With key Asian markets (China and Japan) closed for the second day in a row, Europe’s share markets struggled early on even as US equity futures levitated form session lows…

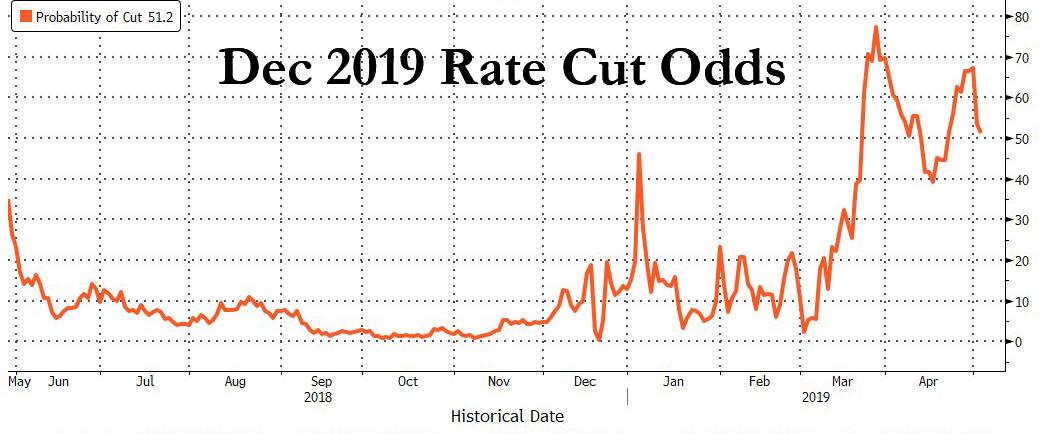

… after the Fed crushed hopes that it is preparing its first interest rate cut in years, as Powell said inflationary pressures were “transitory”, sending 2019 rate cut odds sliding.

As a result, stocks were mixed on Thursday as, in Bloomberg’s words “investors switched their focus from monetary policy back to company earnings and the outlook for global trade”. The dollar was little changed, while treasury yields continued their ascent.

Starting off the overnight session, Asian trading was thinned by holidays in Japan and China but Hong Kong and Korea’s stocks gained after CNBC reported the U.S. and China could announce a long-awaited trade deal by May 10, as Chinese Vice Premier Liu He heads to Washington. Though now expected by markets if confirmed, it would remove significant uncertainty that has weighed on markets and global data for a year now.

“I would still expect some relief rally once the deal gets done. The question is how big that move might be,” State Street GM’s Metcalfe added.

Following the subdued Asian action, Europe’s basic resource stocks led the downward shift in equities with a 1.4 percent drop to their lowest since late March. Continental Europe was also trying to get back up to speed having been shut for holidays on Wednesday. Oil and metals markets added to the pressure on stocks on Thursday with traders sending copper to a 2-month low while news of record US production sent the price of oil sliding after a 33% rise this year.

Elsewhere Turkey’s lira remained under pressure near the 6 per dollar mark after data there had showed manufacturing activity contracting for the 13th month in a row. Euro zone factory activity also contracted for a third straight month. “Demand shortages were again evident in the Turkish manufacturing sector in April, while currency weakness led to inflationary pressures building again,” said Andrew Harker, associate director of IHS Markit.

But the biggest driver of risk on Thursday was the reaction to the Fed, where for all the intense political pressure to ease policy and the mixed growth/inflation data, the central bank held the line on Wednesday and refused to signal anything other than it was still on pause as Reuters put it.

Although the Fed made the predicted 5 basis point cut to the interest it pays on banks’ excess reserves – a technical move to ease money market tightness as it runs down its balance sheet – chair Powell was unwavering on the rate outlook and said the recent relapse in inflation rates was likely temporary.

“The market has gotten perhaps ahead of itself in quite confidently pricing in (U.S) interest rate cuts,” said Michael Metcalfe, head of global macro strategy at State Street Global Markets. “Powell was quite dismissive of the latest downturn in inflation… which I think has caused the market to reassess that a little bit.”

Emerging markets steadied from Wednesday’s knee-jerk sell-off as the US spike slowed down, and investors weighed the Fed’s comments for clues on the global-growth outlook. The EM benchmark index rose for a second day, while an index developing-nation currencies was little changed, as the focus turned to the next big catalyst for risk sentiment – the U.S. jobs report due Friday.

