Authored by Lance Roberts via RealInvestmentAdvice.com,

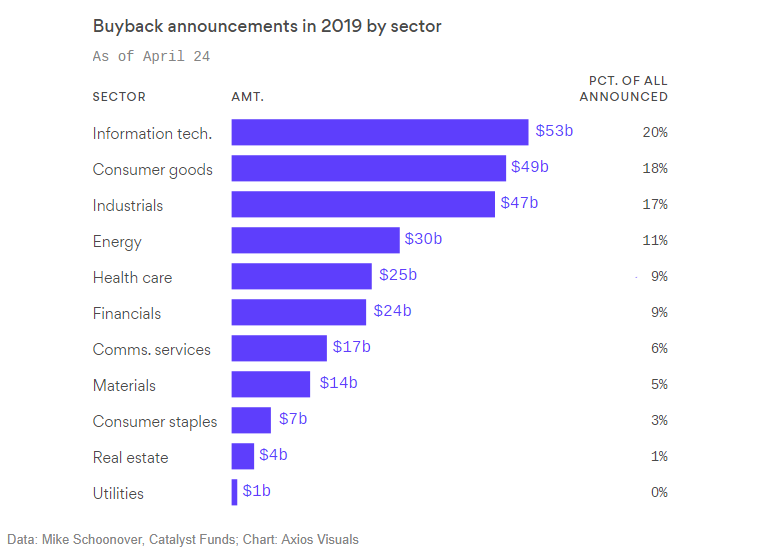

I recently wrote about stock buybacks in our weekly newsletter. However, a recent report from Axios noted that for 2019, IT companies are again on pace to spend the most on stock buybacks this year, as the total looks set to pass 2018’s $1.085 trillion record total.

“By the numbers: Companies so far have spent $272 billion on buybacks, data compiled by Mike Schoonover, COO of Catalyst Funds, for Axios shows.

Between the lines: The amount of spending on buybacks announced by companies in the IT sector has fallen significantly this year as other industries, particularly energy and industrials, have picked up the slack. Companies in those sectors have about doubled their percentage of announced buybacks.

The top 5 sectors for buybacks this year accounted for 76% of the total. Last year, the top 5 sectors accounted for 82%, led by IT, financials, health care, consumer discretionary and industrials, respectively.

Interestingly, buyback spending has not coincided with market performance for most sectors.

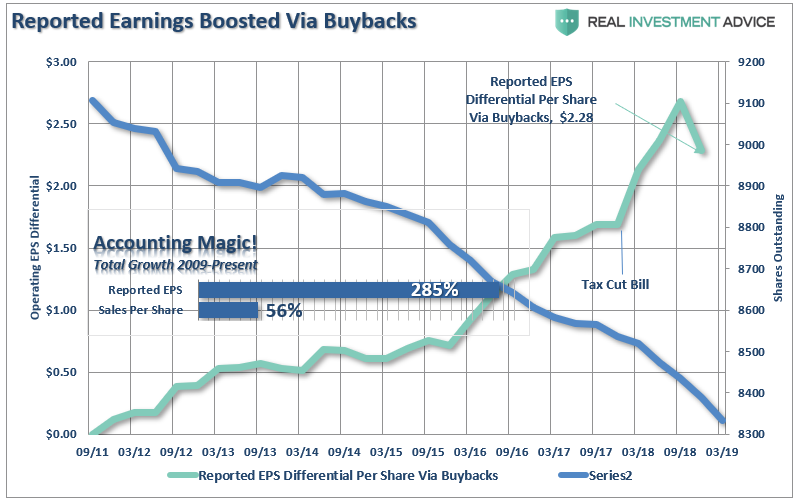

As I have shown previously, the runoff in shares outstanding since the financial crisis lows have been nothing short of stunning.

It has been the magnitude of buybacks which have now brought it to the attention of politicians. It is a “political football” perfectly suited for the 2019 primaries as the “wealth gap” in America has become a visible chasm. Debates around share repurchases invoke themes for everyone: shades of corporate greed, historic income inequality, images of populism, and the idea that they’ve propped up the most-hated bull market of all time.

As noted by Business Insider:

“Politicians like Sens. Elizabeth Warren, Bernie Sanders, Chuck Schumer, and Marco Rubio have derided buybacks’ explosive rise due in large part to the Trump administration’s tax cuts, demanding Congress more fairly regulate what public companies can do with their cash.

