Warren Buffett’s Berkshire Hathaway announced Sunday it would expand its brokerage operations into Middle Eastern markets by opening Berkshire Hathaway HomeServices Gulf Properties, reported Reuters.

The new unit will be led by Chairman Ihsan Husein Al Marzouqi and Chief Executive Officer Phil Sheridan. The team will consist of 30 advisers and support staff, according to a company statement. “Gulf Properties aspires to grow quickly by tripling its advisor count and opening a second office in Abu Dhabi within a year,” it said.

“We are excited to enter the UAE and Dubai with such experienced and respected leaders as Dr. Ihsan Husein Al Marzouqi and Phil Sheridan,” said Berkshire Hathaway HomeServices Chairman Gino Blefari. “Dubai has been a top priority for our network’s global expansion as it represents innovation among world leaders and is a top global center for trade, logistics, tourism and finance. Gulf Properties will connect our growing brokerage network between East and West and will provide unrivaled access to one of the world’s most exciting real estate destinations.”

Berkshire Hathaway HomeServices partnered with London-based Kay & Co. last year, its second overseas franchise in Europe, after Rubina Real Estate in Berlin. The company expects to add Milan, Vienna, and Dubai to its international book. Berkshire Hathaway Specialty Insurance recently began operations in Dubai.

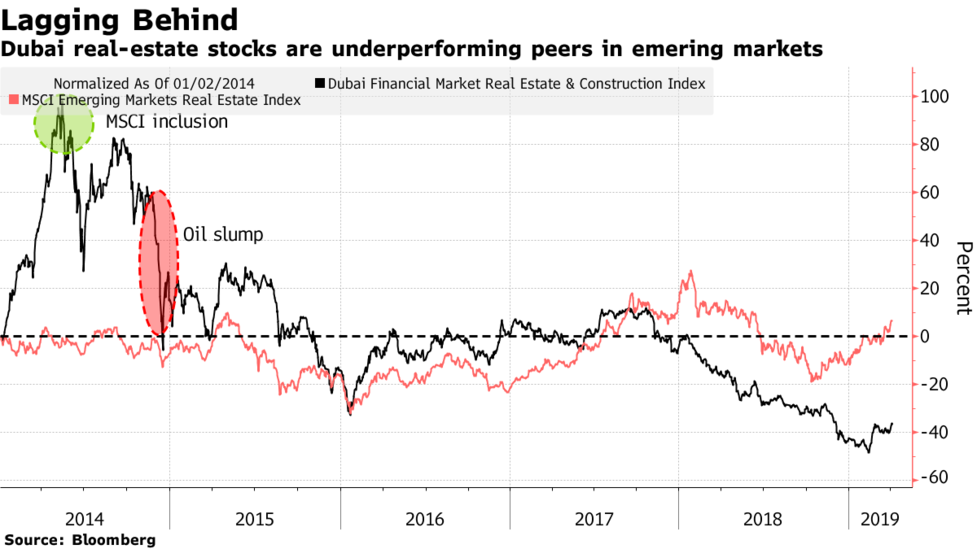

Buffet is entering the Dubai property markets as prices have fallen 25% since the 2015 peak.

Lower oil prices, weaker currencies in nearby countries (UAE’s currency is pegged to the USD), a global synchronized slowdown, and political turmoil in the Middle East have all contributed to the downward pressures on price.

Property development is a vital part of Dubai’s economy, so the fall in prices has slowed the city’s economy.

The city is also suffering from a glut, having overexpanded in the last decade. It was a strategy that powered the city after the 2008 financial crisis, brought developers from around the world to build tens of thousands of homes.

The glut is expected to depress prices for several more years. Dubai is one of the world’s biggest ongoing construction sites, with nearly 1,200 cranes active across the city, constructing an estimated 31,000 homes this year, far exceeding demand.

“We are excited for the future and honored that our franchise agreement makes Dubai the first Berkshire Hathaway HomeServices location outside the U.S. and Europe,” said Al Marzouqi. “The presence of such an iconic global brand is further testament that Dubai is indeed a global destination when it comes to commerce and real estate investments.”

Chris Stuart, CEO of Berkshire Hathaway HomeServices, said their Duabi unit has “experienced leadership, talented agents and an ambitious growth plan for Dubai and the UAE.”

S&P Global Ratings warned in February that Dubai home prices could drop by at least 10% this year due to a continued imbalance in the market, before bottoming out in the early 2020s. Seems like Buffet’s next big move into the Gulf region is to capitalize on an extremely dangerous bet that Dubai’s housing could bottom soon.

via ZeroHedge News http://bit.ly/2PG8vQe Tyler Durden