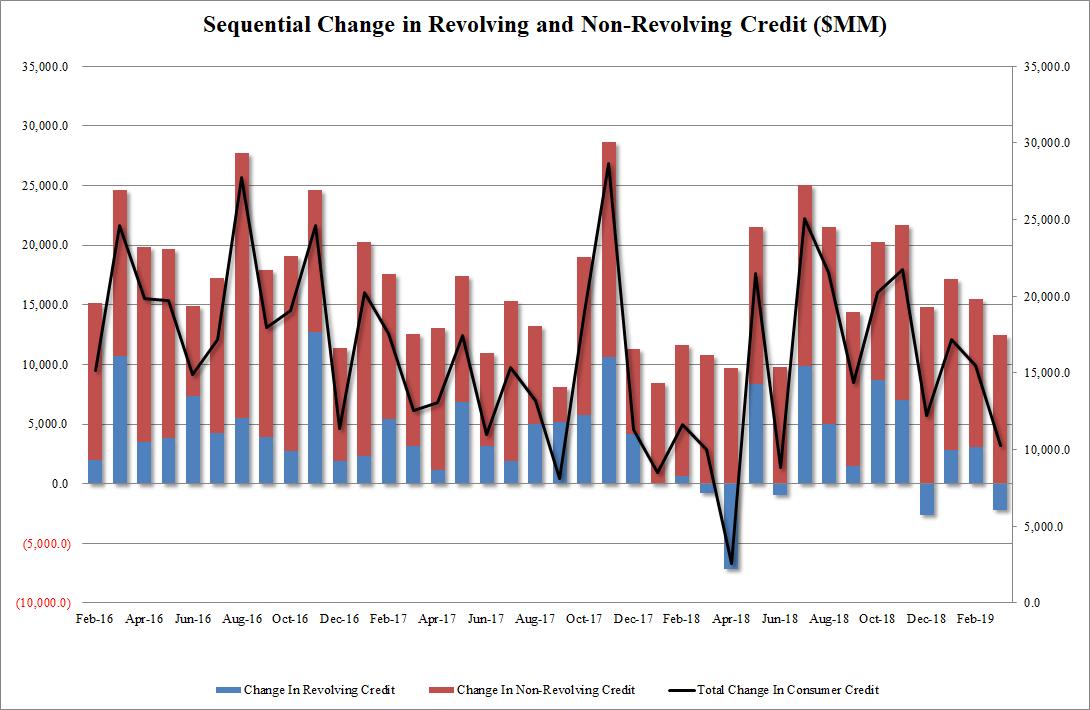

After a few months of wild swings in mid-2018, followed by solid growth at the end of last year, in March growth in US consumer credit continued to slow, rising by only $10.3 billion, far below the $16 billion expected following February’s $15.5 billion increase, and the lowest monthly increase since June of 2018.