In rates, most government bonds in Europe initially tracked the slide in Treasuries, though they reversed declines to edge higher after data showed the euro area’s manufacturing slump extended into a third month. Dollar bonds of shorter tenors from Ukraine to Turkey advanced, with money managers saying the asset class has received a new lease of life from the Fed’s pause on rate moves.

The Bloomberg Dollar Index was little changed after rising 0.1 percent on Wednesday; the dollar index drifted around 97.600 against its set of major currency peers after going as high as 97.728 and hovering around $1.1211 to the euro and $1.305 to Britain’s pound after the Bank of England kept its rates on hold. An increase in Treasury yields helped to narrow the premium on emerging-market sovereign bonds. Manufacturing data from Asia suggested the worst may be over for the region. “Emerging-market credit is holding up reasonably well,” BlueBay strategist Tim Ash told Bloomberg. “It is emerging as the asset of choice in the EM space as people feel nervous about investing in local currencies and local markets given enduring dollar strength and the U.S.-EM growth differential.”

In commodities, the drop in oil prices came after US crude production output set a new record, though the losses were capped by the intensifying crisis in Venezuela and the stopping of Iranian oil sanction waivers by Washington. US crude was last off 27 cents at $63.32 a barrel while Brent slipped 33 cents to $71.86. Copper was at a two month low after a heavy tumble on Wednesday, while spot gold was marginally weaker at $1,271.55 an ounce.

Looking at today’s calendar, durable goods orders, factory orders and initial jobless claims are due. Scheduled earnings include DowDuPont, Gilead Sciences and Cigna.

Market Snapshot

- S&P 500 futures up 0.2% to 2,927.25

- STOXX Europe 600 down 0.3% to 389.82

- MXAP down 0.02% to 162.64

- MXAPJ up 0.1% to 540.16

- Nikkei down 0.2% to 22,258.73

- Topix down 0.2% to 1,617.93

- Hang Seng Index up 0.8% to 29,944.18

- Shanghai Composite up 0.5% to 3,078.34

- Sensex up 0.2% to 39,093.26

- Australia S&P/ASX 200 down 0.6% to 6,338.41

- Kospi up 0.4% to 2,212.75

- German 10Y yield rose 1.9 bps to 0.032%

- Euro up 0.2% to $1.1215

- Brent Futures down 0.8% to $71.59/bbl

- Italian 10Y yield fell 2.9 bps to 2.184%

- Spanish 10Y yield rose 0.8 bps to 1.009%

- Brent Futures down 0.8% to $71.59/bbl

- Gold spot down 0.5% to $1,270.65

- U.S. Dollar Index down 0.1% to 97.55

Top Overnight Headlines from Bloomberg

- It’s possible for U.S. and China to announce a trade deal by May 10 as Chinese Vice Premier Liu heads to Washington for further talks next week, CNBC reported, citing people familiar with matter

- Theresa May and her arch political rival Jeremy Corbyn are both signaling they may be edging closer to a Brexit deal after a month of talks between their teams that seemed to be going nowhere

- U.K. Prime Minister May fired her defense secretary for revealing secret discussions about Huawei Technologies’s role in Britain, as she attempted to assert control over a government that has become dominated by the battle to succeed her

- BOC Governor Stephen Poloz said he still believes policy interest rates would likely need to rise if the slew of factors slowing the expansion vanish

- European Union warned about greater transatlantic political tensions after President Trump decided to let U.S. citizens file lawsuits over property confiscated in Cuba during the 1959 revolution

- Federal Reserve Chairman Jerome Powell pushed back against pressure for interest-rate cuts from traders and President Donald Trump, saying inflation will rebound and the economy will stay healthy without fresh help from the central bank

- The Federal Reserve’s message of patience this week further relieves pressure on “resilient” economies across Asia, said a regional body

- The euro area’s manufacturing slump showed tentative improvement in April as Italy’s contraction slowed markedly and French industry stopped shrinking

Asian equity markets were mixed as the region partially shrugged off the negative lead from US where all major indices were pressured, and the S&P 500 snapped a 3-day streak of record closes after Fed Chair Powell downplayed prospects for looser policy at the post-FOMC presser. ASX 200 (-0.6%) traded negative with the index led lower by financials after AMP Capital reported net cash outflows widened in Q1 and with ‘Big 4’ bank NAB also weighed after it lowered its interim dividend by 16%. Elsewhere, both KOSPI (+0.4%) and Hang Seng (+0.8%) recovered from early losses on return from Labour Day holidays amid US-China trade optimism as reports suggested a trade deal could be possible by the end of next week, while China also recently announced several measures to open up its financial sector to foreign companies in a concession to the US. As a reminder, Japan and mainland China remained closed for holidays.