“Corporate self-indulgence has become an enormous problem for workers and for the long-term strength of the economy,” Sens. Sanders and Schumer wrote in a New York Times op-ed in February, which was met the following month with an opposing piece in the paper.

The pressure on buybacks, which hit a record $806.4 billion in 2018 according to an estimate from S&P Dow Jones Indices, isn’t expected to let up.”

Where’s The Beef

The buyback boom can be traced back to Bill Clinton’s 1993 attempt to reign in CEO pay. Clinton thought, incorrectly, that by restricting corporations to expensing only the first $1 million in CEO compensation for corporate tax purposes, corporate boards would limit the amount of money they doled out to CEO’s.

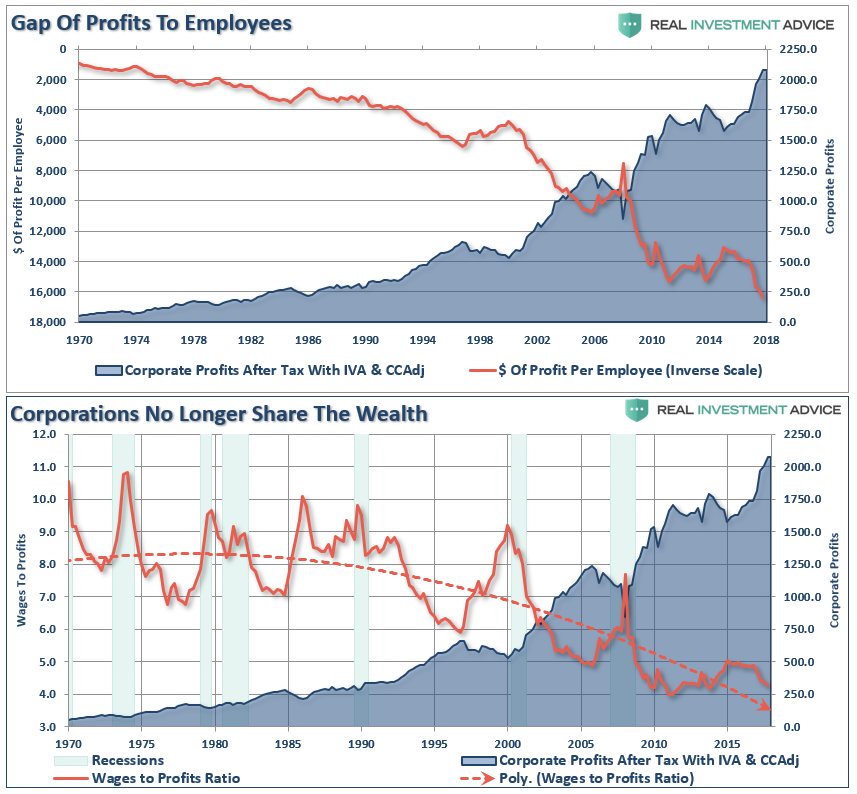

To Bill’s chagrin, corporations quickly shifted compensation schemes for their executives to stock-based compensation. Subsequently, CEO pay rose even higher, and as I showed previously, the gap between profits and wages has become vastly distorted. Rising profitability, fewer employees, and increased productivity per employee has all contributed to the surging “wealth gap” between the rich and the poor.

In 1982, according to the Economic Policy Institute, the average CEO earned 50 times the average production worker. Today, the CEO Pay Ratio’s increased to 144 times the average worker with most of the gains a result of stock options and awards.

You can understand why it is a political “hot topic” for 2020.

The arguments in support of corporate share buybacks are relatively “thin” in terms of substance.

-

Limited potential to reinvest for growth. (Least favorable use of cash.)

-

Management feels the stock is undervalued. (Rarely a consideration)

-

Buybacks can make earnings and growth look stronger. (Main reason given by firms)

-

Buybacks are easier to cut during tough times. (Easy to deploy and controlled by the board)

-

Buybacks can be more tax-friendly for investors. (Rarely a consideration)

-

Buybacks can help offset stock-based compensation. (Primary use in many cases)

Of the reasons given, the ones which support executive compensation are the most valid.