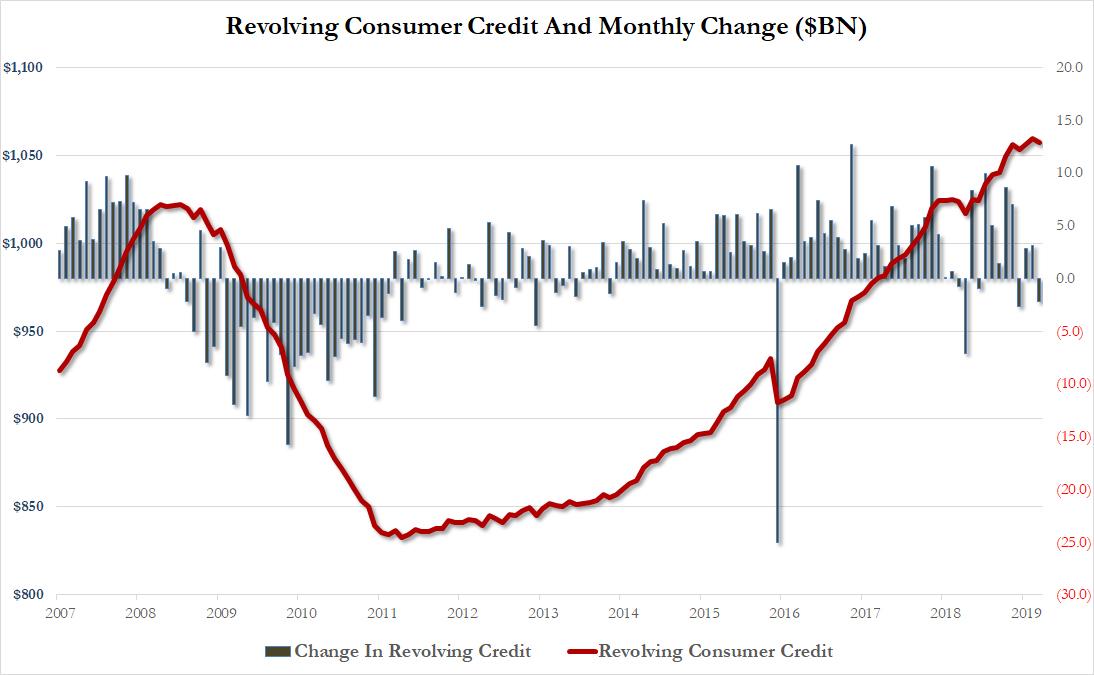

Despite the slowdown, the continued increase in borrowings saw a new all time high of $4.045 trillion on the back of a America’s ongoing love affair with auto and student loans, if not so much credit cards: in fact, the reason for the sharp slowdown in March was due to an unexpected $2.2 billion decline in credit card debt, the first of 2019, and the third biggest in post-crisis history. This reduced the total outstanding credit card debt to $1.057 trillion, still just shy of all time highs.

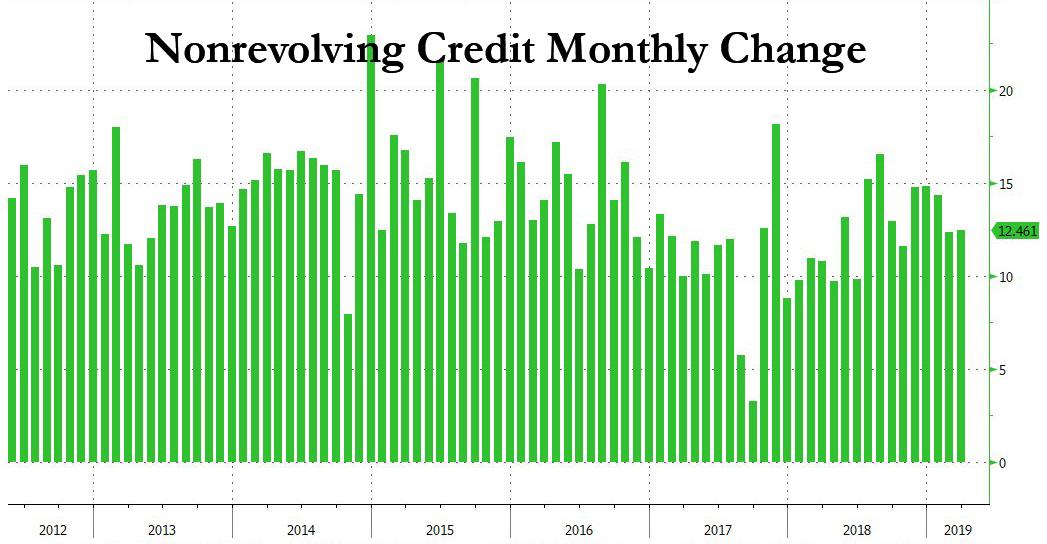

Non-revolving credit, i.e. student and auto loans, rose jumped by $12.5 billion, almost unchanged from last month’s 12.4 billion and in line with recent monthly increases; the latest jump brought the nonrevolving total also to a new all time high of $2.995 trillion.

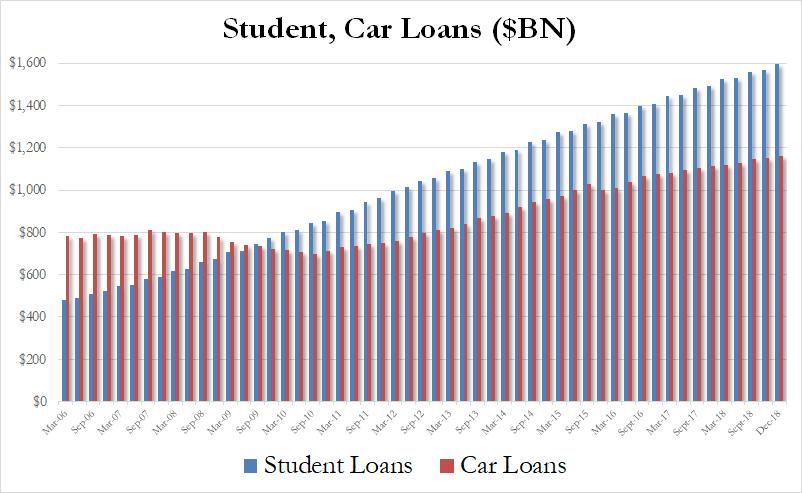

And while February’s sudden drop in credit card use may prompt some concerns about the financial stability and propensity of the US consumer to spend, one place where there were no surprises, was in the total amount of student and auto loans: here as expected, both numbers hit fresh all time highs as of March 31, with a record $1.598 trillion in student loans outstanding, a whopping increase of $30 billion in the quarter, while auto debt also hit a new all time high of $1.161 trillion, an increase of $8.3 billion in the quarter.

In short, whether they want to or not, Americans continue to drown even deeper in debt, and enjoying every minute of it.

via ZeroHedge News http://bit.ly/2YfRY8N Tyler Durden