Top Asian News

- Huawei is Said to Hold Fixed-Income Investor Meetings in Asia

- Naval Ships Deployed as India Braces for Worst Storm Since 2014

- AIA Hits High After China Plan to Open Up Financial Industry

Major European indices have traded indecisively this morning [Euro Stoxx 50 -0.3%], as the region struggles to find direction post-FOMC where US indices were subdued but Asia did manage to somewhat shrug off the negativity. It is also worth bearing in mind that markets are playing catchup due to yesterday Labour Day holiday for much of Europe which may account for some of the volatility. Sectors are subdued this morning, although there was some mild outperformance in Healthcare and utility names at the open. This morning’s notable earnings release came from Shell (+2.3%) who beat on their Q1 adj. profit and have begun the next tranche of their share buyback programme, with the heavyweight lifting energy names higher in-spite of lower oil prices. Separately, Volkswagen (+4.5%) are towards the top of the Stoxx 600 after beating on Q1 revenue and confirming their FY outlook for car sales. Also of note are Bayer (+3.3%) whose share prices are supported this morning by the US Environmental Protections agency stating that glyphosate is not a carcinogen. Elsewhere Lloyds (-1.0%) are in the red post-earnings as the Co’s Q1 statutory pre-tax profit missed on Co. complied estimates, Lloyds have also made an additional PPI provision of GBP 100mln.

Top European News

- Volkswagen Gains After Profit Rises, Confirms Annual Targets

- Watches of Switzerland Considers IPO as Apollo Reduces Stake

- Deutsche Bank Said to Have Virtually No New Plan for What’s Next

In FX, although the Greenback has a lost a degree of its post-Powell recovery momentum, the index remains above 97.500 and on a more stable footing as the Fed chair refrained from flagging any shift towards a rate cut or even a hint that soft inflation could tip the policy balance from neutral to dovish. In fact, after the 5 bp IOER reduction he stressed that the move was technical rather than fundamental and repeatedly downplayed slowing price developments as transitory. Hence, the DXY has rebounded from sub-97.200 lows and just above a Fib support level (97.121), albeit with the Buck now mixed vs G10 peers.

- EUR – The single currency has drawn a bit more encouragement from the run of Eurozone manufacturing PMIs, as all bar Germany posted better than expected headlines, including Italy that rebounded relatively firmly following a return to GDP growth in Q1. Eur/Usd is back above 1.1200 as a result having probed a few pips below the 200 HMA at 1.1194, but the headline pair may be hampered by heavy option expiry interest stretching from 1.1200-10 through 1.1225-40 and up to 1.1250 (1.5 bn, 2 bn and 1.1 bn respectively). Moreover, chart resistance could cap the upside given the 30 DMA at 1.1236 and a Fib at 1.1242.

- NZD/AUD – The Kiwi and Aussie are marginally outperforming vs major counterparts amidst reports that a US-China trade accord may be in the offing as soon as next week and at the end of the next talks to take place in Washington, with Beijing said to be offering concessions in return for a recent olive branch from the US. Nzd/Usd is hovering between 0.6620-39 and Aud/Usd within a 0.7012-29 range as the Aud/Nzd cross sits just under 1.0600 and attention down under turns towards next week’s RBNZ and RBA policy meetings (notwithstanding NFP tomorrow of course). Both rate calls are seen tight with swap pricing not far from evens for easing, but as NAB contends that it may be to early for the RBA options are indicating higher break-evens as a result (circa 80 pips).

- GBP/CAD/CHF/JPY – All on a more even keel vs the Greenback, with Cable straddling 1.3050 and braced for BoE super Thursday after only deriving modest support from a return to growth in the UK construction sector. However, the Pound is consolidating gains relative to the Euro over 0.8600 amidst some talk that 1 MPC voter could break ranks and switch into hike mode – full preview on the headline feed and via the Research Suite. Conversely, the Loonie is struggling to hold above 1.3450 against the backdrop of ongoing weakness in oil prices, while the Franc is back down near 1.0200 and sub-1.1400 against the Euro in wake of weak Swiss retail sales and a contractionary manufacturing PMI. The Yen has also retreated from Wednesday’s pre-FOMC peaks through 111.50 and the 30 DMA (111.42) into decent option expiries (1.2 bn between 111.50-55).