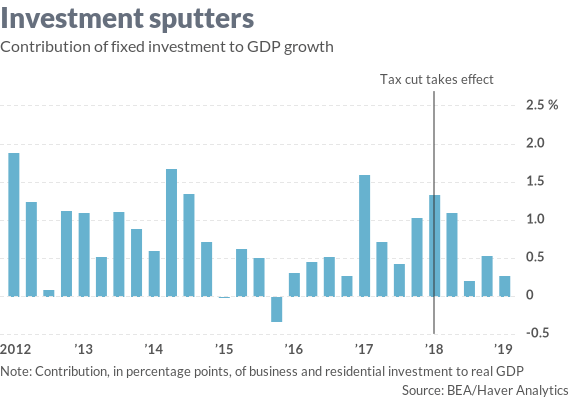

The debate over share repurchases came to the fore following the tax cuts in December of 2017. The bill was targeted at corporations and lowered the tax rate from 35% to 21%. The tax cut plan was “sold” the the American public as a “trickle down” plan and by giving money back to corporations; they would in turn hire more workers, increase wages, and invest in America.

It didn’t happen. As Caroline Baum penned:

“Kevin Hassett, chairman of the White House Council of Economic Advisers said ‘the gross domestic product report confirms our view that the momentum from last year was not a sugar high but a serious response to long-run policies that have made the U.S. a more attractive place for business.’

There’s just one problem with Hassett’s assessment.

The unexpected strength in the GDP report came from inventories, trade, and state and local government spending, not from business investment, which is where one would expect to see the response to the kind of long-run, supply-side policies Hassett implied.”

Where did the money primarily go? Just one place; share repurchases.

The problem with the surge in share repurchases is that such actions divert ever-increasing amounts of cash from productive investments which ultimately impairs longer-term profit and growth.

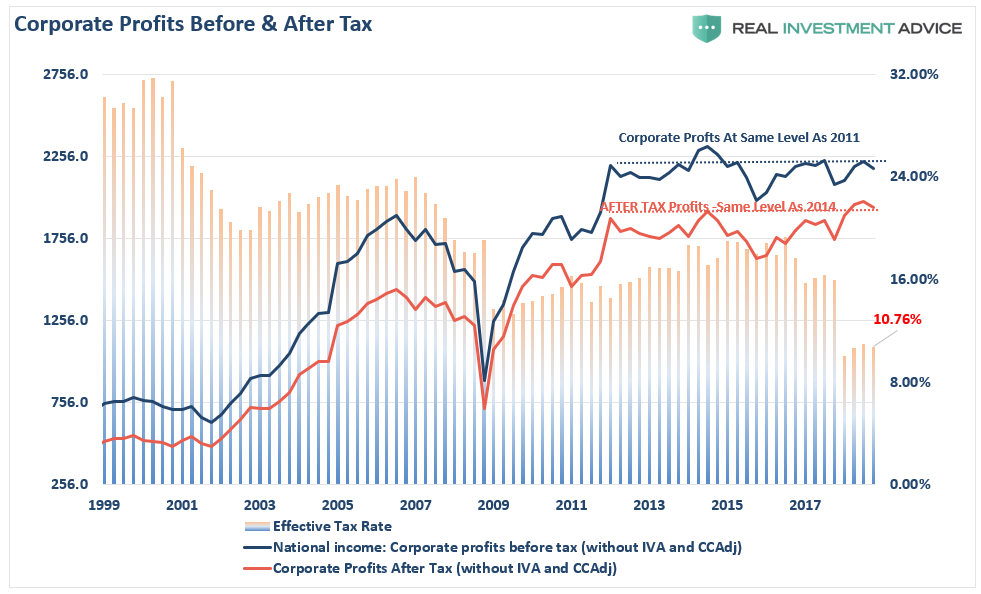

“But, corporate profits have been surging.”

Not so much.

The reality is that stock buybacks create an illusion of profitability. Such activities do not spur economic growth or generate real wealth for shareholders, but it does provide the basis for with which to keep Wall Street satisfied and stock option compensated executives happy.

Let’s clear up a myth used to support the benefit of stock buybacks:

“Share repurchases aren’t bad. It is simply the company returning money to shareholders.”

Not really.

