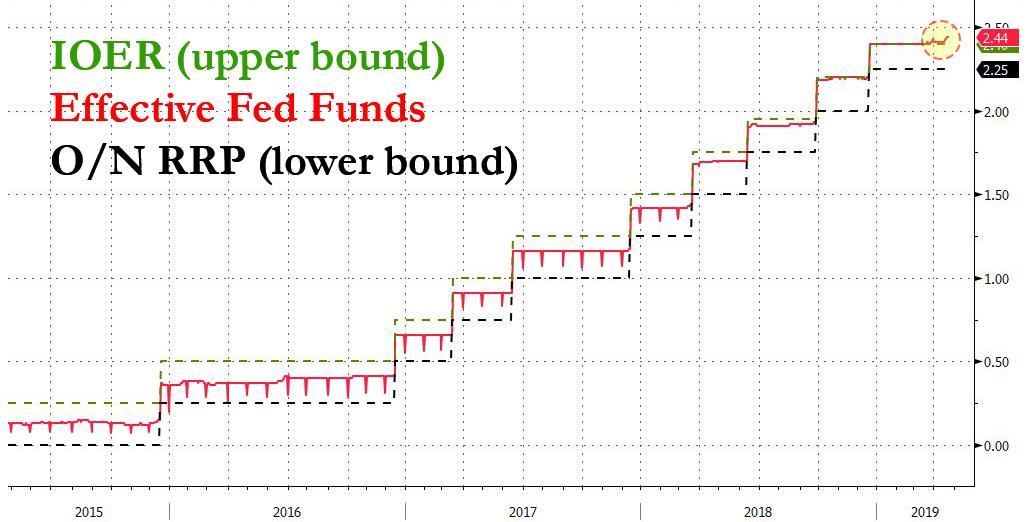

Last Wednesday, before the Fed “unexpectedly” cut its IOER rate by 5bps o 2.35%, we warned that the “Fed Loses Control Of Rates” when pointing out the ongoing divergence of the effective fed funds rate from the Overnight Repo – IOER rate corridor.

Now, one week later and following the Fed’s admission that even it was surprised by how quickly the overnight funding market plumbing had gotten clogged up, others are starting to ask the very question we posed a week ago.

In a note published overnight by Rabobank’s Phillip Marey, the US strategist – just like us – asks “Is the Fed losing control of the policy rate system?” Needless to say, the answer could have profound implications not only for the future of US monetary policy, but whether or not the dollar can remain as the world’s reserve currency in a world in which the US central bank loses the ability to set the price of money.

Here’s Marey’s full note:

The pause continues

The FOMC statement noted that economic activity rose at a solid rate, but repeated that household spending and business fixed investment slowed in the first quarter. The Fed repeated that job gains have been solid, on average, in recent months, and dropped the reference to the weak February nonfarm payroll figure. The Fed also noted that core inflation has declined and is running below 2%. At the press conference, Powell said that the data are not pushing the FOMC in either direction. The Committee does not see a strong case for a rate move either way.

Therefore, the FOMC kept the target range for the federal funds rate at 2.25-2.50%.

Is the Fed losing control of the policy rate system?

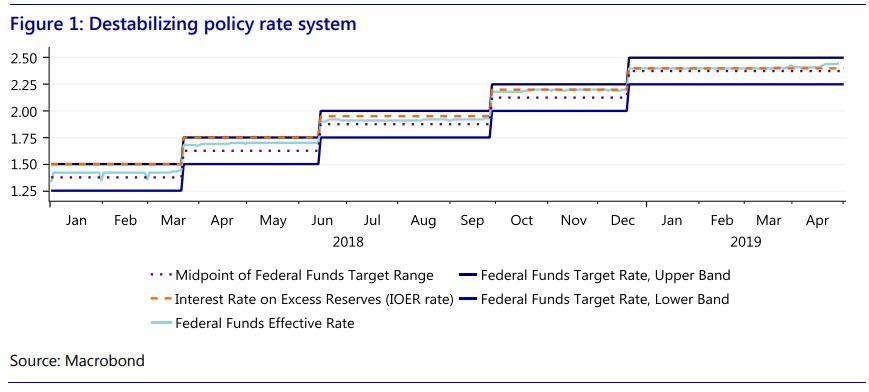

However, the Fed’s Board of Governors cut the IOER rate to 2.35% from 2.40%. While speculation of another tweak to the IOER rate has been around for some time, the consensus expectation was that the Fed still had time to give a formal warning. After all, the previous two tweaks of the IOER rate, in June and December 2018, were signalled in the minutes of the preceding FOMC meeting.

In the minutes of the May meeting it was mentioned that ‘Many participants judged that it would be useful to make such a technical adjustment sooner rather than later.’ In the November minutes the Chairman noted that ‘it might be appropriate to implement another technical adjustment in the IOER rate relative to the top of the target range for the federal funds rate fairly soon.’ So the expectation was that the Fed could use the minutes of today’s meeting, to be released on May 22, to signal a change to the IOER rate in June.

