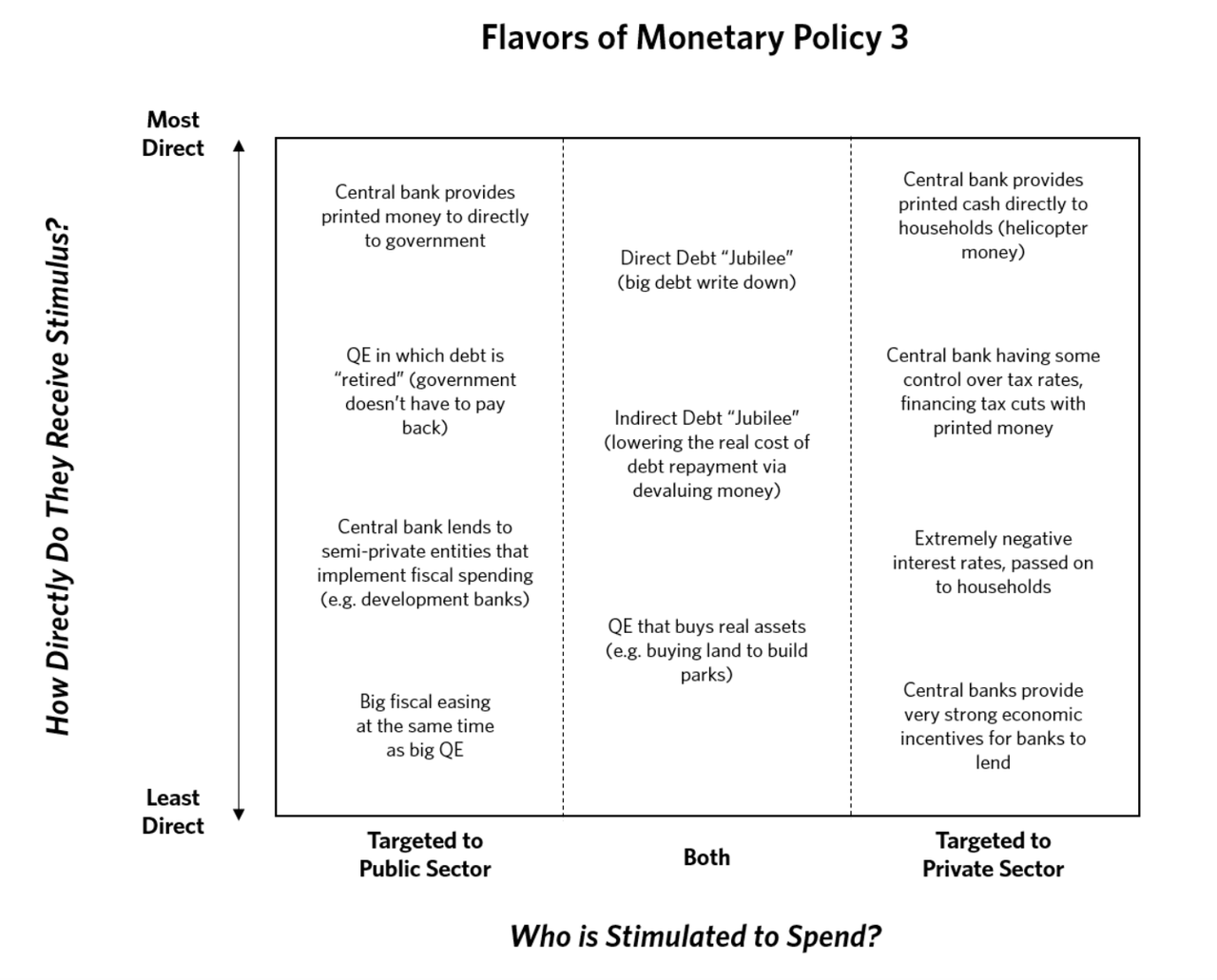

For anyone who is unfamiliar with MMT, Dalio created this handy chart to explain the different ‘flavors’ of the policy.

Of course, Dalio isn’t the only Wall Street luminary to come out in favor of MMT. But will he stick to his guns after the inevitable backlash? Or will he eventually change his mind like Carl Icahn?

via ZeroHedge News http://bit.ly/2Vaai6i Tyler Durden