- NOK/SEK – Disappointing Scandi manufacturing PMIs vs consensus and previous readings have soured sentiment to a degree, but Eur/Nok has also been driven higher by the aforementioned crude retracement, to 9.7400+ at one stage vs Eur/Sek topping out just shy of 10.7050.

In commodities, Brent (-1.0%) and WTI (-0.9%) prices are lower, with oil prices subdued as this week’s large crude stockpile builds overshadows Iranian waiver woes and Venezuela concerns, although some of downside in the complex could be attributed to a firmer post-FOMC Dollar. In terms of recent newsflow Russia’s April oil production stood at 11.23mln BPD vs. 11.3mln in March, with these levels being relatively in-fitting with recent IFX reports. Additionally, the Russian Energy Ministry have stated that they are to keep May’s production in-line with the prior agreements; which was agreed at a reduction of 228k BPD (from the October baselines of 11.4mln BPD) in the OPEC pact. Gold (-0.5%) was also afflicted by the surge in the Dollar, with the yellow metal unable to recover from this downside, in spite of the Buck easing off highs, and is currently trading firmly at the bottom of its USD 7/oz range. While copper prices are still around 2-month lows as the red metal is missing the support of its largest buyer China which is on Labour Day holiday for the remainder of the week.

US Event Calendar

- 7:30am: Challenger Job Cuts YoY, prior 0.4%

- 8:30am: Initial Jobless Claims, est. 215,000, prior 230,000; Continuing Claims, est. 1.66m, prior 1.66m

- 8:30am: Nonfarm Productivity, est. 2.2%, prior 1.9%; Unit Labor Costs, est. 1.5%, prior 2.0%

- 9:45am: Bloomberg Consumer Comfort, prior 60.8

- 10am: Factory Orders, est. 1.5%, prior -0.5%; Factory Orders Ex Trans, prior 0.3%

- 10am: Durable Goods Orders, prior 2.7%; Durables Ex Transportation, prior 0.4%

- 10am: Cap Goods Orders Nondef Ex Air, prior 1.3%; Cap Goods Ship Nondef Ex Air, prior -0.2%

DB’s Jim Reid concludes the overnight wrap

Needless to say, the focus yesterday in markets was on the Fed meeting, and though the eventual outcome was broadly in line with expectations, we did finally see a return of some volatility after the statement’s release and subsequent press conference. The only change in policy was a 5bps cut to the IOER, though that was just a technical adjustment and not a monetary policy signal. The S&P 500 initially rallied on dovish expectations, but then retraced to end the day -0.75% lower for the biggest decline since March as Powell spoke hawkishly about the inflation and growth outlook at his press conference.

Indeed, markets made a bit of a u-turn between the statement and press conference. First, Treasury yields fell as much as -4.9bps to touch 2.453% and the S&P 500 advanced as much as +0.29% to a new intraday all-time high. The reason for the rally was the initially dovish Fed statement, which contained few changes but did change the assessment on inflation from “near 2%” to “have declined and are running below 2%.” That was interpreted as a signal that the committee is more concerned about weak inflation data, which could be a catalyst to justify a rate cut in the near or medium term. However, in his press conference, Powell emphasized that recent inflation weakness is expected to be “transient or idiosyncratic” and that he doesn’t see a strong case for a move in either direction.Even when prompted about how he would respond to a downside surprise, he explicitly stopped short of endorsing a rate cut. He also spoke positively about the growth outlook in China and Europe, and said that financial conditions are accommodative. All in all, he sounded more optimistic about the economy than expected. Our US economists last night reiterated their view that they expect the Fed to remain patient and keep rates steady for the foreseeable future. See their note here .

Powell’s comments caused markets to promptly reprice, with bond yields completely reversing their moves. 10y yields ended the session flat at 2.501%, though they had already fallen earlier in the session after the weak ISM report – more on that below – so they ended net higher after all the Fed drama was done. 2y yields rose +3.8bps and the 2s10s curve, which had steepened over one basis point after the Fed’s statement, retraced to end -4.0bps flatter at 19.3bps. Along with the S&P 500’s retreat, the NASDAQ and DOW ended -0.56% and -0.61%, with losses fairly widespread. In fact, 83% of S&P 500 companies ended lower, the highest ratio in over five weeks and third worst day of the year. The dollar rallied +0.21%, which was +0.53% off its intraday lows, with losses spread evenly between the euro (-0.17%) and a basket of EM currencies (-0.17%). WTI oil prices mirrored the dollar’s move, falling -0.49%, though the big driver was data that showed another large build in US inventories.

