Oil prices have plunged to one-month lows since President Trump tweeted against OPEC’s “artificially high prices” thanks to soaring inventories and a surprising (high) Russian production print.

The drop was triggered by rising supply concerns (Russia production and US inventories) and demand worries (green shoots in China and US fading fast).

“U.S. inventories have come in quite high and there was already evidence and anticipation that they will be supplying more oil,” said Frances Hudson, a global thematic strategist at Aberdeen Standard Investments in Edinburgh. “I don’t think we’re particularly bullish on prices from here.”

Russia missed a target for production cuts in April, dampening the impact of its agreement with OPEC to prop up prices.

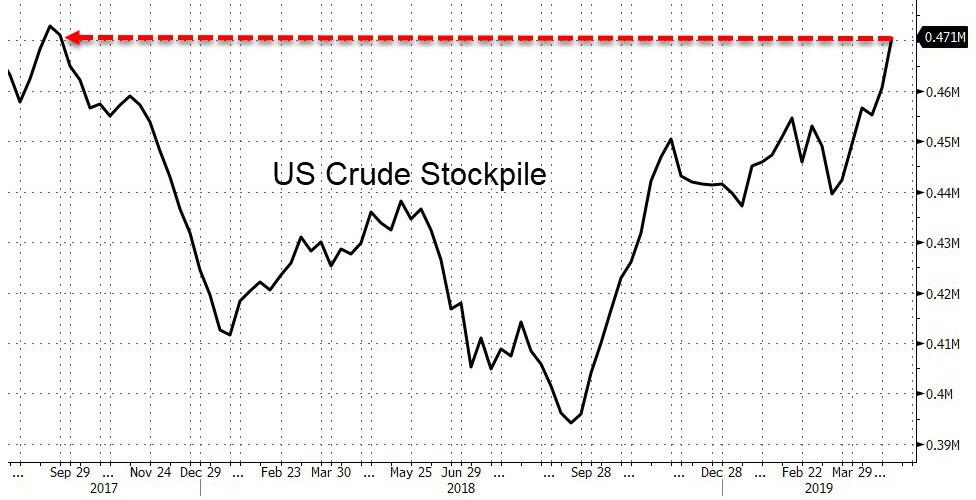

US crude stockpiles are at two-year highs…

“When the U.S. crude-oil warehouses bulge to their highest levels since September 2017, while production continues to set new high-water marks, warning signals should be flashing red,” said Stephen Innes, head of trading at SPI Asset Management.

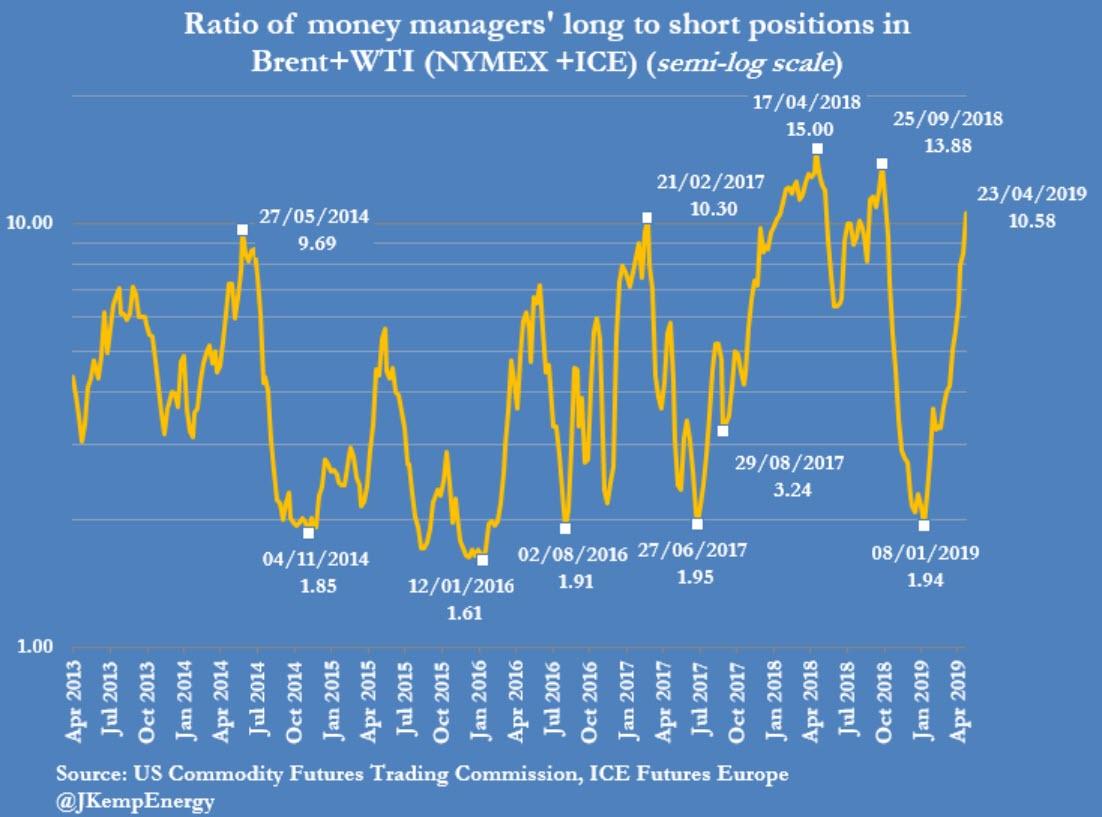

And don’t forget, speculators are positioned extremely long once again…

via ZeroHedge News http://bit.ly/2LjFQ57 Tyler Durden