The reason for the recent market rumors of another tweak was the effective federal funds rate rising above the IOER rate. While this is what the federal funds rate was supposed to do in the first place – if the IOER rate had not been a leaky floor–, in the Fed’s current monetary policy framework it means that the federal funds rate is moving away from the midpoint of the target range again. In order to push the federal funds rate back to the midpoint, the Fed decided today to cut the IOER rate by 5 bps. While we have seen two tweaks to the IOER rate before, they took place at the same time as a hike in the target range for the federal funds rate.

In June and December 2018, a 25 bps federal funds rate hike was accompanied by a 20 bps hike in the IOER rate. Today’s tweak to the IOER rate will be implemented in isolation. This means that we should not interpret this rate cut as a change in the Fed’s monetary policy stance, but rather a technical adjustment to get the federal funds rate closer to its intended level, the midpoint. Powell and the Fed’s implementation note said that this is a technical adjustment to keep the federal funds rate in the target range.

What to make of the lack of a formal warning? In the first place, it means that the recent rise in the federal funds rate took the Fed by surprise. In the second place, it means the Fed thought it could not afford to wait for another six weeks. This shows that the Fed’s current framework for monetary policy implementation is not working. It has difficulty keeping the effective federal funds rate close to the midpoint of the target range announced by the FOMC. Moreover, the changes in the IOER rate present a challenge to the Fed’s communication to the public: the central bank is tweaking one of its policy rates now and then, but this supposedly has nothing to do with its monetary policy stance? What’s more, this time the Fed could not even afford to give a formal warning to the markets. Today’s decision proves the failure of the current policy rate system.

Therefore, the Fed’s debate about effective monetary policy implementation is likely to continue. While the current system has two floors, the interest on excess reserves (IOER) and the overnight reverse repurchase agreement (ON RRP) as we discussed back in 2015, it is lacking a ceiling. At the press conference, Powell said that the FOMC will be looking at a repo facility as a possible tool in an upcoming meeting, think about it for a while, and then make a decision.

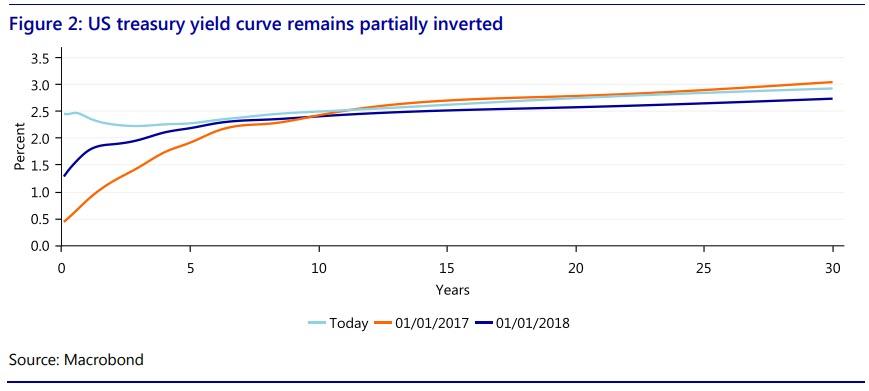

Meanwhile, the yield curve remains partially inverted. As we have stressed before, it is important to distinguish between coincident, lagging and leading indicators. The fact that the economy may be currently growing at a rate of 3.2% does not tell us anything about growth in the future. Neither do large econometric models that always show that the economy will get back to trend growth. These models are not very helpful in spotting turning points in the economy. In contrast, inversions of the yield curve do have a strong forecasting record when it comes to recessions 12-18 months in the future.

The explanation for the current yield curve inversion at the short end is that investors expect short-term rates to fall in 2020. Under normal circumstances, the yield curve is upward-sloping as it was at the start of 2017 and 2018. The shape of the yield curve is the combined result of the expected path of short-term rates and the term premium. The latter is assumed to be upward-sloping as holding longer-terms bonds requires a risk premium. However, if this pattern is outweighed by expectations of falling short-term rates the yield curve inverts. A decline in shortterm rates is likely to occur if the Fed starts cutting its policy rate. In practice this only occurs if the Fed thinks that a severe slowdown or recession is around the corner. This is the most straightforward explanation of the explanatory power of the yield curve.

However, most FOMC participants do not seem very concerned about the current inversion of the yield curve. They think that this time is different because quantitative easing is suppressing longer-term rates and therefore artificially flattening the curve. In fact, former Fed Chairman Bernanke used the same argument in 2006. At the time the global savings glut was the reason that we were supposed to ignore the yield curve inversion. What followed was the Great Recession.

We take the inversion of the yield curve more seriously and we continue to expect the economy to fall into recession in 2020H2. Consequently, we think that the Fed will be forced to start cutting rates in 2020.

via ZeroHedge News http://bit.ly/2WkLHbk Tyler Durden