This morning Asia has followed in a slightly more mixed fashion, however the various holidays in Japan and China have sapped some liquidity out of the market. Of those open, the Hang Seng (+0.63%) and Kospi (+0.41%) are both up, however the ASX (-0.67%) has retreated. US futures are also slightly positive. The gains in Hong Kong and Korea seem to have got a boost from news out of CNBC that a US-China trade deal is “possible” by next Friday. Politico is also reporting that the two sides are close to an agreement and that the plan being put forward is for the US to remove a 10% tariff on a portion of the $200bn of Chinese imports hit by tariffs, before lifting the rest not long after. However, the article also suggests that a 25% tariff on $50bn of Chinese goods would stay in place longer and possibly until after the 2020 election.

That story comes as US-China trade talks wrapped up in Beijing yesterday. Treasury Secretary Mnuchin confirmed in a tweet that the meetings had been “productive” and that talks between both sides will continue in Washington DC next week. So, we’re nearing the business end of talks at last it seems.

The other highlight for markets yesterday was the US data and most notably that much softer than expected ISM manufacturing report. The 52.8 reading for April came in well below expectations for 55.0 and represented a drop of 2.5pts from March. It was also the lowest reading since October 2016 and it means that the current level is now 8pts below the August 2018 peak. The breakdown was also soft with the employment component dropping over 5pts to 52.4, new orders also down over 5pts to 51.7 and most notably the prices paid component falling over 4pts to 50.0. The associated statement highlighted Mexico/US border crossing delays on numerous occasions as slowing supplier deliveries.

Prior to this and in contrast to the ISM data, we got a much stronger than expected April ADP employment change print (275k vs. 180k expected) which also included upward revisions to the March data. In fact, it was the strongest monthly reading since July 2018 and continues the theme of the labour market still being incredibly strong. A reminder that we’ve got the April employment report tomorrow. The only other notable US data yesterday was the April vehicle sales figures, which fell to 16.4mn, the lowest level since August 2017. That’s still higher than every month from mid-2007 through early 2014, so not a cause for alarm yet.

In Europe, it was only the UK that was open of the main markets, with the FTSE 100 closing -0.44% and Gilt yields falling -3.4bps. Sterling also ended +0.14%, despite the dollar’s broad strength, after the April manufacturing PMI was confirmed at 53.1 – matching the consensus – and therefore down 2pts from March. In addition, mortgage approvals in March were confirmed as declining to 62.3k and the least since 2017. Consumer credit was also the weakest since 2013 at just £0.5bn and therefore continues a declining trend for consumer lending in the UK. All-in-all this just means more confusing data to untangle for the BoE – which as a reminder meet today at lunchtime.

Staying with the UK, the Brexit newsflow is starting to slowly creep back onto our screens. The last couple of days have seen both the Conservatives and Labour talk up recent progress and especially compromise on a customs union, with PM May seen to be pushing for a deal being reached next week and ahead of the EU elections in just three weeks now. It’s worth flagging that the UK local elections are today, where an expected bad result for May will only increase pressure to a reach a deal sooner rather than later.

In other news, the ECB’s Guindos said yesterday that the ECB is “open-minded” to discussions around changing the inflation target, but haven’t yet discussed anything. This is similar to recent comments fellow policy maker Rehn made. This morning we’ve got the final April manufacturing PMIs in Europe where the consensus is for no change in the 47.8 flash reading for the Euro Area. A reminder that this included sub-50 readings for Germany (44.5) and France (49.6) while Italy is forecast to print at 47.8 which is only a marginal improvement on the very soft March reading. Spain is forecast to improve to 51.2. Those readings will be drip fed from 8am BST.

To the day ahead now, where this morning the focus is on those aforementioned final April PMIs in Europe. The focus after that turns to the BoE meeting where no policy change announcement is expected, however our UK economists expect the tone to be marginally hawkish given stronger than expected growth a tight labour market coupled with weaker rate expectations. This afternoon in the US we’ve got another busy slate of data releases with claims, preliminary Q1 nonfarm productivity and unit labour costs, and final March durable, capital and factory orders data all due. We’ve also got comments due from the ECB’s Hansson this morning and then Praet this evening, while from today US waivers on purchases of Iranian oil officially expire. The earnings highlights today include Shell, Volkswagen, DowDupont, BNP and Lloyds.

via ZeroHedge News http://bit.ly/2IUlNrL Tyler Durden