Share buybacks only return money to those individuals who sell their stock. This is an open market transaction. For example, Apple (AAPL) just announced they plan to buy $75 billion of their stock back. Via NY Times,

“Apple’s record buybacks should be welcome news to shareholders, as the stock price is likely to climb. But the buybacks could also expose the company to more criticism that the tax cuts it received have mostly benefited investors and executives.”

Let’s clear something up. Buybacks do not RETURN money to shareholders. A dividend does.

The only people who receive any capital from the buyback are those who opt to sell their shares. They have their capital back, but they no longer have the shares. Also, while it is believed that buybacks ALWAYS increase share price, that is not necessarily the case. Apple bought a vast amount of shares back in 2018, the stock lost 15% of its value.

So, who are the ones mostly selling their shares?

“Corporate executives give several reasons for stock buybacks but none of them has close to the explanatory power of this simple truth: Stock-based instruments make up the majority of their pay and in the short-term buybacks drive up stock prices.” – Financial Times

A recent report on a study by the Securities & Exchange Commission found the same:

- SEC research found that many corporate executives sell significant amounts of their own shares after their companies announce stock buybacks, Yahoo Finance reports.

Finally, as Jesse Fried wrote for the WSJ:

“The real problem is that buybacks, unlike dividends, can be used to systematically transfer value from shareholders to executives. Researchers have shown that executives opportunistically use repurchases to shrink the share count and thereby trigger earnings-per-share-based bonuses.

Executives also use buybacks to create temporary additional demand for shares, nudging up the short-term stock price as executives unload equity.”

What is clear is that the misuse and abuse of share buybacks to manipulate earnings and reward insiders has become problematic.

Ending The Addiction

Now that you understand the background, and who share buybacks actually benefit, you can understand the reason why this debate has become a much more visible topic heading into the 2020 election cycle.

Most people have forgotten that share repurchases were banned in 1933 following the “Crash of 1929,” until the ban was repealed during the Reagan Administration in 1982.

Why were they banned? Via Vox:

“Buybacks were illegal throughout most of the 20th century because they were considered a form of stock market manipulation. But in 1982, the Securities and Exchange Commission passed rule 10b-18, which created a legal process for buybacks and opened the floodgates for companies to start repurchasing their stock en masse.”

But more importantly, they are obfuscating the normal functioning of the market relative to price discovery. As John Authers recently pointed out:

“For much of the last decade, companies buying their own shares have accounted for all net purchases. The total amount of stock bought back by companies since the 2008 crisis even exceeds the Federal Reserve’s spending on buying bonds over the same period as part of quantitative easing. Both pushed up asset prices.”

In other words, between the Federal Reserve injecting a massive amount of liquidity into the financial markets, and corporations buying back their own shares, there have been effectively no other real buyers in the market.

The other problem with the share repurchases is that is has increasingly been done with the use of leverage. The explosion of corporate debt in recent years will become problematic during the next recession particularly as the proliferation of sub-investment grade issuers are locked out of the bond market for refinancing activities. As noted by the Bank of International Settlements.

“If, on the heels of economic weakness, enough issuers were abruptly downgraded from BBB to junk status, mutual funds and, more broadly, other market participants with investment grade mandates could be forced to offload large amounts of bonds quickly. While attractive to investors that seek a targeted risk exposure, rating-based investment mandates can lead to fire sales.”

With 62% of investment grade debt maturing over the next five years, there are a lot of companies that are going to wish they didn’t buy back so much stock.

One of the best pieces of analysis on the whole issue is from William Lazonick via The Harvard Business Review in which he summarized:

“The corporate resource allocation process is America’s source of economic security or insecurity, as the case may be. If Americans want an economy in which corporate profits result in a shared prosperity, the buyback and executive compensation binges will have to end. As with any addiction, there will be withdrawal pains.”

There aren’t any easy fixes and banning them altogether is probably a “horse that is long gone.”

However, an honest assessment of the abuses, some rule changes in both reporting requirements and timing of sales, as well as potentially some limits on the amounts of annual repurchases could provide a start.

Just like any addiction, it is always better to ween the subject off of the addiction than just going “cold turkey.”

But, like 1929, it will likely be the next major market crash which solves the problem.

via ZeroHedge News http://bit.ly/2UV1NXD Tyler Durden